Author(s): <p>Abhishek Shende</p>

This research paper provides a comprehensive exploration of the pivotal role of distributed computing in reshaping risk management and compliance in the banking sector. It delves deeper into how distributed computing technologies enable financial institutions to process vast amounts of data more efficiently, accurately, and swiftly, thereby significantly improving their risk assessment and compliance mechanisms. The paper also examines the broader implications of these technological advancements for the banking industry, including their potential to streamline operations, mitigate risks, and ensure adherence to stringent regulatory standards. By presenting a blend of current trends, case studies, and practical applications, the paper illustrates the capacity of distributed computing to not only meet compliance requirements but also to drive significant financial gains. Through this exploration, the research underscores the importance of distributed computing in the modern financial landscape, highlighting its role as a critical tool that banks can leverage to enhance their operational efficiency, compliance standards, and ultimately, financial performance. The insights provided aim to demonstrate the tangible benefits that distributed computing offers in the dynamic and challenging world of banking and finance.

The banking sector, characterized by its dynamic nature and complex regulatory environment, faces ongoing challenges in risk management and compliance. In recent years, technological advancements have played a pivotal role in addressing these challenges, with distributed computing emerging as a significant force in transforming banking operations. Distributed computing refers to a model where computational processes are distributed across multiple computing devices, offering enhanced efficiency, reliability, and scalability [1].

Historically, the banking industry has undergone a considerable transformation, evolving from traditional, manually intensive processes to more sophisticated, technology-driven approaches. This evolution has been driven by the need to manage increasing volumes of data, comply with stringent regulatory requirements, and mitigate diverse risks effectively. In this context, distributed computing has emerged not just as a tool for managing operational complexities but as a strategic asset that can drive significant improvements in risk management and compliance [2].

is multifaceted. Primarily, it enhances the capability of banks to process and analyze large datasets, enabling more accurate risk assessments and decision-making processes. This is particularly important in the context of credit risk management, where the ability to quickly process and interpret vast amounts of data can lead to more informed lending decisions [3]. Furthermore, distributed computing aids in the automation of compliance processes, allowing banks to navigate the complex landscape of financial regulations more efficiently. This automation is crucial in reducing the risk of non-compliance and in ensuring that banks adhere to the evolving regulatory standards [4].

Moreover, the implementation of distributed computing in banking is not without its challenges. It requires significant investment in technology infrastructure, skilled personnel, and ongoing maintenance. Additionally, as the volume and complexity of data increase, so do concerns regarding data security and privacy. Ensuring the integrity and confidentiality of customer data is paramount, and banks must navigate these challenges while leveraging the benefits of distributed computing [5].

In conclusion, the role of distributed computing in the banking sector is increasingly critical. As banks continue to grapple with the challenges of risk management and compliance, the strategic integration of distributed computing offers a pathway to not only address these challenges but also to drive operational efficiencies and enhance overall financial performance. The future of banking, in many ways, is intertwined with the continued advancement and integration of distributed computing technologies.

Distributed computing, a paradigm where computational processes are executed across multiple computing nodes, has become a cornerstone in the banking sector's technological strategy.

This section delves into the foundational aspects of distributed computing, its transition from traditional computing systems, and its practical implementation in the banking industry

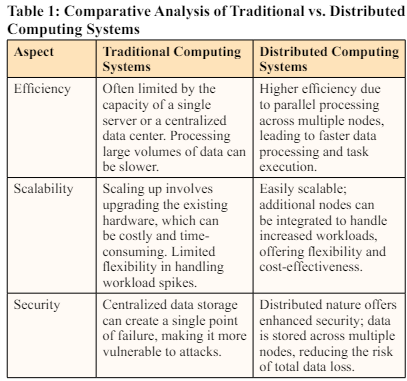

Distributed computing involves the division of tasks across multiple computers, harnessing the power of parallel processing to enhance computational speed and reliability [1]. This approach contrasts significantly with traditional centralized computing, where a single system handles all computational tasks. The key concepts of distributed computing include decentralization of processes, redundancy to ensure reliability, and scalability to manage varying workloads. To provide a clearer comparison, Table 1 outlines the fundamental differences between traditional and distributed computing systems in terms of efficiency, scalability, and security

