Author(s): Farhang Mossavar Rahmani* and Bahman Zohuri

The financial landscape is undergoing a profound transformation, with Artificial Intelligence (AI) emerging as the catalyst for unprecedented change in banking institutions. This paper briefly examines the multifaceted impact of AI across critical domains, encompassing customer experiences, security protocols, risk management, operational efficiency, return on investment, and regulatory compliance. In customer-centric evolution, AI-driven chatbots and virtual assistants redefine interactions, providing personalized and anticipatory services. In the field of finance, security is a paramount concern. At the same time, we are witnessing AI as the guardian, fortifying trust through real-time fraud detection and biometric authentication. Risk management undergoes a paradigm shift, with predictive analytics steering financial institutions toward strategic advantages in navigating dynamic markets. Operational excellence is achieved through AI's automation, liberating human resources for strategic endeavors, and fostering a costconscious ethos. Regulatory compliance, often intricate, finds harmony through AI-driven automation tools and biometric authentication, ensuring transparency and accountability in the face of relentless regulatory scrutiny. Striking the right balance between innovation and ethical considerations is pivotal in ensuring that the consolidation of AI and finance is a force for good.

The financial landscape is undergoing a profound transformation, and at the heart of this evolution is the relentless integration of Artificial Intelligence (AI) into the core operations of financial institutions. As we navigate the intricate web of technological advancements, it becomes abundantly clear that AI is not merely a trend but a seismic force reshaping the foundations of traditional financial institutions, especially banking. In an era where data is currency and agility are paramount, financial institutions are turning to AI to unlock unprecedented opportunities, tackle complex challenges, and reimagine the very nature of their services.

Combining data analytics, machine learning, and advanced algorithms has accompanied an era where financial institutions are not just adopting AI; they are fundamentally recalibrating their strategies to harness its transformative potential. (i.e., Figure 1, which shows key players in the field gathering together). In this intricate dance between innovation and financial prudence, banking institutions find themselves at the forefront of a digital revolution that transcends routine automation to redefine how financial services are delivered, experienced, and secured.

The pivotal role of AI in this transformation is particularly noteworthy in the banking sector, where the stakes are high, the regulatory landscape is intricate, and the demand for personalized, secure, and efficient services is insatiable. This article delves into the multifaceted impact of AI on financial institutions, with a laser focus on the banking domain, unraveling the layers of change that AI is bringing to customer experiences, security frameworks, risk management paradigms, operational landscapes, and the broader outlines of financial decision-making.

As we embark on this exploration, it becomes evident that integrating AI into banking operations is not a mere technological upgrade but a strategic imperative. The repercussions of this technological revolution ripple through every facet of the financial ecosystem, challenging conventional norms, enhancing capabilities, and ushering in an era where adaptability and innovation are prerequisites for survival. The following sections dissect the transformative impact of AI on financial institutions, painting a picture of the profound changes underway, with a sharp eye on the intricate dance between technological expertise and financial insight.

In the dynamic landscape of modern banking, where customer expectations continue to evolve, the infusion of Artificial Intelligence (AI) has emerged as a catalyst for enhancing customer experiences to unprecedented levels. Integrating AI- powered chatbots and virtual assistants is at the forefront of this transformation, ushering in a new era of seamless, personalized interactions. See Figure 2.

AI enables financial institutions to analyze customer data, preferences, and behaviors faster and more accurately to offer personalized services and products.

This can lead to improved risk assessment, better decision-making, more efficient operation, and ultimately, reduced losses, positively impacting ROI.

Generative AI has gained international attention in recent times. Generative AI is a significant advance in artificial intelligence (AI) that allows machines to produce new types of material, such as writing, graphics, music, and even complete virtual worlds. Nevertheless, despite the excitement, we must remember that it's still early.

AI-driven chatbots, equipped with Natural Language Processing (NLP) capabilities, have become abundant in banking customer service. These virtual assistants provide instantaneous responses to customer queries, quickly navigating complex information and offering solutions in real-time. This expedites query resolution and ensures round-the-clock availability, transcending the limitations of traditional banking hours.

Moreover, AI's ability to analyze vast datasets allows for a deeper understanding of customer preferences, behaviors, and needs. Financial institutions leverage this wealth of data to tailor services and recommendations with previously unimaginable precision. From suggesting personalized investment strategies to recommending suitable financial products, AI fosters a sense of individualization that resonates with customers, building stronger connections between them and their financial service providers. For example, "Yabx's innovative use of AI/ML algorithms on raw data has led to the creation of 15,000 features for comprehensive financial profiles of borrowers, highlighting their commitment to data-driven lending. This transformation is pivotal, with credit scoring and risk assessment at its core [1].

