Inter-Plan Blue Cross Blue Shield Programs - A Case Study in Payor Claims

© 2023 Gokul Ramadoss, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Abstract

ABSTRACT

The Blue Cross Blue Shield (BCBS) Inter-Plan Programs that comprise BlueCard, National Accounts, and the Federal Employee Program (FEP) are significant to broaden the healthcare benefits for all members by offering consistent and supreme features. With the help of these programs, it is possible to access a wide range of services in the healthcare industry both on a country level and across the world. Though these benefits are available for all members, people who travel frequently find these pros appealing. In addition, members who are shifting from burn to another place gain more benefits from these offerings. Furthermore, EDI 837 transactions enhance smooth submissions by offering an effective exchange of information across all related elements of BCBS. This rapid exchange of information among coordinators enhances the functionality of the system by real-time collaboration which increases the level of satisfaction among all members. This further reduces the possible delays as well as the probability of mistakes. Unlike their competitors including CVS Health as well as Aetna, BCBS features offer a wide range of appealing prospects making it an ideal choice for those looking for inclusive healthcare insurance. BCBS Inter-Plan Programs' requisite assortment of effective and robust care plus inclusive accessibility tend to bring diversity in healthcare outcomes throughout the BCBS system.

Introduction

The healthcare industry in the United States is empowered by considerable health insurance programs. These programs play a crucial role in facilitating medical expenditures as well as ensuring an equal level of access to required healthcare services. Many health insurance organizations are active for the same reason where Blue Cross Blue Shield (BCBS) stands prominent. This is an association of 36 independent and fully functional Blue Cross and Blue Shield firm's data active on the local level. These companies provide solo services, but they work together on a national level to enhance healthcare insurance benefits across the country. The most essential framework of the BCBS system elaborates the well-known Inter-Plan Programs data developed to enhance the level of collaboration + information processing throughout radius BCBS elements. The purpose of this research is to elaborate on the significance of these BCBS Inter-Plan Programs while emphasizing their accurate mechanism, defined outcomes, probable challenges as well as their thorough influence on the overall healthcare industry [1].

Background

Blue Cross Blue Shield companies offer insurance programs to three Americans that promote them as the backbone of the nationwide healthcare landscape. The nature of this group of organizations ensures rapid delivery of health coverage along with inclusive features and consistent services. Its decentralized mechanism allows each of these member organizations to evaluate the particular requirements of their local citizens and hence offer requisite services accordingly [1].

Inter-Plan Programs: An Introduction

Inter-Plan Programs are developed to cater to the claims processing as well as access to health insurance offerings throughout various elements of the BCBS system. The members of these programs can access a wide range of healthcare insurance offerings anywhere regardless of their location which guarantees the consistency of healthcare despite any demographic restrictions. These programs have different elements including BlueCard, certain National Accounts as well as Federal Employee Program (also known as FEP) [2].

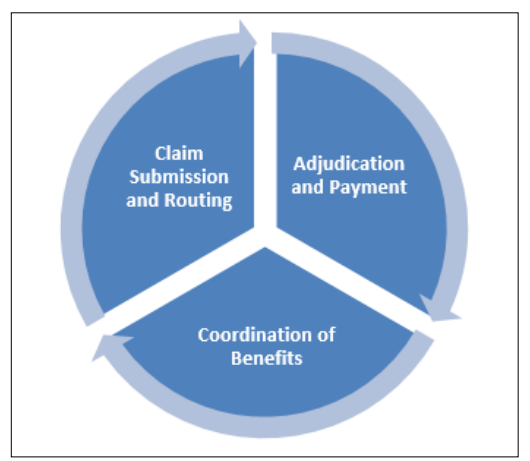

Payor Claims Process

Claim Submission and Routing

The process of Payor claims works in such a way that when a member of BCBS gets healthcare outside their identified location of home, the concerned healthcare provider provides a claim to the local BCBS plan that is also known as the host plan. Next, the BlueCard Program allows the host plan to deliver this claim towards the home plan of that particular member. Finally, the home plan is responsible for dealing with the claim based on the specified and defined benefits plus insurance features of that particular member [3].

