An Implementation Framework for a Blockchain Based Trial Tax

© 2020 Piergiorgio Ricci, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Abstract

Blockchain technology represents one of the most promising introductions in the technological scenario. Despite the growing interest from both the general public and the scientific community in this regard, there is a lack of strategies capable of guiding, under a technical and managerial perspective, the introduction of blockchain technology within existing business processes. Inspired by the main software engineering methodologies, which currently do not include specific techniques to coexist with blockchain paradigm, in this article, we propose an innovative blockchain implementation framework, which provides for a series of tools and strategies able to exploit the benefits arising from its integration within public administration business models while reducing related risks of introduction. In order to assess the framework operational effectiveness, we also test its application in the development of a blockchain based system allowing the conduct of telematic trial tax in order to make its execution safer, faster and cheaper.

Introduction

Blockchain technology represents one of the most important technological innovations in the age of the information society [1]. This innovation goes beyond a simple technology and it can be considered as a true paradigm, which, due to its many potential fields of application and related benefits, will revolutionize future business models [2]. The main strengths deriving from the application of blockchain technology consist in a secure and decentralized data management that guarantees their confidentiality and immutability. This radical innovation allows achieving higher levels of data security and process efficiency than those offered by previously technologies used in the computer science area.

Radical innovations represent discontinuous events that directly derive from research with a significant impact on existing business models [3]. In most cases, these types of innovation are driven by revolutionary technological changes that determine the replacement of existing technologies in their fields of application, differently from the incremental innovations scenario, which provides for the introduction of new features to existing technologies [4]. In addition to its great potential, radical innovations also present a risk component, as they become an integral part of business models in a process that requires a lot of time and integration work [5,6].

Previous research in the blockchain technology field is mainly focused on technical and economic aspects related to Bitcoin cryptocurrency [7]. Some authors in literature have analyzed the socio-economic implications of ICOs, while others have proposed blockchain applications in different contexts [8,9].

Although there are numerous contributions focused on blockchain technical aspects, there is a lack of scientific literature that can guide its implementation within different business processes, in fact the introduction of a radical technological innovation within an organizational context requires the use of a series of rules and best practices, able to guarantee its correct integration within existing business processes. Current software engineering methodologies do not include practices that can guide the introduction of blockchain paradigm within the software development process. For this reason, we propose a framework for implementing blockchain technology within public administration processes and we test its application in the field of Italian tax justice with the aim of making the trial tax faster, cheaper and capable of secure processing of judicial data in compliance with the constraints regulations imposed by national legislation. This new implementation also guarantees the enforceability of the tax court’s decision and therefore the fulfillment of sentence’s device obligations towards the parties involved.

Blockchain technology

Blockchain technology is based on a distributed ledger able to keep track in a secure and immutable way of a series of transactions [9]. The entries on the ledger are carried out in a distributed manner and they are validated through specific rules established a priori by the participants in the system that are part of a peer to peer network [10]. The ledger’s content is organized into blocks containing a timestamp, a cryptographic hash of the previous block, and transaction data. The use of decentralized architectures in data management avoids the problem of single point of failure that characterizes centralized architectures. The use of cryptographic algorithms, such as SHA256, makes it possible to obtain the immutability and inalterability of the data contained within the blocks which are validated by system participants through the use of mechanisms for reaching distributed consensus [11]. In the last few years, several blockchain models have been defined, the application of which derives from the characteristics of the reference context such as the number of entities involved and the level of confidentiality to be achieved [12]. Public blockchains are unpermissioned and represent the most widespread model of blockchain due to their use in the field of cryptocurrencies. The algorithm usually used to reach distributed consensus in these systems is the proof of work and each system entity can participate in the consensus process without a permission, by simply running software on their own machine. The federated blockchains represent an evolution of the private blockchains, in which groups of authorized participants are involved. It is a permissioned model that is suitable to function in a context characterized by a federation of organizational groups, such as departments of a single or different organizations.

A blockchain implementation framework

The introduction of blockchain technology into public administration processes helps to achieve many of the objectives that characterize a modern administration, such as reducing bureaucracy times and costs, as well as the secure management of public data, which are part of the administration’s assets. Inspired by some project management practices and in particular by software engineering methodologies1, such as AGILE and spiral models, from which the fundamentals are derived, the framework we propose, aimed at implementing blockchain technology within public administration business processes, provides for the conduct of the following activities in an incremental and iterative manner [13-15].