The integration of AI extends beyond mere personalization; it manifests in predictive analytics that anticipates customer needs. (AI-powered algorithms can analyze vast amounts of data to identify patterns, anomalies, and potential risks more effectively than traditional methods.) AI algorithms can proactively offer relevant services or products by analyzing transaction histories, spending patterns, and life events. For example, a customer approaching a significant life event like purchasing a home might receive timely mortgage or home insurance suggestions. This proactive approach adds value to the customer and positions the financial institution as a trusted and responsive partner in their financial journey.

Furthermore, AI plays a crucial role in sentiment analysis, measuring customer satisfaction through social media interactions, reviews, and feedback. Financial institutions can swiftly identify and address concerns, ensuring a continuous feedback loop that fosters a culture of responsiveness and constant improvement.

Integrating AI in banking has elevated customer experiences from transactional to relational. The ability to provide instant, personalized, and anticipatory services positions financial institutions not merely as service providers but as strategic partners in the economic well-being of their customers. As AI continues to evolve, so will the possibilities for creating more prosperous, more meaningful interactions that redefine the very essence of customer-bank relationships.

Overall, one of AI's most significant impacts in banking is enhancing customer experiences. AI-powered chatbots and virtual assistants are now prevalent in customer service, providing instant responses to queries and streamlining issue resolution. These systems leverage natural language processing (NLP) to understand and respond to customer inquiries, making interactions more seamless and efficient.

AI algorithms also analyze customer data to personalize services, offering tailored product recommendations and financial advice. This personalization not only improves customer satisfaction but also strengthens customer loyalty, a crucial factor in an increasingly competitive banking landscape.

Fraud exists in all walks of life, and detecting and preventing fraud has become even more critical today. At the same time, with the rise in big data and artificial intelligence, new opportunities have arisen in using advanced machine learning models to detect and prevent fraud.

AI has significantly reinforced the security measures implemented by financial institutions. Advanced machine learning algorithms can detect patterns indicative of fraudulent activities in real time. These systems analyze vast amounts of data, identifying irregularities and potential threats more accurately than traditional methods. As a result, banks can swiftly respond to security breaches and protect both customer assets and the institution's integrity. See Figure 3

Biometric authentication, another facet of AI, adds an extra layer of security. Facial recognition, fingerprint scanning, and voice recognition technologies are becoming integral parts of identity verification, reducing the risk of unauthorized access and identity theft.

The timely understanding and detection of fraud vectors is fundamental to reducing the growing payment card fraud problem. In an era where digital transactions are the lifeblood of financial ecosystems, the imperative for robust fraud detection and security measures has never been more critical. Artificial Intelligence (AI) has emerged as the forefront in protecting financial institutions against the ever-evolving landscape of cyber threats and fraudulent activities.

Furthermore, AI's predictive capabilities are pivotal in staying one step ahead of potential threats. AI systems can anticipate and preemptively address emerging security risks by analyzing historical data and identifying subtle anomalies. This proactive approach is especially crucial in an environment where cyber threats are increasingly sophisticated and capable of adapting to traditional security measures.

The advent of AI in fraud detection also marks a paradigm shift in the security concept from reactive to proactive. Instead of merely responding to incidents after they occur, AI enables financial institutions to deploy preemptive measures, thwarting potential threats before they can manifest. This not only safeguards customer assets but also fortifies customers' trust in their financial institutions.

Combating money laundering is another area of AI that has been very effective. In a recent AML technology study by SAS, KPMG, and the Association of Certified learned; "that a third of financial institutions are accelerating their artificial intelligence (AI) and machine learning (ML) adoption for anti-money laundering (AML) technology in response to COVID-19 Meanwhile, another 39% of compliance professionals said their AI/ML adoption plans will continue unabated, despite the pandemic's disruption [2]."

In conclusion, integrating AI in fraud detection and security measures represents a quantum leap forward in the perpetual battle against financial crimes. As technology evolves, so will the sophistication of cyber threats. Through the intelligent application of AI, financial institutions can build robust defenses, ensuring the sanctity of digital transactions and cultivating an environment where customers can confidently engage in the digital realm without fear of compromise.

