Author(s): <p>François Jeanjean</p>

The relationship between competition and investment is generally characterized by an inverted-U relationship. The position of these curves and, in particular their maximum, i.e, the degree of competition that maximizes investment, depends on the degree of technical progress that characterizes each industry. Industries experiencing a high degree of technical progress, as information technologies, maximize their investments in innovation for lower degrees of competition than other industries. Sectoral and competition authorities should take this into account for regulation of competition. Information technologies should not be regulated as brick and mortar industries.

It is usual to consider that competition favors both investments and lower prices. However, according to Aghion et al., it turns out that the relationship between competition and investment is not monotonous but rather inverted-U shaped [1,2]. Moreover, Ciriani & Jeanjean found such inverted-U shaped relationships for the different sectors of the french economy between 1078 and 2015 [3]. They highlighted that the top of the inverted-U curve depended on the level of technical progress of the sector. The higher the technical progress the lower the level of competition that maximizes the curve. This feature is explained by Jeanjean in an industrial organization theoretical model [4].

This paper aims to explain, in a synthetic way, the reason why the relationship between competition and investment is inverted-U shaped and why technical progress reduces the degree of competition that maximizes this relationship.

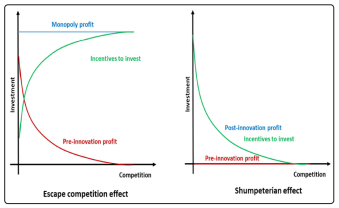

In their article Aghion et al., the authors explain the reason of the inverted-U relationship between competition and investment. Competition generates two different and contradictory effects on firms in a particular industry [2].

The first is the “escape competition effect” where firms invest to become a technological leader in order to increase their market power and to avoid the decreasing impact of competition on their margins. In other words, they invest to escape competition. At the limit, if their investment is very successful, they can experience, at least temporary, a monopoly power.

The second is the “Schumpeterian effect” named after economist Joseph Schumpeter who formalized the idea of creative destruction. Firms that are technologically laggard and experience very low margins invest in order to catch up with the technological leaders and restore their margins.

In the “Escape competition effect” firms tend to increase their investment with the level of competition. Indeed, the gain of escaping competition is higher. By cons, in the “Schumpeterian effect”, firms tend to decrease their investments with the degree of competition. The gain of catching up with the leaders is lower. In a particular industry, both effect coexist and, because they have a contradictory effect on the relationship between competition and investment, the overall impact depends on which effect dominates; and this depends on the type of competition. In neck-and-neck competition, where there is no leader or laggard, there is no “Schumpeterian effect”, there can only be an “escape competition effect”. In leader laggard competition there is no “escape competition effect” but only “Schumpeterian effect”.

For a low degree of competition on the market the “escape competition effect” dominates. Indeed, the gain for escaping competition is low and by cons, the gain for catching up with the leader is high, therefore, only few firms invest to become technological leaders and laggards are encouraged to invest. This means that firms are mostly in neck and neck competition rather than in leader laggard competition. For a high degree of competition, on the contrary, the “Schumpeterian effect dominates”. Firms in neck and neck competition are encouraged to invest while laggard in leader laggard competition have less incentives to invest. In that case competition is mostly leader laggard competition rather than neck and neck competition and therefore, the “Schumpeterian effect” dominates.

In short, for a low degree of competition “escape competition effect” dominates which means that an increase in the degree of competition increases investment, the relationship between competition and investment is increasing. For a high degree of competition, on the contrary, the “Shumpeterian effect” dominates and therefore, an increase in the degree of competition reduces investment, the relationship between competition and investment is decreasing. In between, there is an intermediate level of competition where the “escape competition effect” and the “Schumpeterian effect” are balanced and the relationship between competition and investment is flat. Investment is thus maximum at this level and this means that the relationship between competition and investment is inverted-U shaped.

The level of technical progress is very different from one industry to another or from one sector to another. Some industries are very innovative, such as information technologies, others are less so. Koh & Magee highlighted that technical progress rate is much higher in information technologies than in energy technologies [5,6]. Above 20% in information technologies during the last century versus around 6% in energy sector. Those differences have an impact on the relationship between competition and investment.