Adjudication and Payment

Next, the purpose of the home plan is to evaluate the claim to find the accurate insurance amount according to the coverage of a member. After this evaluation, the required details of the insurance payment are sent back to the host plan that repays the healthcare service provider. This requisite procedure in tales and guarantees that all healthcare providers are recompensed rapidly despite the nature of the home plan of the member [4].

Coordination of Benefits

The Inter-Plan Programs help the coordination of benefits (COB) in dealing with scenarios when members are equipped with diverse health coverages. It makes it easier for the COB to ensure the accurate processing of the claims without any mistakes plus accurate payment to healthcare providers [5].

Figure 1: Payor Claims Process

How Inter-Plan Programs Help Members in the BCBS Ecosystem The benefits of the Inter-Plan Programs provided by the Blue Cross Blue Shield (BCBS) enhanced health insurance experience across the nation. It is ensured that all members receive requisite coverage services anywhere in the country without any restriction on their permanent location. Though these benefits are encouraging for all populations, people who are traveling frequently find these offerings more valuable. This is because they do not have to worry about the actual location of the home plan, rather they may receive health insurance services anywhere in the United States. At the same time, relocating people also experience additional benefits of these insurance programs not just within the country but also internationally. With the help of their BlueCard, specified National Accounts, plus the Federal Employee Program (FEP), members of these Inter-Plan Programs get rapid access to required insurance coverage anywhere. The National Accounts program allows large entities to provide a wide range of insurance coverages that are necessary all the time, especially in the case of serious diseases when rapid insurance is necessary [6]. The payor process works seamlessly where the host plan sends the basic information of the healthcare provider to the home plan evaluates the submitted claims and sends the processing back to the host plan. Now the host plan ensures rapid payment to the health insurance provided based on the information entailed through the processed claims. During this process, the coordination of benefits (COB) is liable to guarantee the accuracy of repayment while maintaining the rapidness of reimbursement. The error or duplication of payment is also thoroughly checked especially for all the members having multiple insurances. At last, the responsibility of the Federal Employee Program (FEP) is to treat federal employees as well as retired persons in such a manner that the required level of coverage services are delivered efficiently regardless of the location of these members [7].

Complementary Nature of BCBS Inter-Plan Programs Compared to Other Products by Aetna, CVS

The value of the Inter-Plan Programs provided by the Blue Cross Blue Shield (BCBS) makes it prominent among other health insurance providers in the healthcare industry of the United States. For instance, BCBS unlike its competitors including Aetna as well as CVS Health, comprises three significant elements including its BlueCard, the National Accounts, plus the Federal Employee Program (FEP) that ensure a seamless process of delivery of insurance coverages to all members regardless of their locations. The purpose of the BlueCard is to offer smooth access to health insurance to all members throughout the country as well as internationally. On the other hand, National Accounts facilitates large groups in receiving requisite insurance offers anytime anywhere especially when they need to move from one to another location or in the case when they have multiple locations. At the same time, the third most essential element of this BCBS system, the Federal Employee Program (FEP) allows federal employees, retired persons as well as their linked dependents to get consistent insurance anywhere. Though Aetna offers timely nationwide coverage services, it doesn't fulfill the standards of international health insurance programs offered by the BCBS network, whereas CVS Health focuses more on local insurance services. The accuracy of the processing of the claims and the coordination of benefits enhances the worth of the BCBS Inter- Plan Programs among its prominent competitors. Therefore, the BCBS with its inclusive and comprehensive set of coverage features highlights its standings in the healthcare sector of the United States [8].

EDI 837 Transactions Briefly and their Data Exchange between Each Blue Cross Organization

The role of the EDI 837 transactions in the BCBS ecosystem cannot be underestimated because of the seamless benefits it offers. EDI refers to the electronic data interchange that means a smooth transaction of information among various entities within numerous Blue Cross Blue Shield (BCBS) organizations. This includes different information about patients like their physical location, related codes, treatment details as well as associated costs based on the coverage offerings. An evident range of outcomes is acquired through the EDI 837 transactions suggesting accurate and timeless delivery of health insurance coverage and reimbursements.