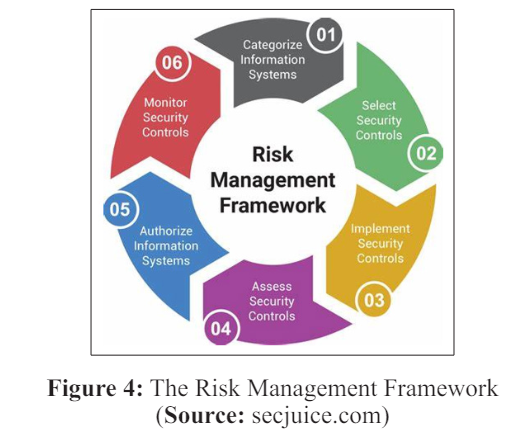

In many organizations, AI is the primary driver for firms to remain competitive and sustainable because of its time-saving advantages. In the intricate landscape of financial institutions, where decisions center on a delicate balance between risk and return, the arrival of Artificial Intelligence (AI) has revolutionized the traditional paradigms of data analysis and risk management. The marriage of advanced algorithms and vast datasets has empowered financial institutions to navigate complexities with unprecedented precision, leading to a new era of strategic decision-making. See illustration of Figure 4

AI's ability in data analysis is exemplified by its ability to examine and interpret colossal volumes of data in real time and at speeds incomprehensible to human capabilities. This analytical ability transcends traditional methods, offering a deeper understanding of market trends and patterns, customer behaviors, and macroeconomic indicators.

This allows financial institutions to better assess risks related to lending, investments, and compliance.

Financial institutions also leverage this capability to make informed decisions, optimize operational efficiency, and gain a competitive edge in an ever-evolving market.

In risk management, AI algorithms play a pivotal role in assessing and mitigating various forms of risk, from credit defaults to market volatility. Traditional risk management models rely on historical data and predefined rules, limiting their adaptability to dynamic market conditions. Conversely, AI employs machine learning to continuously analyze real-time data, adapting its risk models in response to changing variables and unforeseen events.

The predictive analytics capabilities of AI are instrumental in forecasting potential risks before they materialize. By identifying patterns and correlations within vast datasets, AI algorithms can anticipate market shifts, credit defaults, and other risk factors, enabling financial institutions to take proactive measures. This forward-looking approach is a quantum leap beyond reactive risk management, positioning institutions to navigate uncertainties with resilience and foresight.

Moreover, AI contributes significantly to portfolio management by providing real-time insights and recommendations. Automated trading algorithms, driven by AI, execute transactions based on market trends, optimizing investment decisions and asset allocations. This enhances the efficiency of portfolio management

and allows financial institutions to capitalize on market opportunities in a timely and strategic manner.

At the same time, in financial institutions, risks relate to safety and soundness, fair access to financial services, fair treatment of consumers, and compliance with applicable laws and regulations [3]. It is important to determine that AI applications do not compromise these areas and that the intended use case is properly designed or managed. Most resulting adverse outcomes stem from:

•Models being poorly designed or faulty data used.

•Inadequate model testing or validation

•Narrow or limited human oversight.

•Inadequate planning or due diligence.

In conclusion, the integration of AI in data analysis and risk management represents a paradigm shift in how financial institutions navigate the intricate world of finance. The ability to analyze vast datasets, make real-time predictions, and adapt to dynamic market conditions empowers institutions to make informed decisions, minimize risks, and embark on a path of sustainable growth in an era where agility and foresight are paramount.

In the competitive landscape of financial institutions, operational efficiency is not just a desirable attribute but a strategic imperative. Artificial Intelligence (AI) has emerged as a transformative force, reshaping the operational frameworks of banks and financial entities, driving efficiency gains and facilitating significant cost reductions.

Robotic Process Automation (RPA), a key component of AI, is employed to automate routine and repetitive tasks that traditionally consumed valuable human resources. Mundane processes such as data entry, document verification, and transaction processing are now seamlessly executed by AI-driven bots. This not only reduces the margin for human error but also liberates human employees to focus on tasks that require creativity, critical thinking, and complex decision-making. See Figure 5

The integration of AI in customer service operations is equally impactful. AI-powered chatbots and virtual assistants handle routine customer queries, providing instant responses and streamlining issue resolution. This accelerates response times and reduces the workload on customer support teams, allowing human agents to tackle more complex and nuanced inquiries. The result is a more responsive and efficient customer service ecosystem.

