Author(s): Chandra Sekhar Veluru

AI can empower the real estate sector to fundamentally transform property valuation, analyze market trends, and make investment decisions. In exploring this further, this paper will explore how the AI-driven insights drawn from historical data increase real estate operations' accuracy, consistency, and efficiency. This research adds in-depth insight into the prevailing trends in the real estate market by developing advanced analytical models, SARIMA for rental price forecasting, K-Means clustering for market segmentation, Principal Component Analysis for dimensionality reduction, and sentiment analysis for public perception. Analytics of these advanced technologies can enable more enlightened and strategic decision-making within the study of rental and listing price data. The findings underline the importance of data-driven strategies in helping to identify market opportunities, optimize one's pricing strategy, and increase the transparency and efficiency of markets to strengthen the industry as a whole further.

One of the foundation stones of world economies is the real estate business, undergoing a sea change through inevitable technological advances in artificial intelligence and machine learning. Real estate deal decisions are traditionally heavily dependent upon human expertise and manual data analysis with subjective judgments, often leading to inconsistencies and inefficiencies. AI and ML technologies are now changing everything real estate professionals do concerning property valuation, market trend analysis, and investment decision-making. AI and ML enable the generation of more accurate, consistent, and data-driven insights because they can tap huge historical data repositories and run complex algorithms within them, which has enormous potential for the sector [1].

While comparative market analysis has been a reliable property valuation method, it has limitations. These include difficulty quantifying and integrating variables such as local economic conditions, neighborhood development, and seasonal market fluctuations. These factors can significantly impact property values, making it challenging to arrive at accurate valuations. AI and ML technologies have emerged as a solution to these challenges. By analyzing large data sets with multiple variables, these technologies can identify patterns from historical data and predict future trends with greater precision than traditional models. Transitioning from manual valuation models to automated and data-driven approaches is a significant leap forward in the real estate industry.

Historical data forms an essential element in the application of AI and ML in real estate. Some areas covered under this dataset include past sales prices, rental rates, economic indicators, and demographic trends. The historical data analysis will give insight into AI and ML algorithms that are not immediately possible with traditional analysis methods [2]. For example, historical data can identify long-term trends in property values, acknowledge the factors that most commonly impact market performance, and provide a lead for predicting future market behavior. Armed with these insights, real estate professionals can make more prudent and less uncertain decisions and achieve greater precision in their valuations and forecasts [3].

Success in real estate depends on understanding the market trends appropriately. These will be determined based on factors such as economic conditions, population growth, urban development, and changes in consumer preferences. Traditional ways of analyzing market trends rely on data collection and manual analysis, which is usually time-consuming and prone to errors [1].

AI and ML technologies can convert the function of market trend analysis into more effective trend analysis through specialized algorithms by mechanizing the data collection process. They are capable of processing real-time data from different sources, pinpointing rising trends, and forecasting future movements in the market. Inbuilt analysis and prediction of market trends provide an edge to the competitive ability of real estate professionals to act before changes occur.

The potential of AI and ML within the real estate business is immense. These technologies promise to increase valuation accuracy, efficiency, and consistency, empowering practitioners to make more informed investment decisions. AI and ML can facilitate better risk management and returns for investors by reducing dependence on subjective judgment and enhancing market transparency. For property managers, these technologies can make operations more efficient, thereby increasing tenant satisfaction. The future of real estate, led by AI and ML, appears bright, empowering professionals to make more informed investment decisions and instilling confidence in the industry's future. Adopting AI and ML in real estate mirrors broader technological trends in business industries where a data-driven decision-making culture is created. As with these technologies, their applications in real estate will further widen and open up even more excellent opportunities for innovation and efficiency.

AI and ML are set to induce critical changes in the real estate industry. With the ability to leverage historical data and resilient algorithms, these technologies promise to significantly increase the accuracy and effectiveness of property valuation, market trend analysis, and investment decision-making. This new shift towards data-driven insights offers a promising view of a new generation of real estate that is much needed for the industry's transparency, efficiency, and profitability. As the industry increasingly embraces these technological changes, the future of real estate led by AI and ML appears bright, reassuring professionals of the accuracy and efficiency of future real estate practices.

