Author(s): <p>Reshma Sudra</p>

The financial sector has undergone many changes with the advancement of technology. Artificial intelligence algorithms are used to analyze large datasets and support making trades at high speed based on market patterns. Machine learning algorithms discover trends and patterns from data fed to examine creditworthiness more precisely than conventional methods. By incorporating ML techniques, FI can enhance risk assessment and make well-informed lending judgments. The most commonly embraced applications of machine learning in investment include risk management, fraud detection, customer support, and process automation. The financial industry is mostly driven by customer expectations and preferences. The usage of machine learning in investment is developing and focusing on moving in the direction of autonomous finance. Hence, the present study examines the development and influence of machine learning in investment and credit risk modeling. ML in financial institutions improves security, precise prediction, and efficiency. ML positively influences investment and credit risk modeling as it offers many benefits. The present study analyses the impact of machine learning-based decisions in preventing financial losses. The ML majorly enhances the process of decision-making by predicting opportunities, risks, and threats with fed data from the investor.

Furthermore, the current study delibe rated on machine learning-based credit risk modeling and investment challenges. The main challenge is the overfitting, under-fitting, insufficient, and poor quality of training data, such as missing and abnormal values. Therefore, the study also recommends the use of machine learning-based decisions for the investment.

Machine learning (ML) is a subject of artificial intelligence (AI), which offers machines the capability to mechanically acquire knowledge from data and previous experiences when finding patterns to make forecasts with the least human intervention. ML techniques allow computers to function autonomously without obvious programming. Applications of ML are fed with a vast amount of data and ML can independently adapt, grow, learn, and develop. ML applications have developed exponentially in the last decade and as an effect, gained substantial interest in the finance sector. After the accomplishments in the various fields and the quantitative nature of finance, it has become appealing to implement ML for the analysis of financial data. It is essential to be cautious regarding the ML application in finance since it has a unique data ground and different particular requirements. Finance, regardless of its quantitative nature, is a discipline widely handled with social aspects where the fundamental paradigms vary considerably from other fields where ML progressed [1].

ML originates insightful information from a massive volume of new data by leveraging algorithms to discover patterns and acquire information in an iterative procedure. ML algorithms utilize computation methods to gain information directly from data rather than depending on any predetermined equation whic

may act as a model. The ML algorithm’s performance adaptively enhances with increased samples in a learning process. Such as deep learning which is a sub-domain of ML which trains computers to have natural human personalities like learning. ML is a more famous form because it is important to developing the finance and banking industry. The main advantages of ML in the banking business include the capacity to obtain, examine, and organize a large volume of data in ML-based methods [2].

In terms of investment, ML has developed how financial institutions (FI) and private investors examine fed data, manage risks, and support decision-making. ML algorithms are specifically appropriate for analyzing a vast amount of data to identify a complex pattern that may not be found through human analysts. This ability of ML has made its algorithms an irreplaceable implement for investment professionals looking for opportunities to attain a competitive edge in the finance [3]. Through leveraging ML techniques, investors can acquire valuable insights from a large amount of data, improve investment strategies, and enhance the precision of their forecasts. The field of ML has substantially impacted the financial industry with its advancement in algorithms and computing. These algorithms and technologies reshape different sectors, especially finance, through improving trading processes, decision-making, automation tasks, personalized services, and risk management (RM) [4].

The emerging use of ML and artificial intelligence (AI) within the financial sector is transforming and disrupting industries as wel as societies. From traditional fund management organizations and investment banks to current financial technology service suppliers, many financial institutions (FI) today are widely implementing the acquisition of ML and data science expertise [5]. ML algorithms are used to analyze the individual risks in investment and portfolio, cultivate strategies for reducing risks, and predict potential risks. By incorporating ML into RM processes, investors can enhance assets and improve returns.

The methods of AI and ML provide significant advantages to financial decision-makers in the context of a variety of approaches to forecasting and modeling from data [6]. ML algorithms can be implemented to automate trading tactics known as quant trading or algorithmic trading. The main application of ML in investment is in quantitative finance, the field where algorithms are utilized to analyze. The algorithms assess historical data in the market, identify patterns and trends, and create predictive models for predicting asset costs. These models help the investors to make well-informed decisions regarding buying and selling securities as well as help in managing portfolios more efficiently and reducing risks.