Furthermore, AI's ability to analyze large datasets and generate actionable insights is leveraged to optimize resource allocation. Financial institutions can identify inefficiency, streamline processes, and allocate resources judiciously. For example, AI- driven predictive maintenance can anticipate equipment failures, reducing downtime and avoiding costly repairs.

The cost-reduction impact of AI extends beyond operational processes to risk management. AI algorithms can identify potential risks and vulnerabilities in real time through their predictive analytics capabilities. This proactive approach minimizes the financial impact of risks and reduces the need for reactive, costly interventions.

Additionally, AI-driven analytics aids in fraud detection and prevention, saving financial institutions substantial sums that might be lost to fraudulent activities. The adaptive nature of AI allows it to evolve alongside emerging threats, providing a robust defense against ever-evolving cyber risks.

In conclusion, the integration of AI in operational processes is a catalyst for fostering a culture of efficiency and cost-consciousness within financial institutions. As AI continues to evolve, its role in driving operational excellence and cost reduction will likely become even more pronounced, enabling financial institutions to operate with agility, responsiveness, and a keen eye on the bottom line in an increasingly dynamic and competitive environment.

Maintaining compliance with an ever-evolving landscape of laws and regulations is paramount in the complex and tightly regulated realm of financial institutions. The integration of Artificial Intelligence (AI) has proven to be a game-changer in navigating the intricate web of compliance requirements, offering efficiency, accuracy, and adaptability that traditional methods often struggle to match.

AI's impact on regulatory compliance is most evident in automating compliance checks and monitoring transactions for suspicious activities. Machine learning algorithms analyze vast datasets in real time, identifying patterns indicative of potential compliance breaches. This enhances the speed at which compliance checks are conducted and augments the precision of detection, reducing the risk of oversight and non-compliance Figure 6.

Regulatory frameworks' vast and ever-changing nature poses a significant challenge for financial institutions. AI addresses this challenge by continuously learning and adapting to new regulations. This adaptability ensures compliance systems stay abreast of the latest legal requirements, reducing the risk of penalties and reputational damage associated with non-compliance.

Moreover, AI streamlines the labor-intensive process of regulatory reporting. Automation tools powered by AI can compile and organize the necessary data, ensuring that reports are accurate, comprehensive, and submitted within mandated timelines. This not only reduces the administrative burden on compliance teams but also minimizes the risk of errors that might result from manual data entry.

Biometric authentication, a subset of AI, contributes to compliance by enhancing identity verification processes. Facial recognition, fingerprint scanning, and other biometric technologies provide a more robust and secure means of verifying the identities of individuals, reducing the risk of unauthorized access and fraudulent activities.

As the regulatory landscape becomes increasingly global and interconnected, AI offers a standardized and scalable approach to compliance. The ability to deploy consistent compliance measures across diverse markets and jurisdictions streamlines the regulatory burden on financial institutions operating on a global scale.

In conclusion, the integration of AI in regulatory compliance represents a paradigm shift in how financial institutions navigate the intricate maze of legal requirements. The efficiency gains, adaptability, and precision offered by AI not only ensure compliance but also position institutions to proactively address regulatory challenges, fostering a culture of transparency, accountability, and resilience in an environment where regulatory scrutiny is relentless.

However, it is noteworthy as a caution to be aware of the risks and monitor upcoming regulations, utilizing Generative AI in the form of ChatGPT.

To successfully implement AI, we must be fully aware of its drawbacks and potential biases and put precautions in place to guarantee responsible use. Significant concerns associated with generative AI are those related to privacy, content attribution, algorithmic bias, racism, and disinformation?the latter is frequently present in training data and unavailable because it is proprietary. Additionally, there's a chance that the model will exaggerate or imagine things.

When the model produces erroneous or unexpected outcomes that are not corroborated by actual data, this is known as "hallucinogenic error." These could be made-up information, news, or content. This problem was brought to light earlier in 2023 when a lawyer utilized ChatGPT to look up information for a case and found that it was all made up.

Regulation is on the way. Some of the first AI laws in the world are being implemented in China. This month, concurrently with the EU and US developing AI frameworks, these will take effect. If this legislation is approved, it might have repercussions in other nations.

As company leaders, we need to establish our boundaries and actively provide chances for staff members to test out AI in the workplace appropriately. PwC says, "As the ones closest to the day-to-day work, they'll have valuable insights into where AI might be most effective."