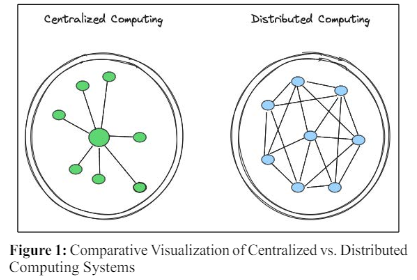

The shift from traditional computing systems to distributed architectures in the banking sector has been driven by the need for enhanced data processing capabilities and improved system resilience. Traditional systems, while robust, often struggle with the scalability and flexibility required to manage large data volumes and complex financial transactions [2]. This contrast between traditional and modern computing paradigms is visually represented in Figure 1. Distributed computing addresses the limitations of traditional systems by allowing banks to process transactions and analyze data across multiple nodes. This leads to operations that are not only more efficient but also highly scalable, as depicted in the figure. The visual comparison in Figure 1 underscores the distinct advantages of distributed computing in handling the demands of modern banking.

Several financial institutions have successfully implemented distributed computing to improve their operations. One notable example is the use of blockchain technology for secure and transparent transaction processing [2]. Blockchain, a form of distributed ledger technology, has been adopted by some banks to streamline payment processes and enhance security. Another application is in risk management, where distributed systems enable banks to analyze large datasets for credit risk assessment, fraud detection, and regulatory compliance more effectively [3]. These case studies demonstrate the diverse applications and benefits of distributed computing in banking, highlighting its role in modernizing the financial services industry

In conclusion, distributed computing represents a significant shift in the way banks handle data and execute transactions. By adopting distributed computing architectures, banks can achieve greater scalability, reliability, and efficiency in their operations, paving the way for more innovative and customer-centric financial services.

The integration of distributed computing in the banking sector has revolutionized risk management by providing enhanced capabilities for risk identification, assessment, and mitigation. This section explores the impact of distributed computing on various aspects of risk management in banking.

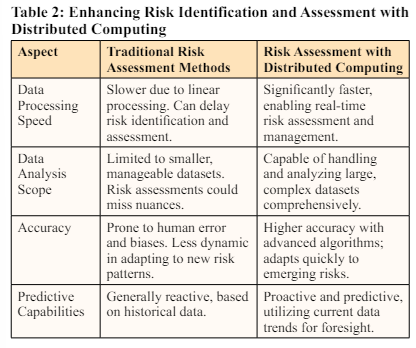

Distributed computing enables banks to process and analyze large volumes of data rapidly, a crucial factor in identifying and assessing risks. With distributed systems, banks can integrate data from various sources, including transaction histories, market trends, and customer profiles, to create comprehensive risk models. This approach allows for more accurate and timely risk assessments, crucial in today's fast-paced financial environment [1]. Table 2 illustrates the significant improvements that distributed computing offers over traditional risk assessment methods, particularly in terms of data processing speed, data analysis scope, accuracy, and predictive capabilities. For example, in the realm of credit risk management, distributed computing enables real-time analysis of borrower data, significantly enhancing the assessment of creditworthiness and potential default risks [3].