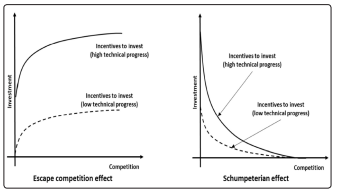

Technical progress increases incentives to invest both in ”Escape competition effect” and ”Schumpeterian effect”, however, the slope is preserved in the ”Escape competition effect” while it is sharped in ”Schumpeterian effect” by: Technical progress increases incentives to invest both in ”Escape competition effect” and ”Schumpeterian effect”, however, the slope is preserved in the ”Escape competition effect” while it is accentuated in ”Schumpeterian effect”.

In summary, the decreasing side of the inverted-U relationship is accentuated while the increasing side is not, even if investment increases in both sides. As a result, the top of the curve is achieved for a lower degree of competition. Let us consider the example where investment in innovation allows to acquire a monopoly power. Before investment, profits of firms decrease with competition. The “Escape competition effect encourages firms to invest to gain a monopoly profit. Incentives to invest depends on the difference between monopoly profit with the new technology and competitive profit with the old technology. This difference increases with the pre-innovation profit.

The graph below, Figure 1, illustrates the incentives to invest through both “Escape competition effect” and “Schumpeterian effect”.

Figure 1: Incentives to invest

The graph below, Figure 2, illustrates how incentives to invest are impacted by technical progress. Technical progress increases incentives to invest both in “Escape competition effect” and “Schumpeterian effect”, however, the slope is preserved in the “Escape competition effect” while it is sharped by “Schumpeterian effect”

Figure 2: Impact of technical progress on incentives to invest

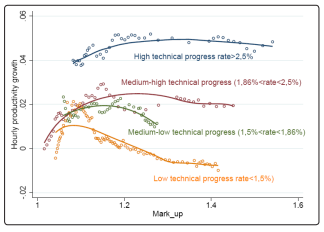

Ciriani & Jeanjean have studied the relationship between competition and productivity growth (a proxy of investment) according to the different sectors of the french economy [3]. They find the inverted-U relationship at sector level and, as expected, they find that sectors experiencing the highest rate of technical progress are those that maximize the growth of productivity for the lowest degree of competition, (more precisely for the highest markup over marginal cost which is inversely related to competition).

The graph below, Figure 3 represents the relationship between the markup over marginal cost and hourly productivity growth for 30 sectors according to the technical progress rate. The 30 sectors are dispatched into 4 groups according to their technical progress. The higher the technical progress, the higher the markup (the lower the degree of competition), and the higher the growth of productivity

Figure 3: Inverted-U relationships according to technical progress

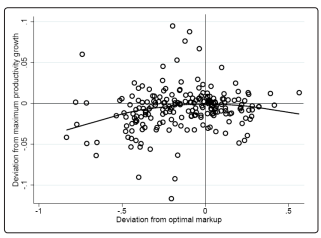

The authors estimated the markup that maximizes productivity growth in each sector and found a strong positive correlation between technical progress rate and the optimal markup. As a result, an unsuitable markup, higher or lower than the optimum entails a loss of productivity. The graph below, Figure 4, shows the losses of productivity growth due to unsuitable markup (too high or too low)

Figure 4: Productivity growth losses due to unsuitable markup

The solid curve is a lowess average smoothing that shows in average, the maximum productivity growth is achieved for the optimal markup. The maximum of the curve is very close to point (0,0). this means that, in average, a deviation from the optimal markup reduces productivity growth. The average loss of productivity growth over the period (1978-2015) is estimated at 0.4% (with an average difference of 0.152 from the optimal markup).

Technical progress increases the level of markup (decreases the level of competition) that maximizes investment and productivity growth. Innovative industries or sectors, experiencing a high rate of technical progress, like Information technologies require a relatively high markup to optimize investment and thus productivity growth. An unsuitable level of markup entails a loss of productivity growth. Such loss of productivity growth due to unsuitable mark-up is estimated in average at 0.4% per year for French economy. Competition authorities and sectoral regulators should take this into account in their decisions regarding high innovative industries.

The views expressed by the author do not necessarily reflect those of the institution with which he is affiliated.