The transformative impact of Artificial Intelligence (AI) on financial institutions, with a specific focus on banking, has unveiled a new chapter in the history of finance. As we navigate the intersections of technological innovation and financial understanding, it is evident that the integration of AI is not a mere extension but a revolutionary force reshaping every facet of the industry. The confluence of AI's capabilities has engendered a seismic shift from customer experiences to security protocols, risk management strategies, operational efficiencies, and regulatory compliance frameworks.

AI has driven financial institutions into a customer-centric evolution. Through intuitive chatbots and virtual assistants, institutions provide services and craft personalized and anticipatory interactions. The era of understanding customer needs through intricate data analytics has been accompanied by a relationship- focused paradigm, where institutions become trusted partners in their clients' financial journeys.

From security and trust, AI is the guardian, protecting against threats with unparalleled precision. From fraud detection mechanisms that adapt in real-time to biometric authentication supporting transactions, AI fortifies the trust customers place in financial institutions. In an age where cyber threats loom large, AI emerges as a determined defender, ensuring the sanctity of financial transactions.

Furthermore, risk management has transformed due to AI's predictive analytics capabilities. Financial institutions now navigate volatile markets with foresight, anticipating risks before they materialize. Automated trading algorithms, guided by AI, optimize portfolios with precision that reflects the maturation of risk management into a strategic advantage.

AI's role in operational efficiency extends beyond mere automation. It leads to a culture of excellence, where human resources are liberated from routine tasks, allowing a shift towards strategic endeavors. Financial institutions, guided by AI analytics, streamline processes, optimize resource allocation, and foster a cost-conscious ethos, ensuring sustainability in an ever-changing economic landscape.

AI brings harmony to the often-complex symphony of regulatory compliance. Automation tools navigate the labyrinth of compliance requirements with speed and adaptability. Biometric authentication, a subset of AI, ensures secure compliance, fostering transparency and accountability in an environment where regulatory scrutiny is relentless.

In this grand tapestry of AI-driven finance, ethical considerations appear large. The responsible deployment of AI technologies, mindful of data privacy and algorithmic biases, becomes a moral compass for financial institutions as they traverse uncharted territories. Striking the right balance between innovation and ethical considerations will be pivotal in ensuring that the transformative impact of AI in finance is a force for good.

As we conclude, it is evident that we stand on the threshold of a technological renaissance in finance. The journey is ongoing, and as AI continues to evolve, financial institutions poised to embrace its potential with ethical rigor will likely emerge as trailblazers in a future where innovation, resilience, and customer-centricity define the new normal in banking and finance.

The ongoing evolution of AI promises to redefine the financial ecosystem, fostering intelligence, security, and adaptability in an era where innovation, resilience, and customer-centricity define the new normal.

The fusion of AI and finance is not just about machines and algorithms; it is about creating a financial ecosystem that is more intelligent, secure, and attuned to the diverse needs of a dynamic and ever-evolving global economy [4-8].

1.Rajat Dayal (2023) Transforming financial inclusion through AI and Machine Learning. IBS intelligence https:// ibsintelligence.com/blogs/transforming-financial-lnclusion- through-ai-and-machine-learning/.

2.(2021) Tellervision https://twitter.com/TellerVision/ status/1452001847640723456.

3.Curtis Campbell (2023) AI Risk Management in Regulatory Environments. ISSA Journal.

4.Farhang Mossavar Rahmani, Bahman Zohuri (2023) The Evolution of Artificial Intelligence: From Supervised to Semi- Supervised and Ultimately Unsupervised Technology Trends. Current Trends in Engineering Science (CTES) 3: 1-4.

5.Bahman Zohuri, Siamak Zadeh (2020) Artificial Intelligence Driven by Machine Learning and Deep Learning. 1st Edition, Nova Science Pub Inc 1-455.

6.Bahman Zohuri, Farhang Mossavar-Rahmani, Artificial General Intelligence (AGI and Its Real-Time Interaction with Humans. To Be Published.

7.(2023) Generative AI: What Is It, Tools, Models, Applications and Use Cases. Gartner https://www.gartner.com/en/topics/ generative-ai.

8.Bahman Zohuri, Farhang Mossavar Rahmani (2020) Artificial Intelligence Versus Human Intelligence: A New Technological Race. Acta Scientific Pharmaceutical Sciences 4: 50-58.

View PDF