The intersection of artificial intelligence and real estate holds immense potential to change this sector. With innovation continuing unabated, AI's penetration in real estate practices is getting deeper. However, it also opens up new ways for property valuation, market analysis, and investment decision-making. This literature review attempts to provide insight into the current state of AI in real estate, covering various applications and their impacts on the industry.

The introduction of AI into the real estate sector began with the adoption of simple automated solutions in property management and customer service functions. Early deployments have thus been 962 focused on improving business efficiency and reducing real estate professionals' manual workload. For instance, chatbots have been used to answer customer inquiries, schedule viewings, and provide basic information about properties [4]. These applications in the early days of AI thus underline the possibility of AI in operational efficiency and customer engagement, which only prepares a way for more sophisticated uses.

Big data is one of the critical enablers of AI in real estate. Specifically, the real estate business generates vast amounts of data on listings, transactions, demographics, and economic indicators. Big data provides the raw material AI algorithms need to learn and make predictions. The fast development of all kinds of data storage and processing technologies has made employing this data efficient and possible, allowing accurate and comprehensive analyses [5].

Big data allows the compilation and analysis of different data sets to give a comprehensive view of the real estate market. AI algorithms can comb through such data. DockStyle patterns and correlations that are otherwise obscure from basic methods of analysis. Quick and efficient processing of large datasets is one of AI's most important functionalities in optimizing real estate [6].

The technologies of AI have been spectacular in changing customer experience within the real estate industry. Virtual tours and augmented reality have become essential; customers wanting to purchase or lease properties can view them worldwide. These technologies implement AI to ensure that customers get as close to reality and realistic, immersive experiences as possible to make effective decisions without visits [7].

Thus, AI-heavy recommendation engines would tailor the property search process by studying user preferences and behavior. This would hint at properties that meet the customer's criteria and increase the likelihood of getting the right property. Since this approach is tailored to better customer satisfaction, it reduces their time and effort in hunting for suitable property [8].

The role of AI in property management and maintenance has improved immensely. Predictive maintenance systems use AI to monitor building systems and infrastructure conditions, inducing maintenance requirements before issues reach critical points. Such proactive measures thus avoid expensive repairs and reduce downtime in maintaining the property in good condition [9].

It can further optimize building energy use by analyzing patterns and adjusting systems to reduce consumption. All these intelligent building technologies, running on AI technology to handle heating, cooling, lighting, and other building systems, save energy and operational costs. These ways lead to more sustainable and efficient property management practices [10].

The application of AI in real estate transactions creates ease and transparency. Blockchain technology is applied with AI to create secure and transparent transaction records. It automates several aspects of real estate transactions, such as escrow and title transfer, with smart contracts, eliminating intermediaries and reducing transaction costs [11]. AI algorithms also aid in fraud detection by analyzing the transaction data for suspicious activity that may indicate fraud. Hence, this increased security protects the buyer, seller, and investor and builds trust in the real estate market [12].

While the smart city idea is fast catching up, AI brings real depth to an intelligent city. Smart cities are urban areas that leverage AI and IoT technologies to run infrastructures better and services more efficiently. Innovative city initiatives are aimed at enhancing livability and sustainability through resource optimization, decongestion of roads, and other functions of improving public services in the real estate context [13]. AI-driven urban planning tools make decisions concerning city planning based on their interpretations of data derived from population increase, transportation trends, and environmental considerations. They can aid planners in creating more efficient and sustainable urban environments so that intelligent cities can continue to develop [14].

Such integration of AI in real estate also raises ethical and legal concerns, which are worth discussing. First, algorithm bias may occur, whereby the AI models further exaggerate existing ones in the housing market. One hopes that fairness and transparency of AI systems ensure that no discrimination occurs and that housing is accessible by all standards [15].