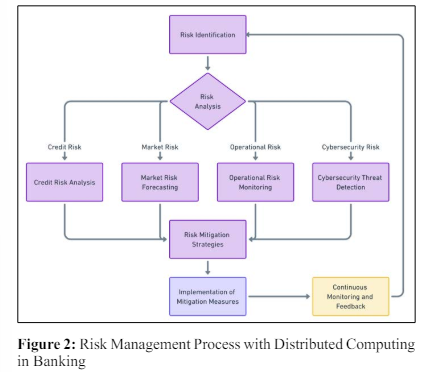

Distributed computing plays a vital role in mitigating a wide range of risks in the banking sector, including credit, market, operational, and cybersecurity risks. By facilitating the rapid processing and analysis of data, distributed systems help banks to identify potential risk factors before they materialize into significant threats. This comprehensive process is visually depicted in Figure 2, which outlines the steps from risk identification to mitigation and continuous monitoring, emphasizing the dynamic nature of risk management in banking. For instance, in the realm of fraud detection, distributed computing allows for the realtime monitoring of transactions, enabling banks to detect and prevent fraudulent activities effectively [2]. Similarly, in market risk management, distributed systems enable banks to analyze market trends and fluctuations more efficiently, aiding in the development of robust risk mitigation strategies. The diagram in Figure 2 illustrates these processes and the pivotal role of distributed computing in enhancing the effectiveness of risk management in banking.

Several banks have successfully implemented distributed computing to enhance their risk management strategies. One such example is the use of advanced analytics and distributed processing to monitor and analyze transaction patterns, helping banks to identify and mitigate potential frauds and defaults quickly [3]. Another instance is the application of distributed ledger technologies, like blockchain, for improving the transparency and security of financial transactions, thereby reducing operational risks [2].

In summary, distributed computing has emerged as a key enabler in enhancing risk management within the banking sector. By providing banks with the tools to process large datasets rapidly and accurately, distributed computing has become indispensable in the identification, assessment, and mitigation of various types of risks, thereby safeguarding the integrity and stability of financial institutions.

In the context of the increasingly complex regulatory environment in the banking sector, distributed computing has emerged as a crucial technology for streamlining compliance processes. This section discusses how distributed computing simplifies compliance and provides real-world examples of its application in the banking industry

The banking sector is subject to a myriad of regulatory requirements that are both complex and constantly evolving. Compliance with these regulations is critical to avoid legal penalties and maintain customer trust. However, managing compliance manually or with traditional systems can be inefficient and error-prone [1]. Distributed computing offers a solution by automating and optimizing these processes, thereby reducing the risk of noncompliance.

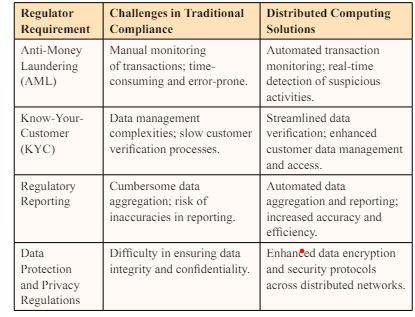

Distributed computing enables banks to automate the collection, processing, and analysis of data required for regulatory reporting, thereby significantly improving compliance efficiency. By using distributed systems, banks can ensure that they are continuously monitoring their operations against regulatory requirements. This real-time monitoring and reporting capability, as summarized in Table 3, is essential for maintaining compliance in a dynamic regulatory landscape. For example, distributed ledger technology, a form of distributed computing, provides a transparent and immutable record of transactions, which is invaluable for compliance with anti-money laundering (AML) and knowyour-customer (KYC) regulations [2]. The table illustrates how distributed computing addresses the challenges in traditional compliance methods and offers streamlined solutions for various regulatory requirements.

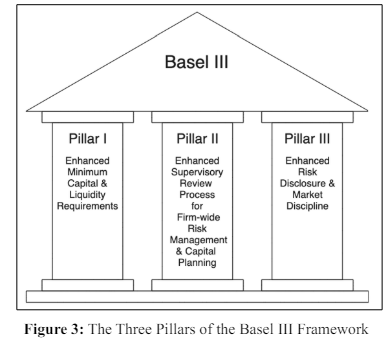

Several banks have effectively leveraged distributed computing to enhance their compliance operations. A notable example is the use of distributed ledgers for Anti-Money Laundering (AML) compliance, where the technology assists in efficient and accurate tracking and reporting of suspicious activities [2]. In the realm of regulatory compliance, banks also apply distributed systems to align with the Basel III regulatory framework. This involves managing and reporting data related to Basel III's three critical pillars: credit risk, market risk, and operational risk. Figure 3. The Three Pillars of the Basel III Framework, visually presents these pillars, outlining the comprehensive regulatory requirements that Basel III encompasses. Understanding these pillars is essential in appreciating how distributed computing can streamline and simplify compliance with such a multifaceted framework [3].

