Author(s): Shriyash Shete

This paper explores Zscaler Risk360, an innovative cybersecurity risk management platform that quantifies cyber risks financially, using Monte Carlo Simulation. Risk360 stands out by converting complex cybersecurity data into financial risk metrics, offering organizations a clear understanding of their cyber vulnerabilities in monetary terms. This approach facilitates informed decision-making, resource optimization, and effective stakeholder communication. The paper briefly discusses the platform’s methodology, including risk score calculation and financial impact analysis, and notes its reliance on data quality and adaptability to new threats as challenges. It concludes with potential future enhancements, such as AI and ML integration, underscoring Risk360’s role in evolving cybersecurity risk management.

In the digital era, cybersecurity has emerged as a critical facet of business strategy, transcending its traditional perception as a mere technical concern. With the digital economy’s expansion, the repercussions of cyber threats have escalated, impacting not only IT infrastructure but also the financial stability of organizations. The necessity to quantify these cybersecurity risks in financial terms has become increasingly evident. It is no longer sufficient to understand the technical aspects of cybersecurity; there is a pressing need for tools that can translate these risks into clear financial metrics. This need is the driving force behind the development of Zscaler Risk360, a state-of-the-art risk measurement and quantification platform. Risk360 represents a significant innovation in cyber- security risk management, offering organizations a quantifiable and financial perspective of their cybersecurity risks, thereby enabling more informed and strategic decision-making [1,2,3]. This paper discusses the process of designing an interface, in the context of the Zscaler Risk360 product, to display the financial risk parameters based on the renowned method of Monte Carlo Simulation.

The Risk360 product designed by Zscaler Inc. aims to provide a holistic security measurement and quantification framework to cybersecurity professionals so that they can assess the overall risk posture of the organization and take necessary actions to mitigate risks. The entire framework is based on the individual risk computation for the underlying hundred contributing factors. These contributing factors are nothing but the critical risk findings in an organization’s environment categorized into four stages of cyberattack: 1. External Attack Surface (where the threat actor attempts to discover an organization’s external attack surface exposed to the internet), 2. Compromise (the threat actor attempts to compromise an organization’s corporate asset via threats delivered from the internet) 3. Lateral Propagation (the threat actor attempts to move laterally within an organization’s environment from the compromised asset) and 4. Data Loss (the threat actor steals sensitive data as part of the actions on the objective stage). These are tailored to CISOs and their security team’s needs to efficiently monitor the security environment of the business and make security enhancement and remediation decisions efficiently.

Risk360 assesses thousands of signals from all other Zscaler offerings to compute a comprehensive and aggregated risk score. It covers all the underlying contributing factors associated with multiple Zscaler capabilities implemented in the organization’s digital environment [4,5].

The conceptualization of Risk360 marks a significant evolution in the field of cybersecurity risk assessment. In contrast to traditional qualitative approaches, which rely heavily on expert opinion and are often marred by subjectivity, Risk360 adopts a quantitatively robust methodology. This approach entails a comprehensive analysis of an organization’s cybersecurity infrastructure, encompassing a wide array of parameters. The output of this analysis is a nuanced risk score that provides a holistic view of the organization’s vulnerability to cyber threats. The ingenuity of this scoring system lies in its ability to convert complex cybersecurity data into a simple, yet informative numerical scale. This risk score, ranging from 0 (indicating a very high security posture) to 100 (signifying the highest likelihood of suffering a cyber event), serves not only as a measure of the current security posture but also as a baseline for the subsequent financial risk analysis, effectively bridging the gap between cybersecurity and financial risk management [4,5].

It is a renowned method to determine the probability of an outcome from a range of outcomes with a random set of variables as the source of uncertainty. This simulation helps organizations quantify various risk-related parameters [6].

The endeavor to quantify cybersecurity risks in financial terms is laden with inherent complexities. The primary challenge stems from the intangible nature of cyber risks. Cybersecurity threats, unlike physical threats, are often abstract until a breach occurs, making it challenging to assess and quantify them straightforwardly. This difficulty is compounded by the dynamic and rapidly evolving nature of the cyber threat landscape. As new technologies emerge and cybercriminals adapt their tactics, the predictability of these threats becomes increasingly volatile, rendering traditional risk assessment methodologies less effective [2,3].

Another significant challenge in the financial quantification of cybersecurity risks is the absence of standardized metrics. The cybersecurity industry, being relatively young and rapidly evolving, lacks a set of universally accepted standards for measuring and quantifying risk. This gap has historically resulted in inconsistent and subjective risk assessments, often varying significantly across different organizations and industries [6]. Risk360 aims to address these challenges by enhancing the sophisticated quantitative framework that integrates industry- specific data with the robust methodology of Monte Carlo simulations. This approach not only improves the accuracy and objectivity of financial risk assessments but also provides a comprehensive view of the potential financial implications of cybersecurity risks [4].