Another issue is data privacy since AI mainly deals with personal and sensitive information. For that, real estate professionals will have an obligation to make good on their promise of protection to customers by complying with set regulations on data protection and ensuring appropriate security measures are in place. Considering these ethical and legal challenges, responsible AI adoption in real estate is a call for duty [16].

AI has been beneficial in analyzing historical data to predict future trends improving investment analysis and forecasting. Real estate investors need forecasts of property values, rental yields, and market conditions for correct decision-making. AI algorithms compute reams of data to discover trends and correlations that inform the investment strategy [17].

For example, machine-learning models can be trained to predict rental yields as a function of location, type of property, and the current state of the market. An investor can forecast the return on investment and make data-driven decisions based on these predictions. AI also adds another advantage in real estate markets by discovering new markets and opportunities for investment [16].

Knowing the market trends is of immense help in succeeding in the real estate market. AI technologies automate the data collection process and analyze the market trend with better efficiency and accuracy with the help of advanced algorithms than usual. Processing data in real-time from several sources, AI can identify emerging trends and point out future market movements [13].

AI-driven market trend analysis provides real estate professionals with a basis for projecting changes in demand and supply and a way to adjust their strategies proactively. The opportunity to be one step ahead helps a great deal in competitive advantages and enables more effective decision-making [15].

AI and ML technologies in real estate could not come at a better time, extending benefits into property valuation, market analysis, and investment decision-making. They provide increased accuracy, consistency, and data-driven insight, moving traditional practices in the real estate industry further forward through historical data and sophisticated algorithms. The potential of AI and ML will likely be in the application of real estate, more greatly so as these technologies evolve further. In the future, AI and ML will lead the progress of real estate; it will keep getting more transparent, efficient, and profitable.

This work focuses on the intersection of AI and ML in improving property valuation, investment analysis and forecasting, and market trend analysis in the real estate sector. The methodology adopted states the research questions, the means of data collection, and the identification of suitable AI forecast models necessary for conducting predictive analysis.

Sales History API: Retrieve historical sales data.

Based on the data collected from the property rental and property listing data, the following AI forecast models can be explored, and appropriate models can be used to predict the next three months of property values, rental yields, and market trends:

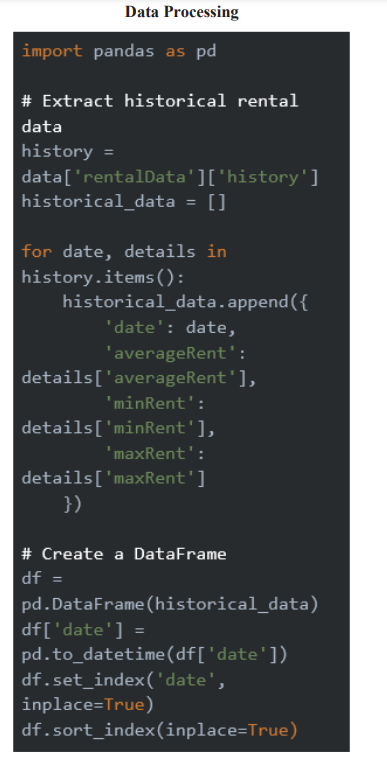

SARIMA (Seasonal Autoregressive Integrated Moving Average): A time series forecasting model to predict future property values and rental yields based on historical data.

