Author(s): Sridhar Mooghala

The study examines how third-party APIs have changed banking technology and how banks run their businesses. Fintech has changed over time as customers' needs have changed, showing how important third-party APIs are for fostering new ideas. The study is mostly about how these APIs can be used, like making payment systems better, giving real-time market info, and showing how to work together well, like IG.com and TradingView did. According to the study, APIs have improved regarding how customers feel and how efficiently things are run. The study also discusses how third-party APIs are important for the fintech business to improve and build banking services and the risks that might happen while integrating API into the fintech industry.

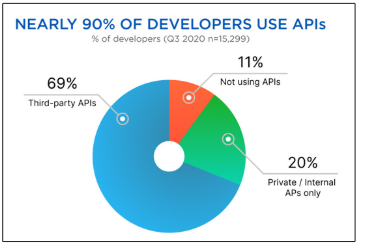

APIs help financial companies develop new goods by giving them the building blocks they need. Through these APIs, people who work in banking can share data, functions, and services. These changes make it easier for them to work together, meaning that fintech companies can use APIs they already have to make new, better goods and services that change based on users' wants. Thirdparty APIs have become revolutionary tools that have changed how banking is usually done. This is because technology changes so quickly these days. This essay explores the various methods of using third-party APIs and describes how they can improve banking services. This study hopes to show how technology and finance are changing together and how they are important. This will help people understand the effects and opportunities of integrating APIs in the financial services industry.

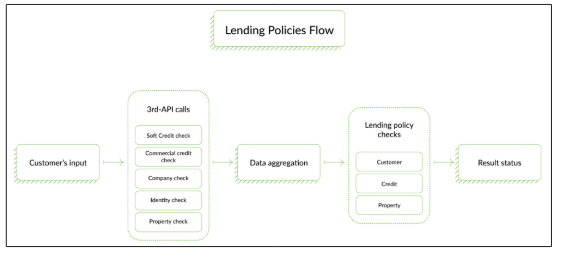

The way financial services are provided has completely changed since third-party APIs were added. This is because fintech is an area that changes quickly. This shift can be seen in the rise of fintech goods like loans and mortgages that make our lives better and easier. The mortgage business has a lot of new companies. This shows how dangerous and competitive the company is. Companies are always developing new ideas, adding advanced features, making products that focus on the user, and giving deals that make people want to buy. Since there are always new ideas, money tools must be quick and useful. It comes from ten years of writing code and making banking apps. This piece discusses smart ways to use third-party API layers in apps for money. There is a lot of information in the piece about how important these layers are for making apps work well and being able to add new third-party services.

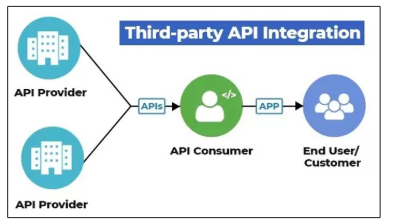

Adding third-party APIs is a good way to use power from outside finance, where speed and dependability are very important [1]. Sometimes, financial apps will use data from outside sources to check markets and credit scores, look for scams, and make it easy for users to connect their bank accounts. Adding these third-party services to banking apps is easier when standard rules are used [2]. Things start to go wrong, though, as more services are added. In this case, adding an API layer is very important because it links the banking app to all the other services. It goes into great detail about how to set up the API layer and how it lets outside services connect to the main part of financial apps in a way that works with everything else.

It's important for financial apps, like those used to get a mortgage, to keep the business and data layers separate. There needs to be this split because the business process is so complicated. There are steps to stop scams that have to be done on the money before it can be changed. An important part of these checks is the data layer, which talks to other apps and systems. The piece discusses an online lending platform to show how hard-working many third-party data providers can be. This proves the importance of having a clear API layer to allow data to flow quickly and meet business rules.

Open API technology is changing the business world in big ways right now. Well-known third-party tech companies, FinTech companies, and traditional banks can now work together in a strong and organized way because of technology. This new idea ensures that links are safe, privacy is kept safe, and it is easy to move files. Big Banks made the right choice when they switched to OpenAPIs as it doesn't cost as much and lets FinTech companies grow, develop new ideas, and reach more people [3].

Banks can also quickly change their business plans to meet the changing needs of their customers by getting information from customers, the public, and other places. Financial institutions can also improve the services they provide with open APIs. For example, they can add digital identity services to their basic goods and payment services. It is now possible to have more customer information in the business field, which makes things run more smoothly.