Analysis

• Study of improvement objectives to be pursued;

• Study of the integration strategy with existing systems;

• Study of legislation and legal constraints;

• Study of risks deriving from the introduction of the new

technology;

Design

• Definition of the blockchain model;

• Definition of the network model;

• Definition of the governance and security rules;

• Definition of the ecosystem of technological architecture

and tools;

Test

Start up

Assessment

• Evaluation of execution time;

• Evaluation of execution costs

• Evaluation of system and data security

• Evaluation of system scalability

• Evaluation of regulatory compliance;

The analysis step, which follows a preliminary feasibility study shared with all the project stakeholders, aims to establish which strategies can be adopted for the introduction of blockchain technology within the business process in order to allow their evolution without operational interrupting. During the analysis, improvement objectives to be pursued, such as time processes reduction, should be defined along with the existing system integration approach. It is also necessary to proceed with a careful study of national sector legislation in force in order to implement a system that is fully compliant with. At this stage, it is also really important to analyse the potential risks in the areas of data security, system operation and regulatory compliance, as well as providing measures for their management.

Once the analysis is completed, follow the design step. It starts by identifying the blockchain model to be used on the basis of the characteristics of the business process to be evolved. In the case of processes that require fast execution time involving a limited number of participants working on confidential data, the choice of private or federated blockchains is strategic, while the best solution for public relevance processes, characterized by open data, is represented by public blockchains.

Blockchain model heavily influences the system rules of governance and the mechanisms that regulate the achievement of consensus on the distributed ledger, in particular, private models prefer voted based or Byzantine fault tolerance (BFT) mechanisms, while Proof of Work or Proof of Stake strategies dominate public blockchains. During the design, it is important to define rules of governance and the entities to be considered trusted as they participate in achieving distributed consent within the blockchain network

Once all the system architectural characteristics and its governance rules have been defined, the choice of the operating ecosystem is made. The ecosystem contains all the tools that will be used for system operation, among them a strategic role is played by smart contracts that allow to translate the process rules in terms of information technology. The ecosystem is developed through the use of a technological platform that allows the system implementation. Recently, several open source technical solutions have been developed, including IBM’s Hyperledger that provides for the creation of private and federated blockchains.

Once the analysis and design steps have been completed, the system can enter the testing phase regarding a limited number of users and, in the event of a positive outcome, it can proceed with the start-up.

In compliance with an iterative and incremental implementation process model, the functioning of the system is subjected to continuous evaluations able to establish its effectiveness and efficiency in the reference context and providing for possible corrective measures as well as constantly assessing compliance with the national sector regulation.

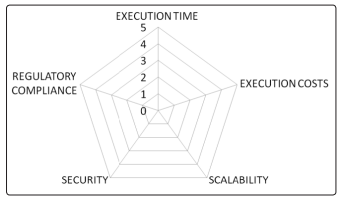

As shown in Figure 1, the assessment is based on the consideration of the the following dimensions: execution times, execution costs, scalability, security and regulatory compliance. Values are calculated on the basis of a comparison with the performance of the existing system before the introduction of the blockchain technology or, in case of a new system, on the basis of the performance of a similar system on the market operating without the use of the blockchain technology. They are evaluated on a scale of values ranging from 0, in case there are no improvements, to 5 in the event of a 100 % improvement on that specific dimension.

Figure 1: The performance assessment diagram of a Blockchain based system

Case study

Italian digital trial tax blockchain based

In the following subsections we experiment an application of the proposed framework in the development of a telematic trial tax system. We will demonstrate how the introduction of blockchain technology within this complex process is able to make its conduct more reliable, faster and cheaper.

Analysis step

Study of improvement objectives to be pursued

The main key objectives that lead to the implementation of a blockchain based digital trial tax system are represented by the need for a higher security level in the management of trial data, as well as guaranteeing that trial parties respect the sentence’s device obligations deriving from tax court’s decision. In addition, it is strategic to speed up the trial conduct while reducing its related costs. The introduction of blockchain technology can certainly help to achieve the above described requirements, due to its ability to manage trial files in a distributed manner and to execute smart contract that ensure the enforcement of sentence’s device.

Since digital trial tax represents an already operating process, it is essential to provide an integration strategy with existing information systems and applications, by guaranteeing the full functioning of system and avoiding damage to user services. The system integration is implemented through the development of a set of REST Application Program Interfaces (APIs) that allows legacy systems to access and interact with data stored in the system blockchain

Study of the integration strategy with existing systems

With regard to compliance with national sector legislation, the Italian law n. 12, issued on 11 February 2019, known as simplification decree, introduces the distributed ledgers technologies and smart contracts definitions assigning them a legal value. According to the negotiated agreements, a smart contract represents “a computer program that operates on technologies based on distributed registers and whose execution automatically binds two or more parts on the basis of predefined effects”. Therefore, in the legislative definition, three characteristics are highlighted: (A) the smart contract is a software based on distributed ledger technologies (such as the blockchain), (B) in programming the smart contract, the contracting parties predetermine the consequences to the occurrence of certain circumstances and (C) where such circumstances occur, the smart contract automatically performs the effects predetermined by the parties, without the need for human intervention.