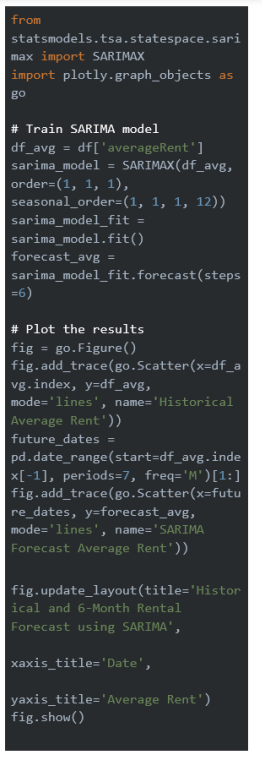

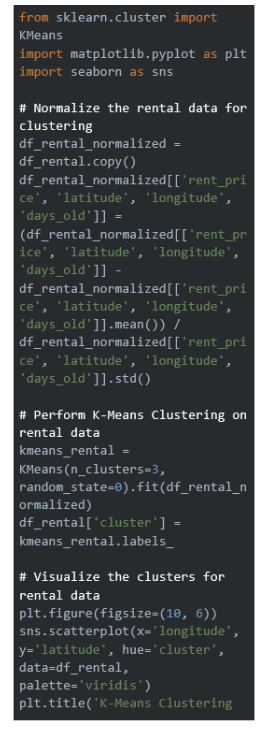

K-MeansClustering: Segment the market into clusters based on property features and demand patterns.

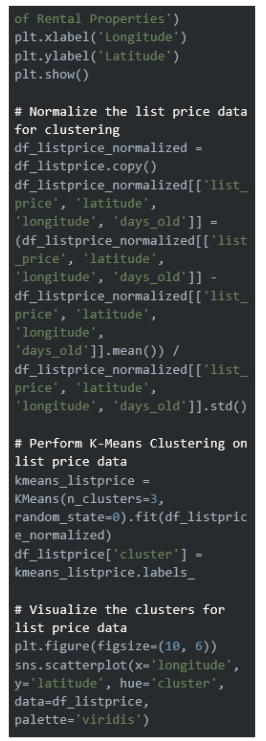

Principal Component Analysis (PCA): To reduce the dimensionality of the data and identify key factors driving market trends.

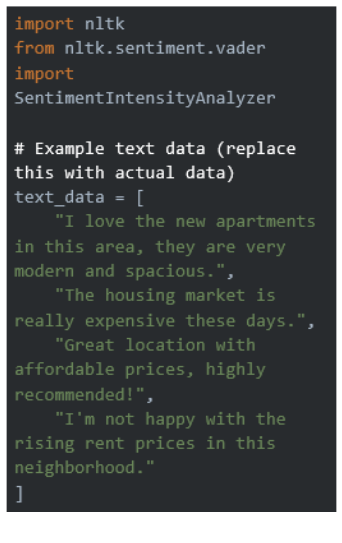

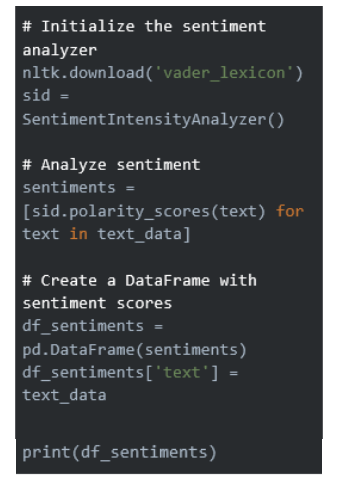

Sentiment Analysis: Using natural language processing (NLP) to analyze text data from social media, reviews, and news articles to gauge public sentiment towards different real estate markets.

The graphs generated from the analysis provide a wealth of information about the rental and list price properties. Below, I discuss each graph in detail, interpreting the data and explaining how these insights can help analyze market trends and develop the real estate business.

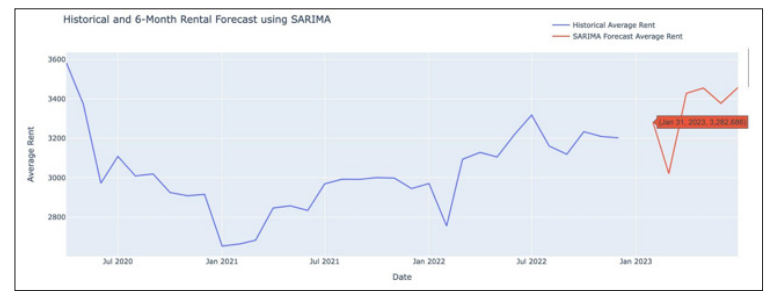

Graph 1: SARIMA Model to Forecast Next Six Months Rental Trends

Historical Trend: The blue line represents the average historical rent for April 2020 to December 2022. As can be seen, the average rent lowered from about $3,600 down to approximately $2,800. The possible reasons range from the saturation of multiple listing markets and neighborhoods to more significant economic downturns.