Open APIs are used for many things, such as online banking, selling crypto currencies, making payments on cell phones, managing your own money, and keeping your home and business safe online. The Open APIs help security traders and coin exchanges change their business and make digital brands [4]. There are more links, and it's easier to do business across boundaries. Open APIs also help new banking services connect to mobile payments. In addition to that, they also make it easier for people in the banking business and the IT business to work together. When people share their private information safely, they have more control over it.

This changes the way that online banking works. Financial FinTech apps use Open APIs to let users pay their bills, check their credit scores, and keep track of their spending. People can, therefore, have a better time with these tools and use them to help plan how to spend their money. Open APIs are making FinTech different. In the area of financial services, they help people work together and come up with new ideas.

A strong and careful plan behind this study is meant to meet the top standards of accuracy and dependability in the fascinating field of academic research. This important part discusses the research methods that give the study depth and dependability. It ensures the reader fully grasps the strategies and what they mean.

The method provides a full way to collect, process, and look at data. This strategic type gets useful insights by skillfully managing the problems at each step. The data was gathered to make it reliable and useful for the study. This is because it builds on previous research. A strict mix of quantitative and qualitative content from other case studies made by scholars is also used to examine it fully. The study's results are more solid and useful because they come from looking at the subject from various angles. This gives us a complete picture of the problem.

Every choice of method adds a different note to the study symphony, keeping the patterns that are starting to form in check. This part goes into more detail about the choices made to make the study more reliable. It explains why each path was chosen. The careful explanation of these decisions, considering moral concerns, limited resources, and the location of the study, builds a strong foundation. This ensures that the next findings are correct to raise the overall credibility of this field of study

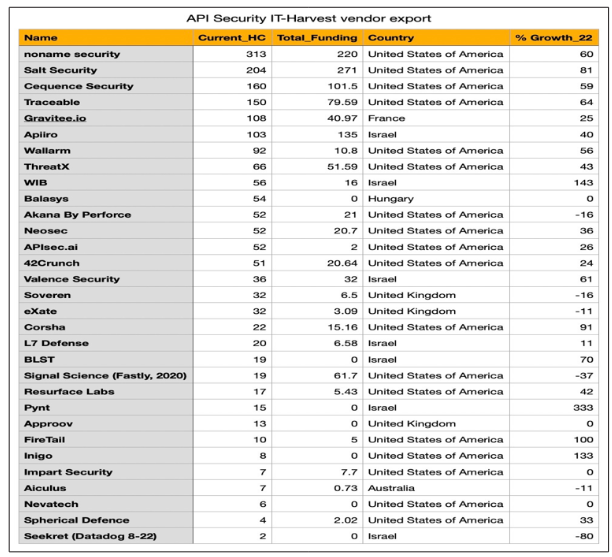

As the world of financial technology moves quickly and always changes, fintech, which stands for "finance and technology," is changing how normal methods and practices are used. Third-party APIs are at the heart of this change journey. They can be used to improve fintech and push it to new heights. Many different features are built on top of these APIs, giving banking institutions the power to change the services they offer completely. These third-party APIs make it easy to use payment gateways, set up complicated systems for verifying identity, and get a better credit score [5]. They are what make banking services better.

Think about what would happen if it were easy to combine payment-handling services with the help of third-party APIs. Not only does this make transactions safer, but it also gives people an element they've never had before. These APIs are powerful because they let payments be made quickly, safely, and without issues. There is also a lot of freedom with third-party APIs; for example, they are used in apps that give you real-time market info and dynamic portfolio management tools that greatly impact investment platforms.

The latest innovative project from EvinceDev is a great example of how well third-party APIs can work in the fintech field when they are added [6]. The project aimed to change how people trade stocks by putting IG.com and TradingView together in a way that didn't go wrong. Not only did users' trading relationships get better when alerts and automation were added to "trading view," but they also changed totally. In real life, this shows how third-party APIs can change how solutions are made and how people can use them.

When used correctly, APIs show that this type of technology interaction can meet and go beyond what users expect. Different pieces of software can talk to each other with these APIs. This makes things go faster, and comes up with new ways to do things. It's not enough to share data; users also need to be able to change and improve how they use different banking apps.