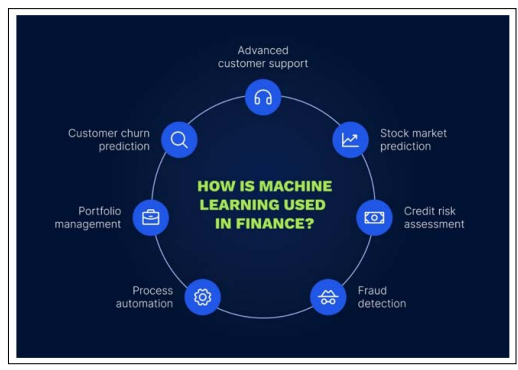

Figure 1: ML Applications in Finance (EffectiveSoft, 2023) [7] ML has become more influential and represented in finance, so it

is crucial to recognize its advantages and drawbacks to prudently examine its performance. ML model can reveal subtle relationships and process unstructured data [8]. Predicting stock market (SM) trends has been demanding in the financial markets. With the increasing power of technologies and progression in graphic processing, financial analysts are deploying advanced techniques like ML to forecast price trends. To help investors in SM and other investments in a short period [9]. Since ML is time-efficient and provides real-time solutions, it is widely applied to speed up the process, which assists in making complex decisions with precise prediction [10].

ML can do repetitive, time-consuming, and complex tasks efficiently to help reduce the workload in the finance sector [11]. As compared to decisions made by humans, ML algorithms are mostly reasonable in decision-making and data selection. Transparent and bias-free decisions made with ML are essential for the financial sector [12]. ML plays a significant part in credit risk (CR) modeling by applying algorithms to predict the possibility of a debtor’s non-payment on the loan. Hence, the present study emphasizes ML in investment and CR modeling.

The rapid advancement of technology and ML fascinates an increasing study interest in the new solutions to existing challenges in the finance industry. ML algorithms can analyze a large amount of data accurately and quickly allowing FI to make well-informed investment judgments and examine CR effectively. This leads to enhanced profitability and decreased losses. By employing ML to analyze data in the real-time market and implement trades automatically based on predefined standards, investors can take advantage of the competitive investment market more efficiently and quickly than traditional trading methods. Furthermore, understanding the advantages of ML in all financial areas can support organizations to stay competitive in the quickly evolving financial sector. At the same time, data-based decision-making has become increasingly necessary. Through leveraging and studying the benefits of ML in investment and CR modeling, FI can improve their RM practices and optimize investment strategies.

ML has a significant influence on the investment sector, allowing stockholders to leverage data-based insights, automate trading tactics, manage risk effectively, and improve the complete performance of the portfolio. As ML continues to develop and evolve, it’s an investment part expected to progress, offering investors different opportunities to achieve a leading place and attain financial goals. Not examining the benefits of ML in investment and CR modeling can lead to various problems. Without examining ML techniques, FI may depend on less accurate and outdated methods for making investment judgments and evaluating CR. This can result in greater ranks of risk exposure, missed chances for increasing ROI (returns on investments), and increased financial losses. In addition, the knowledge of ML benefits in the financial sector may hold organizations back from remaining competitive in the market, as there is a high chance for other institutions to implement these technologies, which poses significant benefits in accuracy and efficiency. Generally, overlooking the advantages of ML in investment and CR modeling can limit the efficiency of RM practices and obstruct the entire organization’s performance of FI.

The present study emphasizes regulatory compliance with AI and risks in the finance and banking sectors. The research objectives of the current study are,

The paper is organized in the following order Section 1 provides an elaborated introduction regarding ML in investment and CR modeling. Furthermore, the introduction section illustrates the significance of the research. In section 2, prevailing research works related to the current study will be reviewed. The current study’s section will elucidate the role of ML in the finance sector along with challenges. In section 4, the current paper will be discussed with existing studies. Finally, in section 5, the brief conclusion regarding the current study will be deliberated along with future recommendations.

The precise forecasting of incoming cash flow allows more successful cash management and organization to change planning according to progressive information. The existing study focused on examining the ML algorithm’s suitability for forecasting client payment dates [13]. Implemented different ML algorithms and validated the possibility of predicting and identifying client payment behavior patterns. The study was based on real data from the DAX-40 organization with more than 1,000,000 datasets with invoices from 2017-2019. The results indicated specific neural networks are applicable to predict client’s payment dates. Moreover, the study demonstrated that logical and contextual prediction models can offer more precise predictions than traditional models like multivariate regression. The study concludes the information about a client’s upcoming payment dates allows the organization to alter its perspective and more to proactive cash management.