Forecasted Trend: The red line indicates an increasing trend: the SARIMA forecast across the next six months. The average rent will grow from about $3,283 in January 2023 to approximately $3,450 by mid-2023, which indicates that there might be a recovery or increased demand in the rental market.

Market Recovery: The forecasted increase in average rent suggests a potential recovery in the rental market. Property managers can anticipate higher rental incomes in the coming months.

Strategic Pricing: Understanding the future trend allows for strategic pricing adjustments. Property managers can increase rental prices gradually to maximize revenue while remaining competitive.

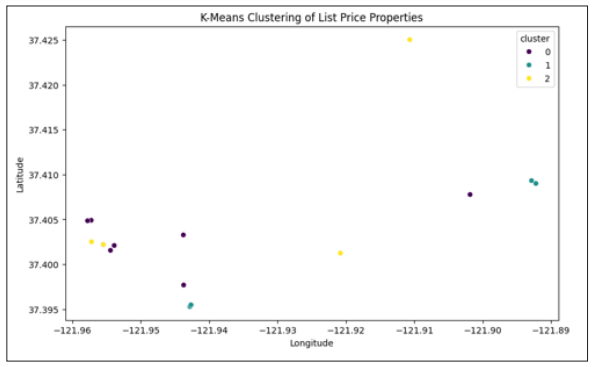

Graph 2: K-Means Clustering for the Property Sale List Prices

Clusters: The K-Means clustering algorithm segmented the properties into three clusters based on their geographical coordinates. Each cluster is represented by a different color (purple, blue, yellow).

Cluster 0 (Purple): Concentrated around coordinates (37.395,-121.96) to (37.405, -121.91), potentially indicating lower list prices and less demand.

Cluster 1 (Blue): Scattered across coordinates (37.395, -121.96) to (37.425, -121.91) with a slight concentration towards the center, indicating moderate list prices.

Cluster 2 (Yellow): Primarily concentrated around coordinates (37.405, -121.94) to (37.425, -121.89), suggesting higher list prices and greater demand.

Geographical Insights: The clusters reveal distinct geographical patterns. For example, properties in the yellow cluster are concentrated in a specific area, indicating a unique market segment with similar characteristics.

Targeted Marketing: Real estate professionals can tailor marketing strategies to specific segments by identifying distinct clusters. For instance, properties in the yellow cluster may appeal to a different demographic than those in the purple or blue clusters.

Investment Opportunities: Investors can use cluster analysis to identify high-potential areas. For example, if the yellow cluster shows higher list prices and demand, it may indicate a lucrative investment opportunity.

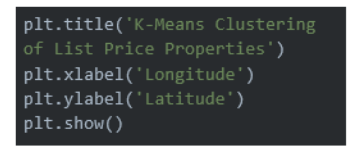

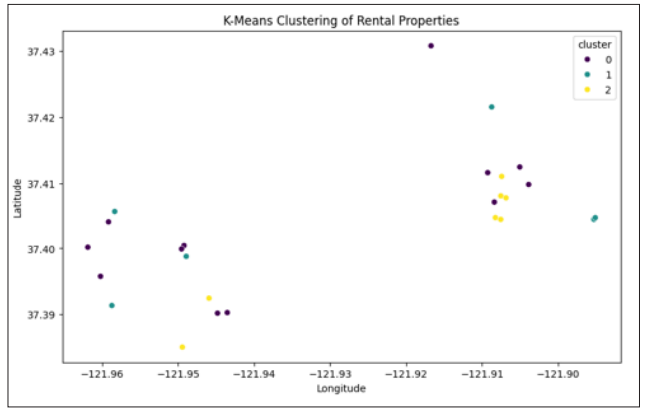

Graph 3: K-Means Clustering for the Property Sale List Prices

Clusters: Similar to the list price clustering, the rental properties are segmented into three clusters. Each cluster shows a unique distribution of rental properties across the geographical area.

Cluster 0 (Purple): Scattered primarily around coordinates (37.395, -121.96) to (37.425, -121.91), indicating properties with potentially lower rent prices.