Study of legislation and legal constraints

With the aim of mitigating any risks deriving from the implementation of blockchain technology, the recommendations of the European and Italian personal data protection authorities has been analyzed in order to guarantee their full compliance by identifying the owner of personal data treatment and respecting the security and confidentiality requirements essential for the processing of judicial data. It has also been provided a strategy that aim to alert the competent authorities in data breach events and to ensure the deletion of certain judicial data following a specific judgment.

Design step

Definition of the blockchain model

Given the data confidentiality and the importance of processes involved, which result under the responsibility of a specific subset of entities represented by the officials and judges employed by the territorial tax commissions, a federated blockchain model is chosen

Definition of the network model

The system hosting infrastructure is represented by the network connecting all the national tax commissions. It guarantees data security, due to its several access protection measures, including a series of intrusion detection systems (IDSs).

Definition of the governance and security rules

The governance polices have been established on the basis of the role and accountability of each entity involving in the trial tax system. In particular, the officials of the various commissions are authorised to inspect and validate the procedural files under their own responsibility which comply with the technical rules. The competence to insert and validate the sentences’ devices issued by tax court and the related smart contract of execution belongs to the judges on whom the competence falls. The identity and role of each entity participating in the system is guaranteed through the use of X.509 identity certificates. The tax legislation translated in terms of smart contracts is uniform for all the commissions therefore it must be approved jointly by all the participants of the system during its start up.

Definition of the ecosystem of technological architecture and tools The ecosystem model consists in a set of tools used for system operation and provided by IBM Hyperledger platform. They are represented by business objects, applications and smart contracts to be introduced in the system blockchain. Specifically, the selected business objects allow for domain modeling by defining entities such as proceedings parties, trials and procedural files. Each of them, is characterized by a series of attributes including an identifier, a timestamp and a status that evolves with smart contracts execution. The timestamp represents one of the key elements for the security of the blockchain technology as it prevents an operation from being eliminated or cancelled once it has been executed. It consists of a sequence of characters that uniquely and unalterably identify the precise time instant attributable to a specific event that is placed within a temporal order in which all events are comparable to each other. Following the affixing of a timestamp, as an output of the timestamping process, a document becomes opposable to third parties as it is connected with a valid date and time from the legal point of view. According to the technical rules provided by the national IT agency, it is necessary to define standards for the introduction of procedural documents that will be treated in a safe and unalterable manner through the blockchain. The documentation submitted by the appellant through the web application must be in PDF/A format and require a digital signature with probative value. The smart contracts represent the IT translation of the trial tax regulation in force and require constant updating. They are invoked by the applications which are computer representations of the operative part of the judgment. Although all smart contracts are loaded into the blockchain, only those appropriately validated by the network contribute to changing the status of business objects. In summary, the launch of a system application causes the execution of smart contracts that change the status of various business objects.

Test and Start up steps

After passing the test step, which involved a limited number of users belonging to a limited geographical areas, suitably guided by personnel specialised in using the system, it is possible to proceed with its start up. In the following paragraphs we proceed with a brief description of system functioning.

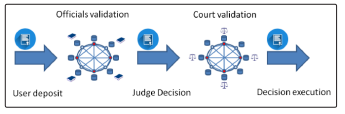

The trial tax begins with the filing of the tax appea by the appellant. This activity is carried out through a web application on which the citizen user registers and accesses through its own login credentials in order to submit a tax appeal. After the system has completed the submission conformity verification in terms of allowed formats and digital signature validation, a trial file is created containing all the documentation deposited by the user and, subsequently, introduced in a secure and unalterable manner in the system blockchain. Once the validation by the officers in charge of the competent territorial commission has taken place, the trial file business object, will modify its status as suitable for the decision and will be included among the decisions pending before a specific tax court. After the court makes the final trial decision, one of its members will proceed with the issuance of a device, represented by a document containing the verdict of the sentence and a smart contract consisting in the translation of the decision into information technology code. Both of them will be introduced into the system blockchain and validated by all members of the tax court according to a voted based mechanism following which, the status of the tax appeal business object will be modified in the concluded state. The smart contract implementing the sentence’s device consists of an application that invokes others smart contracts containing the software transaltion of national tax legislation and performs the activities provided in the operative part of the judgment, such as the refund of the appellant in the event of a successful appeal. The Figure 2 shows the trial tax conduct flow.

Figure 2: The execution flow of a digital trial tax

Assessment step

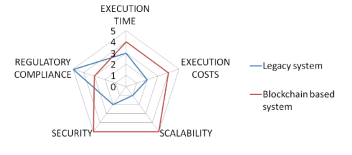

Once the system is running, it is possible to proceed with its assessment. As shown in Figure 3, the introduction of blockchain technology in the conduct of digital trial tax allows an overall performance improvement, particularly in the areas of security and scalability

Evaluation of execution time

A significant enhancement emerges with regard to system execution times due to a faster procedural document retrieval guaranteed by blockchain technology.