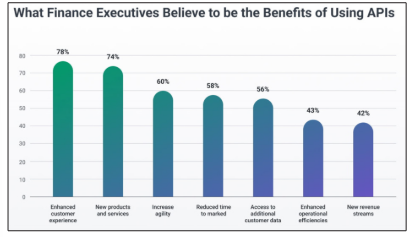

When banks use APIs from outside sources, they get a lot ofbenefits and opportunities. This starts a new age of efficiency, new ideas, and services that put the user first. One great thing about automating complicated tasks is that it can help things run more easily and save money. Transfers happen faster, and costs are lower because operations have been simplified. This is a one-of-a-kind chance for banks to use their resources and run their businesses better.

Adding third-party APIs also makes the experience better for users by making it easier and smoother to do banking online. When it comes to meeting changing customer needs, banks that focus on features that are easy for people to use, like digital wallets and mobile banking apps, are ahead of the curve. Customers stay with businesses that focus on the user, and new customers also come in. This helps businesses grow and stay open. Another great thing about smartly using third-party APIs is that it helps you stay competitive in the business world.

Because these APIs are adaptable, banks can use new tools and services right away as they come out. This gives institutions an edge over their peers by letting them stay on the cutting edge of new ideas. Companies that work with banks are the best at developing new ways to help people with their money because they can adapt to changing market conditions. Adding APIs also lets people make new goods, which help banks offer more services. Institutions are ahead of the curve in giving complete and cuttingedge financial solutions. They offer advanced statistics, robot counselors, and block chain technology, which make banks look like tech stars and get more people to use it.

One of the biggest risks is that banking apps using third-party APIs might be unsafe. Because APIs are so important to the growth of fintech, hackers often start their search for security holes there first. Hackers can access apps for managing money and take private information like personal and banking information. Hackers can access this private information without permission in several ways, such as email scams and software that shouldn't be there. Data breaches at Equifax, JP Morgan Chase, and other high-profile cases show how dangerous this risk is [7]. Better business logic and finding and fixing bugs before they happen are two strong steps that need to be taken to lower security risks.

Heists change the way they do things as the world of fintech changes. Many people fear AI fuzzing, which is when criminals use AI to find zero-day vulnerabilities more quickly. Hackers can use this method to find security holes by giving apps or APIs data they shouldn't have. When hackers use AI in this way, they can find bugs in APIs that they didn't know about before. Banks must reduce the amount of data their computers process, use random testing, and set up good filtering systems to avoid this.

Identity theft is often harder when APIs are added because hackers can use stolen login information to get into financial accounts without permission. Tokens used for authentication are often the target of identity theft attacks. Tokens are an important part of API security. A world study from 2021 found that more and more people were trying to take over other people's accounts [8]. This shows how important it is to set up strong login and authorization steps immediately. It would help if you tightened up security rules to stop identity theft and keep user accounts safe.

Because fintech apps need to use different APIs to talk to traditional banks, there are holes in how they work together and security holes that hackers might be able to use. We must test and pay close attention to every detail to get around this problem. Scanning for vulnerabilities is becoming more and more important. Being scanned often can help you find and fix open API addresses. Also, they closely check every source code change to ensure no security holes are created by accident.

Many people try to attack banking apps, but some don't have good rate-limiting or resource limits, so these attacks are common. Cybercriminals try to overload apps with too much data, which makes them less safe. One good way to stop DDoS attacks is to limit the number and frequency of requests from certain users or IP addresses. These limits must be strictly enforced so DDoS attacks are less likely to hurt fintech apps.

Protecting fintech from internal threats is hard, whether done on purpose or by chance. Money is complicated, so one mistake or action can open security holes. There is no problem with following the rules, but it makes things harder for financial apps. There are strict rules that everyone in the fintech industry has to follow. These include banking rules, data protection laws, and security standards that are normal in the industry.

Phishing attacks, which can be simple scams or complicated plans, are always a security risk for fintech apps. Users need to be aware of this threat because phishing is the cause of 36% of data theft. Fintech apps should teach users how to spot phishing attempts and have strong security measures in place so that users can't get in without permission if phishing works.

In conclusion, this study shows how important third-party APIs are for bringing about a big change in banking technology and fintech services. Third-party APIs' ability to adapt to new technologies has helped fintech change quickly. Their many uses show this. These APIs are necessary for innovation because they do everything from making banking systems safer to giving real-time market data. Collaborations that work well, like when IG.com and TradingView joined forces, show how good things can happen. The study recognizes the improvements in customer satisfaction and operating efficiency but also stresses the need to be careful of the risks of these changes. Thirdparty APIs are increasingly important for improving and expanding banking services in the constantly changing fintech world.