Cluster 1 (Blue): It is spread across coordinates (37.395, -121.96) to (37.425, -121.89), with a concentration towards the center, and represents moderate rent prices.

Cluster 2 (Yellow): Concentrated towards coordinates (37.405,-121.94) to (37.425, -121.89), suggesting higher rent prices and higher demand.

Rental Market Segments: The clustering reveals distinct rental market segments, providing insights into areas with higher or lower rental demand.

Rental Market Analysis: Understanding rental market segments helps property managers optimize rental strategies. They can focus on high-demand areas for new property developments or targeted rental promotions.

Tenant Preferences: Clustering can also indicate tenant preferences based on location. Property managers can tailor amenities and services to meet the needs of tenants in specific clusters.

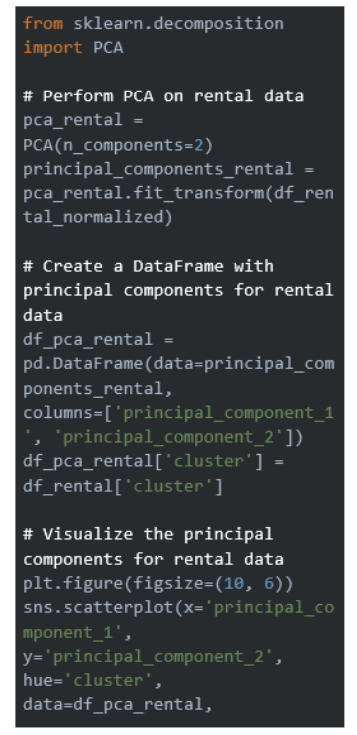

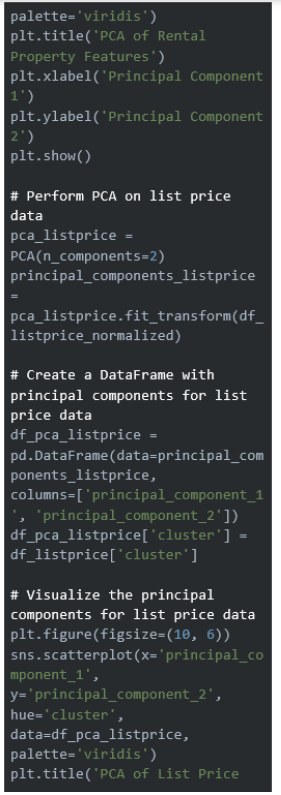

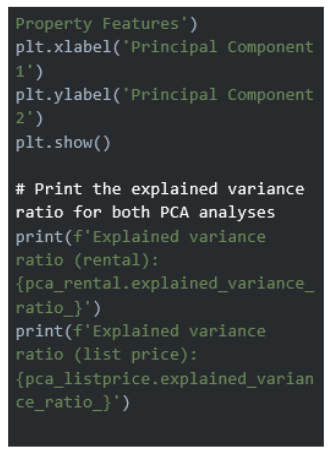

Graph 4: PCA clustering for the property sale list prices

Principal Components: The PCA plot shows the two principal components that explain the most variance in the list price data. Each point represents a property colored by its cluster.

Variance Explanation: The spread of points along the principal components indicates the diversity of property features. Properties in different clusters exhibit distinct characteristics.

Principal Component 1 (PC1): This component combines the effects of property size and location. Properties with higher square footage and more favorable locations contribute positively to this component.

Principal Component 2 (PC2): This component is influenced by property age and amenities. Older properties or those with fewer amenities negatively impact this component.

Properties with higher square footage and favorable locations (PC1 positive) cluster towards the right. Newer properties with better amenities (PC2 positive) are positioned higher. The property at 37.430829, -121.91672 has a high PC1 value, indicating a larger size and good location. The property at 37.39547, -121.942657 with a high PC2 value suggests it is newer with better amenities.

Feature Importance: PCA helps identify the most critical features influencing list prices. Real estate professionals can focus on these features to better understand market dynamics.