In conclusion, distributed computing plays a pivotal role in simplifying and streamlining compliance processes in the banking sector. By automating and optimizing these processes, banks can not only ensure adherence to regulatory requirements but also improve their operational efficiency and reduce the risk of legal and financial repercussions.

The integration of distributed computing in the banking sector has implications far beyond operational efficiency and compliance. This section explores the direct and indirect impact of distributed computing on the financial performance of banks, underscoring its role in driving revenue growth and cost efficiency.

Distributed computing directly contributes to financial performance by enhancing the efficiency and speed of banking operations. This increased efficiency translates into cost savings, as banks can process more transactions and manage data more effectively with fewer resources [1]. Indirectly, distributed computing aids in the mitigation of risks and ensures regulatory compliance, which in turn minimizes potential financial losses and penalties associated with non-compliance. Additionally, the improved risk management capabilities brought about by distributed computing can lead to more informed lending decisions, thereby enhancing credit portfolios and reducing default rates [2].

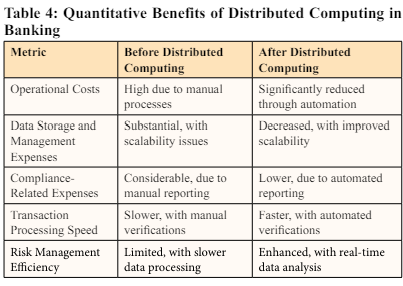

The adoption of distributed computing technologies results in significant quantitative benefits for banks. These benefits, as highlighted in Table 4, include reduced operational costs due to automation of manual processes, decreased expenditure on data storage and management, and lower compliance-related expenses [3]. For instance, the use of distributed ledgers for transaction processing not only speeds up the transaction process but also reduces the costs associated with traditional transaction verification methods [2]. The table provides a clear comparative view of various financial metrics, illustrating the tangible improvements that distributed computing brings to the banking sector.

In the long term, banks that adopt distributed computing are positioned to experience sustained financial growth. This growth is driven by the ability to rapidly adapt to changing market conditions and regulatory landscapes, as well as by the capacity to offer more innovative and customer-focused services. Distributed computing enables banks to leverage data analytics for personalized customer experiences, which can lead to increased customer retention and new revenue streams [1]. Furthermore, the enhanced data processing and analysis capabilities allow banks to identify new market opportunities and investment strategies, contributing to overall financial growth.

In conclusion, the strategic integration of distributed computing in banking operations significantly contributes to the financialperformance of institutions. By enabling cost savings, operational efficiencies, and improved risk management, distributed computing not only streamlines banking operations but also plays a critical role in driving revenue growth and long-term financial success.

While the advantages of distributed computing in the banking sector are evident, its implementation is not without challenges. This section outlines the primary technical, security, and regulatory challenges associated with the adoption of distributed computing in banks, and considers the ethical implications of these technologies.

One of the primary challenges in adopting distributed computing in banking is the complexity of integrating new systems with existing IT infrastructure. Banks often operate on legacy systems that may not be immediately compatible with the latest distributed computing technologies. Upgrading these systems requires significant investment in terms of time and resources [1]. Additionally, there is a need for skilled professionals who are proficient in distributed computing technologies, which can be a challenge given the current skills gap in the market [2].

As banks adopt distributed computing, they face increased risks related to data security and privacy. Distributed systems, by their nature, involve the storage and processing of data across multiple nodes, which can increase the points of vulnerability for cyberattacks. Ensuring the confidentiality and integrity of sensitive financial data is paramount, and banks must implement robust security measures to protect against breaches. Furthermore, with increasing concerns about data privacy, banks must navigate compliance with data protection regulations while leveraging distributed computing [3].