The existing study determined to analyze the impact of AI integration on financial services, customer experience, and products [14]. In addition, it explored various aspects of A1, including process automation (PAM), chatbots (CB), predictive analysis (PA), and ML. The prevailing study adopted a mixed research methodology, applying both qualitative and quantitative methods for analysis purposes, including secondary data exploration, and analysis was carried out for AI subfields. The study showed that implementing AI, especially in the chatbots and ML subfields, provides high tactical potential for FI, which enhances customer experience and services. Furthermore, the importance of PA integration and PAM was comparatively low. The study concludes that AI implementation reduces human errors and interaction in FI.

Investors utilize a wide range of investment tactics and the selected strategy has a significant and direct impact on the investor’s performance. The existing study determined to examine the personality attributes that influence an investor’s pattern in investing and find the particular pattern that yields more profit [11]. The study chose the investor’s personality instead of sentiment, which makes prediction challenging, and used a questionnaire to gather data. ML algorithms and statistics tests are implemented to ensure the significance of personality in profitable investment. The prevailing study revealed that an investor’s personality has a significant influence on the trading performance of an investor irrespective of a term period, such as long or short term. Through a statistical test, it is found that investors with personality traits like extraversion, openness, conscientiousness, and agreeableness perform well for a long period. With ML algorithms, the outcomes demonstrated that investors with openness and extraversion are most likely to obtain profits in the long term. This concludes individual personality influences in choosing investment strategies.

The crypto-currency is the fastest-growing market in the financial sector across the world. The existing study investigated and analyzed the current characteristics of the crypto-currency market in the financial market because of its success in SM forecasting [15]. The study applied the ML approach to forecast the direction of the mid-price variations in the future. ML model was fed with long sequence data for analysis. The results revealed, that the model approach has accomplished better performance and quantified consistently. The outcome was way more promising than other methods in crypto-currency movement prediction. The study concludes ML prediction in SM is efficient and accurate which helps to make data-driven decisions in investment.

For the last few years, individuals have been more interested in SM which has opened a wide range for the financial sector. In a rapidly growing finance market, it is essential to predict future trends accurately in SM for profits. The existing data examined the SM forecasting using ML algorithms [16]. The study implemented ML algorithms focused on linear regression, exponential smoothing, three-month moving average, and time series prediction utilizing Ms-Excel as a statistical tool for the table and graph representation of forecasting outcomes. The study utilized Google stock, AAPL stock, and Amazon stock to examine. The results obtained determined the next month’s future trends of stocks successfully with accuracy using ML algorithms.

CR analysis is the biggest challenge in the financial sector due to an abundant element that has different influences on the solvency issues of institutions through various channels. The existing study determined to examine the emerging ML technology in the investment industry by analyzing the implementation of ML credit rating design [17]. Especially, the study focused on the benefits of new technology and innovative cognitive analytics in the financial sector. The results indicated, the significant advantages of implementing disruptive technologies into the sector. ML is an effective integration to reduce cost and identify patterns from data. The study concludes with ML’s importance in CR rating modeling and its advantages in the applications.

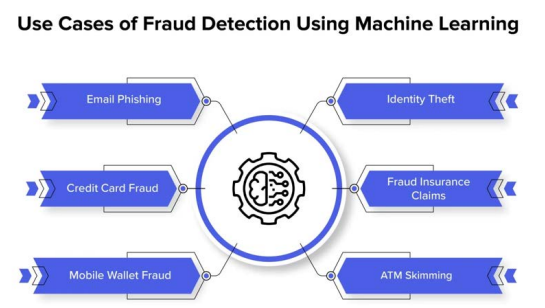

Fraud occurs in different financial industries, such as corporations, insurance taxation, and banking. Financial statement (FS), credit card (CC) fraud, tax evasion, money laundering, and many other financial frauds are increasing. Fraud efforts have increased largely in the past year. This made fraud detection (FD) more challenging than ever before. Due to increased credit card usage, there is a constant rise in fraudulent transactions. Asset misappropriation, FS fraud, and corruption are three types of fraud that occur in occupational fraud [18]. CC fraud is now considered the second most widespread identity theft (IT) recorded in the past year. FD is significant with different greater impact applications in banking and security [19]. Traditional FD techniques like manual detection are inaccurate, ineffective, time-consuming, and costly. CC fraud prices generally endure with retailer accountability for administrative charges, shipping, and chargeback. In addition, companies lose consumer confidence because of fraudulent purchases. As there is a severe repercussion of fraud, prevention is a must. So, FI prioritizes the deployment of an automated FD system.