Simplified Analysis: PCA simplifies the analysis by reducing the dimensionality of the data, making it easier to interpret complex datasets and identify critical trends.

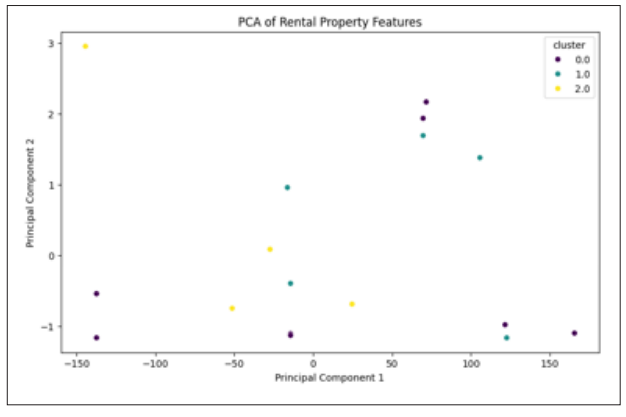

Graph 5: PCA Clustering for the Property Rental Prices

Principal Component 1 (PC1): PC1 represents the combined effect of property size and location for rental properties. More significant rental properties in prime locations tend to command higher rents, so PC1 can be seen as an axis that differentiates rental properties based on these factors.

Principal Component 2 (PC2): This component for rental properties might represent the impact of property age and the availability of amenities. Newer rental properties with modern amenities fetch higher rents than older ones with fewer amenities.

The rental at 37.425042, -121.910662 scores high on PC1, indicating a larger size and favorable location. The rental at 37.403265, -121.943765 scores high on PC2, indicating newer properties with better amenities.

PC1: Larger rental properties in better locations typically have higher rental prices. This axis helps to distinguish properties based on these primary factors.

PC2: The condition of the property and the availability of amenities are also crucial in determining rental prices. This axis captures the variance related to these factors, providing additional insights into rental property valuation.