Evaluation of execution costs

A considerable improvement is recorded in terms of costs reduction, as the secure and unalterable data management offered by blockchain technology, makes it possible to avoid the use of expensive systems for tracking access by users to proceduaral documents

Evaluation of system and data security

The introduction of blockchain technology, due to its data security and immutability properties, allows high levels of data security with respect to traditional form, where security is guaranteed through expensive systems in charge of tracking access to procedural documents by authorized parties. Furthermore, the smart contracts execution ensures the enforceability of the judgment.

Evaluation of system scalability

The system ability to be sized on the basis of the number of territorial tax commissions participating in the network makes it a highly scalable solution.

Evaluation of regulatory compliance

The sector regulation still in the process of being defined does not allow the maximum level of regulatory compliance to be achieved, in particular, some issues relating to the right of users to request the complete deletion of their data remain to be solved. Surely the next Italian digital agency’s guidelines for distributed ledgers technologies will help in achieving a full regulatory compliance

Figure 3: The digital trial tax assessment diagrams

Conclusion

The public administration is a national strategic sector and its business processes are subject to radical changes over time due to the introduction of new technologies capable of making them more efficient, as well as regulatory innovations, that aim to increase their effectiveness.

The purpose of this study has been to define an implementation framework able to drive the introduction of blockchain technology within the public administration process without threatening their operation guaranteed by legacy systems and in full compliance with national sector regulations.

Furthermore, the operational effectiveness of the proposed framework, has been tested by developing a system allowing the conduct of telematic trial tax within the Italian public administration domain. The implemented blockchain based solution is fully integrated with existing information systems and enables the process execution in a more economical, secure and fast way. In addition, it guarantees the compliance with national sector regulation, represented by the provisions of the Privacy Guarantor and the European legislation on personal data protection. The framework application, also helps to develop a scalable solution, in fact, in the specific case of digital trial tax, the number of nodes participating in the blockchain system varies according to the territorial tax commissions that are part of the system federation.

The decentralized and confidential data management guarantees the protection of sensitive data. Confirming this important aspect, the telematic trial tax system developed ensures the confidentiality of procedural documents by introducing them in the system blockchain and by restricting their access rights.

Overall, the application of the proposed framework, enabling the introduction of blokchain technology into public business processes, allows to obtain a significant improvement in their performances evaluated under different dimensions of analysis, as showed by the related assessment diagram. Nevertheless, there exist legal situations in which system users have the right to request the complete deletion of their personal data and the blockchain instead stores them permanently. The definition of a series of error management policies along with some improvements in the framework interactions with legacy systems will be subject of future works.

Acknowledgments

We would like to thank all the officials of the Department of Finance of the Italian Ministry of Economy and Finance for sharing their knowledge on the matter.

References

- Nofer M, Gomber P, Hinz O, Schiereck D (2017) Blockchain - A Disruptive Technology. Business & Information Systems Engineering.

- Morabito V (2017) Business innovation through blockchain: The B 3 perspective. Business Innovation through Blockchain: The B.

- Betz F (2011) Innovation and Economy. In Managing Technological Innovation.

- Dewar RD, Dutton JE (1986) The Adoption of Radical and Incremental Innovations: An Empirical Analysis. Management Science.

- Danneels E (2004) Disruptive technology reconsidered: A critique and research agenda. Journal of Product Innovation Management.

- Hill CWL, Rothaermel FT (2003) The performance of incumbent firms in the face of radical technological innovation. Academy of Management Review.

- Reid F, Harrigan M (2013) An analysis of anonymity in the bitcoin system. In Security and Privacy in Social

- Pilkington M (2018) The Emerging ICO Landscape - Some Financial and Regulatory Standpoints. SSRN.

- Michael C, Nachiappan, Pradan P, Verma S, Kalyanaraman V (2016) BlockChain Technology: Beyond Bitcoin. International Journal of Hyperconnectivity and the Internet of

- Beck R, Avital M, Rossi M, Thatcher JB (2017) Blockchain Technology in Business and Information Systems Business and Information Systems Engineering.

- Mingxiao D, Xiaofeng M, Zhe Z, Xiangwei W, Qijun C (2017) A review on consensus algorithm of blockchain. In 2017 IEEE International Conference on Systems, Man, and Cybernetics, SMC 2017.

- Buterin V (2015) On public and private Blog.Ethereum.Org.

- Dingsoyr T, Nerur S, Balijepally V, Moe NB (2012) A decade of agile methodologies: Towards explaining agile software development. Journal of Systems and Software.

- Munassar NMA, Govardhan A (2010) A Comparison Between Five Models Of Software Engineering. IJCSI International Journal of Computer Science.

- Boehm B (1988) A spiral model of software development and maintenance. IEEE Computer. https://doi.org/10.1109/2.59.