Author(s): <p>Goutham Sabbani</p>

In 2019, A European bank named Deutsche Bank adopted a machine learning model into its system. This resulted in 20% within the first year, showcasing

the transformative potential of artificial intelligence in the credit risk department.

The evolution of machine learning models from simple statistical models to complex machine learning algorithms capable of analyzing vast amounts

of datasets with high accuracy. Early machine models relied upon logistic and linear regression, but the modern approach utilizes decision trees, neural

networks, and ensemble methods to enhance prediction power and reliability.

This paper will talk about advancements in machine learning techniques for credit risk assessment, the benefits and challenges of integrating these models

in traditional banking systems, and the emergence of these technologies in the future. It explores various algorithms, highlighting their applications and

effectiveness in our daily lives. Additionally, regulatory and ethical implications are examined to provide a comprehensive overview of the post.

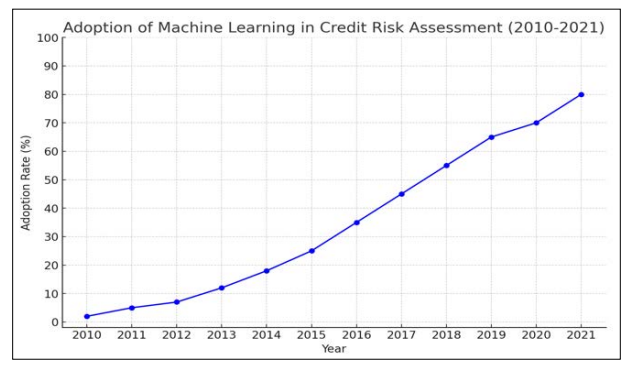

Credit risk assessment is crucial in the banking industry because it indicates the likelihood that a borrower will default on their loan obligations [1]. This practice is fundamental because banks maintain financial stability, minimize losses, and ensure prudent lending strategies. The importance of credit risk assessment cannot be exaggerated. However, these traditional methods can be prone to biases. They may only sometimes capture the complexities of financial behavior. The banking industry started adopting various machine learning models that contain neural networks; decision techniques became more adopted. Here is a line graph showing the adoption of machine learning and credit risk assessment [2].

Source: Knowledge graph-driven credit risk assessment for micro, small, and medium-sized enterprises [3]

In recent years, artificial intelligence, which is a subset of machine learning, has been able to analyze vast amounts of data sets and make predictions based on trained data sets. By using these advanced machine learning models, banks can enhance their predictive accuracy, reduce the potential for human accuracy, and make more informed lending decisions. Innovative models like the Relational Graph Convolutional Network (RGCN) combined with Random Forest (RF) have shown promise in enhancing credit risk assessments for micro, small, and medium-sized enterprises (MSMEs).

The evolution began with the emergence of machine learning algorithms. In previous days, it was with simple statistical tools that more complex machine-learning methods and sophisticated machine-learning models were introduced. The need for high accuracy, efficient, and reliable methods for various banking applications like fraud detection, credit risk assessment, and customer segmentation mainly drove this.

In the early stages of adopting machine learning in banking, simple statical tools like linear regression, which gives continuous output, were best suited for lifeline value or loan amounts based on training datasets. Another one was logistic regression, which was a classification machine learning algorithm. Such as determining the likelihood of a customer defaulting on a loan. These models are favored for their simplicity, ease of interpretation, and relatively computational requirements [4].

Over the years, decision tree networks have become very popular due to their representation of the decision-making process and their ability to handle both numerical and categorical data. Their ability to split the data into various branches to arrive at a decision makes them useful for classification and regression tasks. However, these are prone to overfitting, which led to the development of more robust ensemble methods.

Ensemble methods combine multiple methods to improve predictive performance and robustness. One of the widely used models in banking is Random Forests and Gradient Boosting Machines. They use various decision trees and aggregate their predictions to reduce variance and improve accuracy. Neural networks are inspired by the human brain, which contains multiple neurons with the ability to learn complex patterns and relationship data. Deep learning, a subset of neural networks with multiple layers, has further enhanced their capability to model intricate data structures.

Source: Banking in Terms of Deposit Prediction [5]

Machine learning has significantly evolved over the past few decades, leading to the development of state-of-the-art techniques that enhance the accuracy and efficiency of predictive models. Current advancements in machine learning include sophisticated algorithms capable of processing large datasets, identifying intricate patterns, and making precise patterns. Decision trees are a popular machine-learning technique due to their simplicity and interpretability. They work on recursive splitting of the dataset into subsets based on the value of input features.

Applications of decision trees include credit risk assessment, which is used to evaluate the creditworthiness of the by analyzing their financial history and demographic data. Business decision trees segment customers based on purchasing behavior, helping in starting marketing strategies. Despite their advantages, decision trees can be prone to overfitting, especially with complex datasets.

Deep learning is a subset of neural networks with hidden layers; it works based on humans.

Machine learning provides several benefits when integrated into traditional banking systems for credit risk assessment. Startin' growth improved accuracy. These can analyze vast amounts of data to identify patterns and predict risk assessment accurately more than traditional statical methods. This leads to more reliable assessments and better decision-making. Ml models can be accessed in real-time, enabling banks to make instant credit decisions. This enhances the customer experience by waiting times.ML models can be easily scaled up or down in increasing volumes of data and transactions without a significant increase in infrastructure costs [6].

Despite the benefits, integrating ML models into traditional banking systems presents challenges in data quality and availability. They require high-quality, comprehensive data to function effectively. Consistent, complete, and accurate data can significantly hamper the performance of these models. Many banks still rely on legacy systems that need to be compatible with modern ML models. Integrating new technology with these outdated systems can take time and effort [7].

Future Trends in Machine Learning Integration into Banking Several emerging technologies are poised to revolutionize the integration of machine learning (ML) in the banking sector, like the quantum computing it holds of exponentially increasing computational power, enabling the processing of complex financial models and large data sets at unprecedented speeds. Blockchain can provide secure and transparent data sharing across the banking ecosystem. By processing the data to its source, edge computing can reduce latency and bandwidth. Integrating AI with IOT details can provide banks with comprehensive data for ML models [8].

The widespread 5G technology will enable faster data transmission and connectivity. This can support more advanced and real-time ML applications, such as mobile banking apps with enhanced security features and instantaneous transaction processing.ML will enable banks to offer highly personalized financial products and services based on individual customer behavior and preferences. This will enhance customer satisfaction and loyalty.

The integration of machine learning (ML) models into traditional banking systems for credit risk assessment has proven transformative, as demonstrated by Deutsche Bank's significant improvements. ML models offer improved accuracy, real-time processing, advanced fraud detection, and scalability, making them superior to traditional methods. However, challenges such as data quality, regulatory compliance, and legacy system integration must be addressed.

Emerging technologies like quantum computing, blockchain, edge computing, AIoT, and 5G are set to enhance ML capabilities in banking further, enabling hyper-personalization and autonomous banking operations. Future research should focus on explainable and ethical AI, data privacy, seamless integration with legacy systems, and leveraging quantum computing for advanced financial modeling.

As banks continue to adopt and refine these technologies, the potential for more efficient, secure, and customer-centric financial services will grow. This evolution will lead to a more robust and innovative banking industry capable of meeting the complex demands of modern financial markets and customer expectations. The ongoing advancements in ML and associated technologies promise a future where banking is not only more efficient and secure but also more inclusive and responsive to individual customer needs, ultimately driving financial stability and growth in the global economy.