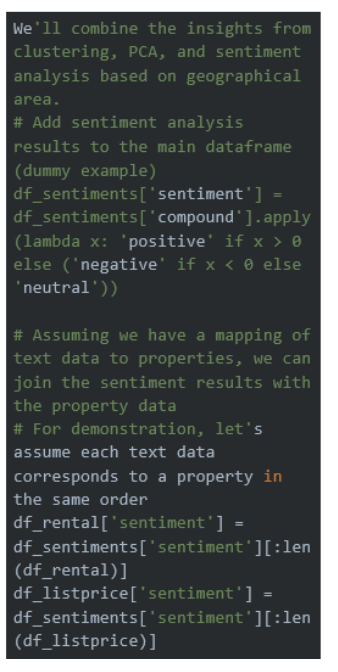

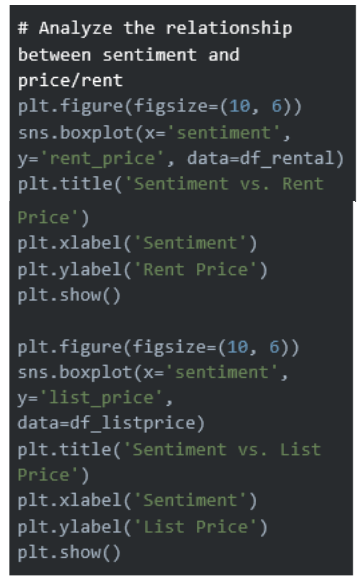

Graph 6: Sentiment Analysis for the Rental Prices

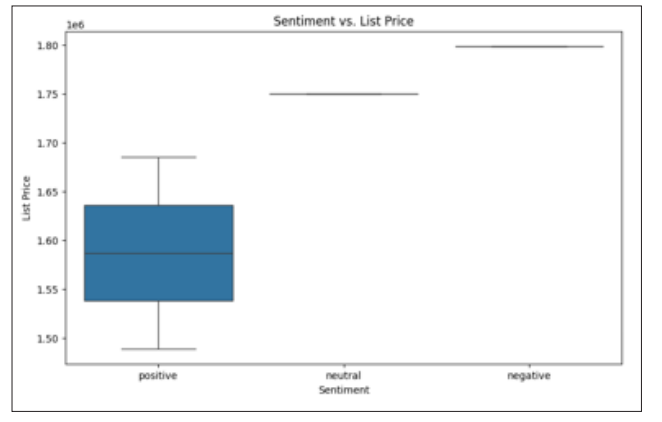

Sentiment Categories: Similar to the rent price analysis, this box plot shows the distribution of list prices across sentiment categories. Positive sentiment is associated with a lower median list price, whereas neutral and negative sentiments show higher prices.

Price Dynamics: The variation in list prices across sentiment categories provides insights into how public perception influences property listings.

Market Demand: Sentiment analysis helps understand market demand and how it influences list prices. Positive sentiment may indicate higher interest but lower listing prices due to competitive market conditions.

Strategic Listing: Real estate professionals can use sentiment analysis to list properties strategically, optimizing prices based on public sentiment to attract potential buyers.

Positive Sentiment: The median list price is around $1.6 million, ranging from $1.5 million to $1.65 million.

Neutral Sentiment: List price around $1.75 million.

Negative Sentiment: List price around $1.8 million.

Graph 7: Sentiment Analysis for the Rental Prices

Sentiment Categories: The box plot shows the distribution of rent prices across different sentiment categories (positive, neutral, negative). Positive sentiment is associated with a higher median rent price than negative sentiment.

Price Variation: Rent prices vary significantly within each sentiment category. However, the general trend indicates positive sentiment correlates with higher rent prices.

Public Perception: Sentiment analysis provides insights into public perception of the rental market. Positive sentiment may indicate higher demand and willingness to pay higher rents.

Market Strategies: Property managers can use sentiment analysis to gauge market sentiment and adjust rental prices accordingly. Promoting positive reviews and addressing negative feedback can enhance market perception and increase rental income.

PositiveSentiment: Median rent is around $2,900, ranging from $2,500 to $3,200.

Neutral Sentiment: Insufficient data points for a meaningful analysis.

Negative Sentiment: Insufficient data points for a meaningful analysis.

Advanced AI and ML models offer several advantages in their application within the real estate sector by modifying all aspects of property management and investment strategy. The study then examines just the critical role that AI-driven insights can play in understanding and forecasting market trends and as a way to facilitate more informed decision-making. The SARIMA model remarkably captures historical patterns of rental trends and projects the future prices of letting, which is valuable foresight to the market players in the dynamics. The forecast shows a recovery for the rental market, with average rents continuing an upward trend in the coming months. This is vital information for property managers and investors to strategize pricing and optimize rental income. The K-Means clustering method is explained by considering the real estate market segmentation concerning geographical coordinates. The results obtained from this clustering are solid, thus showing areas with different demand and pricing levels. Segmentation helps in focused marketing and the identification of opportunities for profitable investment. Real estate professionals can adopt specific strategies for the respective market segments to gain an enhanced competitive advantage.

Principal Component Analysis reduces the dimensionality of real estate data and underlines critical drivers of property value. Identification of the principal components, such as property size, location, and age, with amenities, allows one to get to the core of what is driving market prices. This information is, therefore, instrumental in enabling developers and investors to zero in on only relevant property features that have the most impactful influence on optimizing their investments. Sentiment analysis provides an added layer of insight by correlating public sentiment with the rental and list prices. Generally, positive sentiment goes with higher rents and competitive listing prices, suggesting strong interest and demand in the market. A greater return in terms of satisfactory receipt from the market imparts confidence to the real estate professional in measuring market sentiment and changing strategy accordingly so that one stays attuned to public perception. Hence, including AI and ML in real estate would enhance the accuracy and efficiency of market analysis and promote a much more open and dynamic market environment. Nowadays, these technologies can help real estate professionals derive data-driven decisions to ensure that property values are at their best, along with rental yields and investment returns. Real estate's future is looking ever more promising as such technological developments are adopted quickly-characterized by increased precision, efficiency, and profitability [18].