The adoption of distributed computing in banking also raises regulatory and ethical considerations. Banks need to ensure that their use of distributed computing complies with existing financial regulations, which may not have kept pace with technological advancements. This includes regulations related to financial reporting, anti-money laundering, and customer data protection. Ethically, banks must consider the implications of automation and data analytics on customer privacy and the potential for biases in automated decision-making processes [1,2].

In conclusion, while distributed computing offers numerous benefits to the banking sector, its implementation must be carefully managed to address technical challenges, ensure data security, and navigate regulatory and ethical considerations. By addressing these challenges proactively, banks can fully leverage the potential of distributed computing to enhance their operations and services.

As the banking industry continues to evolve in response to technological advancements and changing market dynamics, the role of distributed computing is poised to become even more significant. This section explores the emerging trends and potential future impacts of distributed computing in the banking sector, providing insights into how it may shape the landscape of risk management and compliance.

The future of distributed computing in banking is marked by several key trends. One such trend is the increasing convergence of distributed computing with other cutting-edge technologies like artificial intelligence (AI) and blockchain. This convergence is expected to lead to more sophisticated, integrated systems that can handle complex banking operations with greater efficiency and security [1]. Another trend is the move towards cloud-based distributed computing models, which offer enhanced scalability and flexibility, allowing banks to respond more swiftly to market changes and customer needs [2].

The continued integration of distributed computing is likely to have a profound impact on the banking sector. For instance, it could lead to the development of more robust and efficient risk management frameworks, enabling banks to predict and mitigate risks more effectively. In terms of compliance, distributed computing could automate and streamline regulatory reporting processes, reducing the burden of compliance and minimizing the risk of errors and penalties. Additionally, distributed computing could enhance customer experiences by enabling more personalized and efficient banking services [3].

Looking ahead, it is anticipated that distributed computing will play a central role in the digital transformation of the banking sector. Banks that effectively leverage distributed computing technologies are likely to gain a competitive edge through improved operational efficiencies, reduced costs, and enhanced risk management capabilities. Furthermore, as regulatory environments continue to evolve, the flexibility and adaptability offered by distributed computing will be crucial in helping banks stay compliant with emerging regulations [1,2].

In conclusion, the future of distributed computing in banking is bright, with numerous opportunities for innovation and improvement. As the sector continues to navigate the challenges of risk management and regulatory compliance, the strategic implementation of distributed computing technologies will be key to success in the ever-evolving financial landscape.

This research paper has systematically explored the integral role of distributed computing in enhancing risk management and compliance within the banking sector, while also highlighting its substantial contributions to improving financial performance. As established in the preceding sections, distributed computing offers banks the tools necessary for efficient data processing, risk assessment, and regulatory compliance, all of which are pivotal in the current financial landscape.

The strategic implementation of distributed computing in banking operations has shown significant potential for cost reduction, increased operational efficiency, and enhanced accuracy in risk mitigation strategies. This, in turn, directly influences the financial stability and growth of banking institutions. As we have seen, distributed computing not only streamlines compliance processes but also plays a critical role in advanced risk management approaches, including fraud detection and credit risk analysis.

However, the adoption of distributed computing is not without its challenges. Banks face technical hurdles in integrating these systems with existing infrastructure, alongside the need to address data security concerns and adhere to stringent regulatory standards. Nonetheless, the long-term benefits, including sustained financialgrowth and improved customer service, far outweigh these initial challenges.

Looking forward, the evolution of distributed computing technologies is poised to continue shaping the banking industry. Banks that successfully adapt to and integrate these technologies will likely emerge as leaders in operational efficiency, risk management, and regulatory compliance. As the banking sector grapples with an ever-changing technological and regulatory environment, the importance of distributed computing as a strategic asset will only become more pronounced.

In conclusion, distributed computing stands as a cornerstone of modern banking, offering a pathway not just to enhanced compliance and risk management but also to greater financial success. Its role in the banking sector is a testament to the transformative power of technology in shaping the future of financial services.