The traditional model of banking, which relied on expertise to identify instances of fraud and money laundering, was unable to keep up with the changes taking place in the finance sector. ML, on the other hand, provides more sophisticated and data-based approaches to finding fraudulent activities (FA). In the past, expertise in banks identified fraud activities by analyzing the withdrawals and cheque deposit patterns. But, now, with internet banking and other digital payments, FD has become more challenging because of large datasets [20] . FD is an important aspect of RM in the financial sector, as FA leads to severe financial damages and losses to the financial institution’s reputation. ML in FD poses a major benefit: its capacity to adjust to varying fraud patterns. Fraudsters frequently develop tactics to prevent detection, making it more challenging for normal FD systems to handle. However, ML models are trained on new information acquired to detect emerging fraud patterns and alter their detection strategies accordingly.

Figure 2: ML in Fraud Detection [21]

The integration of technologies such as ML has gained dominance. The algorithms of ML process complex datasets, learning patterns to identify possible fraud in real-time. This practical approach improves the ability to discover subtle deviations from general behavior, decreasing false positives and enhancing accuracy [22]. ML algorithms analyze a vast amount of data in FI to discover anomalies and patterns that indicate FD. Through training algorithms on old data, FI can train them to identify the characteristics of fraudulent behavior and transactions. This enables ML models to constantly adapt and learn new kinds of fraud, making ML more effective in detecting suspicious activities. The main advantage of implementing ML for FD is its capability to manage complex and large datasets. Financial transactions produce a vast amount of data and conventional methods face challenges in processing and analyzing these data effectively. ML algorithms are appropriate to handle large data so that fast identification of trends and patterns is possible, which indicates FA.

In addition, ML improves the efficiency and accuracy of FD, and ML helps FI to save resources and time. Through automating the analyzing process and flagging possible FA, ML algorithms support human analysts to concentrate more on complex cases that demand human intervention. This helps FI streamline the FD process and respond quickly to possible threats. Overall, FD using ML in the financial sector provides an effective and powerful tool for detecting FA. Through leveraging the abilities of ML algorithms, FI can improve its FD capabilities and accuracy, adjust to developing fraud patterns, and decrease false positives. As fraudsters develop new strategies, ML also provides a powerful defense against finance-related crimes and supports FI to protect their customers from the threats and risks associated with FA.

Financial RM tasks are commonly difficult with frequently developing yet complex data and sparse. Managing and quantifying risks plays a significant part in every organization. FI is growing more complex and larger, and the requirement for refined statistical models to appropriately quantify and reduce the risk is now more crucial than ever. Driven through the industrialized demands for RM systems and the purpose of creating highly appropriate ML algorithms [23].

The need to manage and prevent financial risks has increased in the past decade because of factors including increasing macroeconomic pressure, market competitiveness, criminal activity, and more regulatory demands. Commercial banks are risk managers and risk takers in their ability as financial intermediates mostly. The financial business landscape is getting more risky and complex as financial systems have become more difficult and speed in world financial integration. All the FI, including the bank’s capability to attain competitive advantages in developing environments, is based on their capability to control and prevent risk intelligently [24]. Advanced technologies help banks and other FI get real data on their own and client’s assets, enhancing the algorithm’s effectiveness for validating financial risks [25].

Figure 3: RM Function [26]

RM and prevention in the FI are significantly improved using ML. ML algorithms analyze a large amount of data in real- time to discover potential anomalies and threats, allowing FI to eradicate risks and prevent FA. Through ML models, institutions can enhance the ability to identify patterns of suspicious behavior, forecast market fluctuations, and examine credit risk. This leads to more operational RM strategies and decreased fiscal losses [27].

RM and prevention in the financial sector with ML include leveraging innovative algorithms to scrutinize data, discover patterns, and forecast risks. ML enhances the RM in various ways such as:

Market Risk: ML can examine market news, data, and other factors to forecast market trends and predict potential risks. By incorporating ML models into market risk scrutiny, FI makes more well-informed investment judgments and diminishes the influence of market instabilities.

Compliance Monitoring (CM): ML helps FI monitor compliance with rules and regulations by analyzing a large amount of data and discovering potential violations. Through automating the CM process, organizations can avoid penalties and adhere to regulatory demands.