An EDI 837 transaction is started in case a claim is provided by a healthcare provider to the local host i.e. the host plan. This electronic claim is then checked and validated by the host plan ahead of its delivery to the home plan of the member. The BlueCard Program eases this procedure and allows different elements within a BCBS ecosystem to exchange information inclusively. The next task of the home plan is to evaluate the claim to finalize the actual repayment amount while considering the duplication aspects and avoiding probable mistakes at any stage of processing.

The EDI 837 transactions are initiated again once the home plan processes the claim and delivers it back to the host plan. With the help of this electronic exchange of information, the Inter- Plan Programs of BCBS can ensure the accuracy of the process, preventing the chances of errors and enhancing the member experience through an efficient reimbursement and delivery of coverages.

The coordination of benefits (COB) also finds the EDI 837 transactions beneficial most importantly in the cases when members have numerous coverage plans. At each stage of the exchange process, these EDI 87 transactions evaluate the primary as well as secondary payors to facilitate the processing of the claims accurately and rapidly. In addition, the EDI 837 transactions follow the Health Insurance Portability and Accountability Act (HIPAA) which validates the exchange of information [9, 10].

Conclusion

As a result, the Inter-Plan Programs offered by the Blue Cross Blue Shield (BCBS) stand prominent in the delivery of seamless and comprehensive health insurance coverage in the United States. Their significant programs including the BlueCard, the National Accounts, plus the Federal Employee Program (FEP) enhance the standard of insurance offerings and the level of members satisfaction through their inclusive and complementary range of health insurances especially for frequent travelers.

The BCBS also regards the EDI 837 transactions which play an important role in the exchange of information among various entities of the BCBS system without making any errors. This boosts the process of claims and the repayment to the members while avoiding duplication mistakes at any stage. Overall, the role of the EDI 837 transactions maximizes the efficiency of the process by facilitating the coordination of benefits (COB) to ensure easy access to health coverage at any place within a minimum time.

Unlike its prominent competitors including Aetna as well as CVS Health, the BCBS Inter-Plan Programs ensure both country-level and global health coverage for the usual population, large groups as well as federal personnel and retirees. The inclusive framework of the BCBS ecosystem elaborates its eminence as an ideal solution for standardized delivery of health insurance offerings.

References

- (2020) BlueCard Program Provider Manual. https://bcbsil.com/docs/provider/il/standards/bluecard/bluecard-program-manual.pdf.

- (2021) Inter-Plan Arrangements. https://www.bluecrossmn.com/sites/default/files/DAM/2020-10/2021-inter-plan-pdf.

- Park Young-Taek, Jeong-Sik Yoon, Stuart M Speedie, Hojung Yoon, Jiseon Lee (2012) Health insurance claim review using information technologies. Healthcare informatics research 18: 215-224.

- Orszag Peter, Rahul Rekhi (2021) Real-Time Adjudication for Health Insurance Claims.

- Kirchhoff Suzanne M, Chaikind HR (2014) Medicare Secondary Payer: Coordination of Benefits. Congressional Research

- (2019) Inter-Plan Blue Cross Blue Shield https:// www.bluecrossmn.com/sites/default/files/DAM/2021-11/ P11GA_18699269-peip-2019-inter-plan-programs-080519. pdf.

- (2022) 2022 Inter-Plan Medicare Advantage Care Management and Provider Engagement https://content.highmarkprc.com/Files/Region/PA-WV/MAStars/2022-inter-plan-ma-care-mgmt-provider-engagement-overview.pdf.

- Rodeck David (2014) Aetna vs. Blue Cross: Comparisons, Costs, and More. Investopedia. https://www.investopedia.com/aetna-vs-blue-cross-5190180.

- Madavarapu, JhansiBharathi (2023) Electronic Data Interchange Analysts Strategies to Improve Information Security While Using EDI in Healthcare Organizations. University of the Cumberlands.

- McBride, John S, James J Moynihan (1999) EDI and imaging automate the business office. Healthcare Financial Management 53: 62-65.