Operational RM: ML algorithms examine the operational data to discover possible risks and threats in processes, human behavior, and systems. By identifying patterns that can lead to operational errors and failures, FI can proactively disclose the risks and take action to prevent pricey incidents from occurring.

CR: ML algorithms analyze the existing data on the debtor’s payment histories, credit profiles, and other factors to examine creditworthiness more precisely. Through identifying trends and patterns in the dataset, FI makes more well-informed decisions in lending money and reduces the default risks for the institution.

ML provides significant benefits in RM and prevention in the financial sector through enabling more precise risk assessment, real-time FD, predictive analytics in market risks, proactive discovery of operational risks, and automated CM. Through leveraging ML technologies, FI can improve its RM practices and decision-making processes and protect its reputation and assets [28].

In investment, security analysis (SA) is the estimation and calculation of securities and stocks to determine investment potential. Portfolio management (PM) is the science of choosing and overseeing a set of investments that meet the long-term financial goals and risk tolerance of an institution or a company. SA and PM are significant components of the investment sector, comprising the validation of securities, construction, and maintenance of portfolios in investment. ML has modernized all these areas by providing analytical tools and methods to improve the judgment process and enhance investment results.

SA and PM use ML in the investment for various benefits. Since ML can analyze complex data to identify trends, correlations, and patterns, it is not easy to apply conventional analysis techniques. This eventually helps investors to optimize portfolios and manage more effectively. Evolutionary algorithms allow the problem of optimizing a portfolio to incorporate other constraints. ML methods such as regression and deep learning can be utilized to construct portfolios [29]. In SA, ML algorithms examine financial data containing information regarding company financials, macroeconomic indicators, market trends, and historical cost movements. Through applying ML models like deep learning, clustering, regression, and classification, financial analysts can predict by identifying anomalies, correlations, and patterns in the data which may be easy to find in traditional analysis techniques. This largely helps in SM prediction, discovering overvalued securities, and examining the complete risks, threats, and return individualities of various investments.

PM is a process of frequently adjusting the allocated funds to obtain more profit at minimum risk. The portfolio is handled in two methods such as passive and active PM. In passive PM, fund managers invest a client’s money in selected or index stocks. The constructed passive portfolio does not change till it attains maturity. Managers in passive portfolios undertake that markets are effective. Dissimilar to passive PM, active PM includes investing funds and readjusting the portfolio when there is an occurrence of changes in the market. Active PMs consider the changes in the market as an opportunity to gain more profits. Portfolio optimization, management, and selection are very helpful for investors and institutions as there is a possibility of constructing and managing portfolios [30]. Basically, in PM, ML algorithms can help in constructing an expanded portfolio that matches an individual’s risk tolerance and goals in investment.

ML is used to generate the timing approach from the maximization principle and results in optimal portfolio weights evaluated monthly with the random forest method [31]. PM involves creating and optimizing investment portfolios to attain particular financial objectives when managing risks. ML plays a crucial part in the process by offering advanced tools for portfolio optimization, RM, performance evaluation, and asset allocation. ML algorithms help in discovering optimal profile weights, differentiating investment effectively, and regulating portfolio allocation based on changing market situations. In addition, ML is utilized to develop trading tactics, screen portfolio performance, and systematize portfolio rebalancing in real time.

Though ML offers valuable insights to improve decision-making, it has some challenges. This includes model interpretability, algorithm biases, and data quality problems. Hence, investors need to have knowledge regarding the limitations of ML and implement ML as a supporting tool alongside conventional analysis techniques to attain optimal outcomes in the SA and PM.

In the investment sector, the SM is changeable and complex. It is challenging to select a suitable strategy for investment, this accurate forecast is a major issue [32]. The SM is an important component of a nation’s economy. It is the largest opportunity for investment from investors and companies. An enterprise can obtain a considerable profit by expanding its business. It is a perfect time for stakeholders to purchase stocks and gain profits from dividends provided by the company. An investor can trade stocks in the market. Stock traders (ST) should be able to forecast trends in SM behavior for appropriate judgment-making to sell or hold the stock owned or purchase other stocks. To obtain profits, ST must buy stocks whose prices are anticipated to increase in the future and sell stocks whose costs are expected to reduce. If ST forecasts trends in stock prices appropriately, then traders can gain more profits. Hence, the prediction of SM trends is considered an important task to make judgments through ST. SM investment is risky, nevertheless, when invested properly, SM provides substantial profits. Investors estimate the company’s performance before making decisions regarding stock purchases to avoid risks. Additionally, the SM is very sensitive to microeconomic and macroeconomic states, political factors, investor’s insecurities, and expectations [33].

Consequently, an automated system to support decisions is essential for investors as it will estimate trends in the market using massive data [34]. SM predicting using ML involves using algorithms to analyze SM historical data, market trends, and relevant components to predict future movements of stock price. ML models are trained on huge datasets to find trends, relationships, and patterns that help to forecast stock prices. There are some advantages of ML in SM forecasting, such as enhanced accuracy, possibly leading to enhanced investment judgment, speeder, and more flexible decision making because ML algorithms are processed quickly and offer insights that enable traders to make decisions faster and easily adaptable nature, time efficient, and reduce human error. ML algorithms tailor SM forecasts to individual investor risk tolerance and preferences offering personalization in investment.

There are various approaches to SM prediction with the help of ML including time series prediction, sentiment analysis, and regression analysis [35].

SM forecasting with ML is not foolproof. The SM is influenced by a wide variety of factors, such as geopolitical events, investor behavior, and economic indicators, which makes precise prediction difficult and challenging [36]. ML models are prone to over-fitting where algorithms perform better on past data but fail to simplify for new data. There are other challenges of ML in investment, such as lack and poor quality data, which results in effective and fully functional algorithms, under-fitting, which hinders the model from providing productive conclusions from the data, and irrelevant features. However, ML enables advanced predicting models and methods to reveal new opportunities and insights in the SM.

The present study demonstrates ML in investment and CR modeling. The significance of ML in investment and its advantages are highlighted. The current study also emphasizes the influence of ML-based decisions on investment and challenges. Overall, the study represents the development of ML in the investment sector.

The existing study illustrates the prediction of client payment dates by implementing ML algorithms [13]. The outcome of the prevailing study demonstrated suitable ML algorithms offer precise prediction of a client’s payment date. Similarly, the current study also determined to analyze the prediction possibility using ML algorithms but in SM to understand the impact of ML on the investment. The present study results indicate ML algorithms offer accuracy in prediction which enhances the performance of investors in the market.

The existing study determines the influence of AI integration on financial services, products, and customer experience [14]. The study showed that ML, like AI, enhances the service and customer expectations in the financial sector. The current study demonstrates specifically ML’s influence in investment and CR modeling along with its challenges and results demonstrating that ML has a significant impact and development in the investment sector. The main challenges are poor quality and lack of trained data.

The existing study demonstrates and analyses the current characteristics of the crypto-currency market in the financial market [15]. The study concludes ML prediction in SM is efficient and accurate which helps to make data-driven decisions in investment. Similarly, the current study also determined the influence of ML with focusing SM prediction. In addition, the current study examined the effect of ML-based decisions on investment. The result of the current study indicates the importance of integrating ML algorithms to make well-informed decisions in the SM.

The existing study determined to examine the emerging ML technology in the investment industry by analyzing the implementation of ML credit rating design [17]. The study concludes, with ML’s importance in CR rating modeling and its advantage in the applications. Similarly, the present study also illustrates the ML role in CR modeling along with covering the whole investment, especially in the context of the stock market. In addition, the advantages, such as FD, RM, and prevention, are elaborated. The present study results that ML has a significant role in advanced investment.

ML is a powered software that is rapidly becoming important for trades, investors, financial experts, and bankers. With its capability to process a vast amount of data to discover hidden patterns and proceed processes. ML, with other technologies in the financial industry, has the potential to significantly enhance the decision- making quality, generate revenue, and improve operation efficiency. However, financial service providers must know the possible risks of using digital technologies and the significance of possessing basic skills and knowledge in the workplace. Hence, the current study has examined the ML in investment and CR modeling. Therefore, the present study examined the development of ML in the investment sector. Advanced technologies are implemented in the financial sector to enhance performance and profits, so the influence of ML in CR modeling and investment. In addition, the current study analyzed the impact of ML-based decisions in preventing financial risks. Although ML is a powerful and efficient method used in the finance sector, there exist challenges in ML- based investment and CR modeling. The main challenges of ML algorithm techniques in investment are overfitting of training data, insufficient quantity of data, poor quality data, and underfitting data [37].