The Risk360 platform employs a multifaceted algorithm for its risk score calculation. This algorithm analyzes an extensive range of cybersecurity parameters, including security configurations, incidence response capabilities, and the effectiveness of cybersecurity policies. The platform also examines external factors such as the organization’s industry, size, and geographic location, which can influence the cybersecurity threat landscape. The culmination of this comprehensive analysis is a risk score that accurately reflects the organization’s cybersecurity health. This score is dynamic, adjusting as the organization’s security posture evolves, ensuring that the risk assessment remains relevant over time [5].

One of the unique aspects of Risk360 is its ability to tailor risk assessments to the specific industry of an organization. This is achieved by incorporating a vast repository of third- party data, encompassing industry-specific cyber threat re- ports, historical cyber incident data, and industry compliance standards. By analyzing this data, Risk360 can accurately assess the probability of a cyber event in the context of an organization’s specific industry, thereby providing a more relevant and precise risk assessment [5].

The Monte Carlo simulation, a cornerstone of Risk360’s methodology, is employed to project a range of potential financial outcomes stemming from cyber incidents. This probabilistic approach allows for the simulation of thousands of scenarios, each incorporating varying degrees of risk and impact. The simulation utilizes the risk score calculation and industry-specific data, to project a range of potential financial losses. The financial losses are determined from the same third-party data set, providing thousands of observed historical financial losses experienced by organizations after experiencing a cyber event. The result is an organization’s ‘Inherent Risk’ [5].

In Risk360, each cybersecurity capability within an organization is assigned a distinct financial value. This process involves a detailed analysis of each security measure’s effectiveness in mitigating specific cyber threats. Factors such as the cost of implementation, maintenance, and the expected lifespan of each security measure are considered. This financial valuation provides organizations with a clear view of the return on investment for each security capability, aiding in strategic decision-making regarding cybersecurity investments [5].

An innovative feature of Risk360 is its ability to project the financial impact of enhancing cybersecurity measures. The platform conducts a secondary Monte Carlo simulation, factoring in the implementation of key security improvements. This simulation provides an adjusted ‘Residual Risk’ score, offering insights into how strategic investments in cybersecurity improvement by implementing the critical missing security capabilities determined by Risk360 can reduce financial exposure and improve the overall security posture [5].

The visualization of the Monte Carlo Simulation graph is based on user-centered design principles. It showcases and highlights the important insights for its intended persona of Chief Security Officers and security analysts [7].

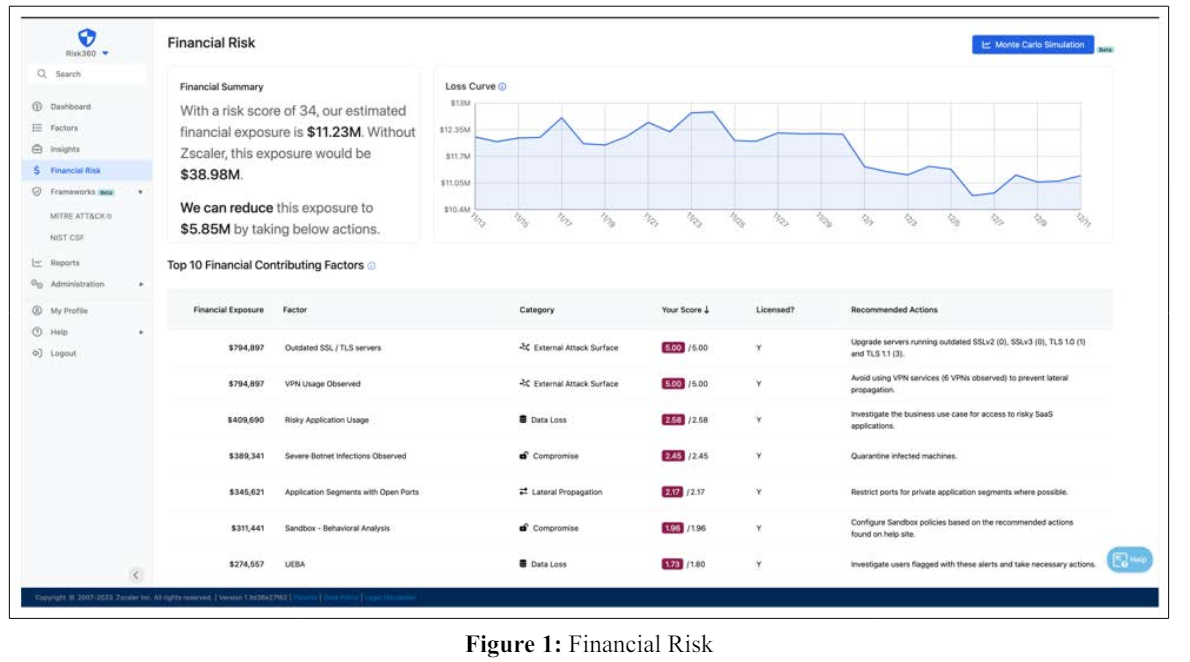

As shown in Figure 1, a dedicated page for Financial Risk inside the Risk360 product can be accessed quickly from the left menu. The Financial Summary section highlights the key actionable insights based on the organization’s risk score and top 10 contributing factors towards financial losses. It’s supported by a ‘Loss Curve’ trend line that allows users to understand how the losses have been reduced by incorporating some of the recommended actions.

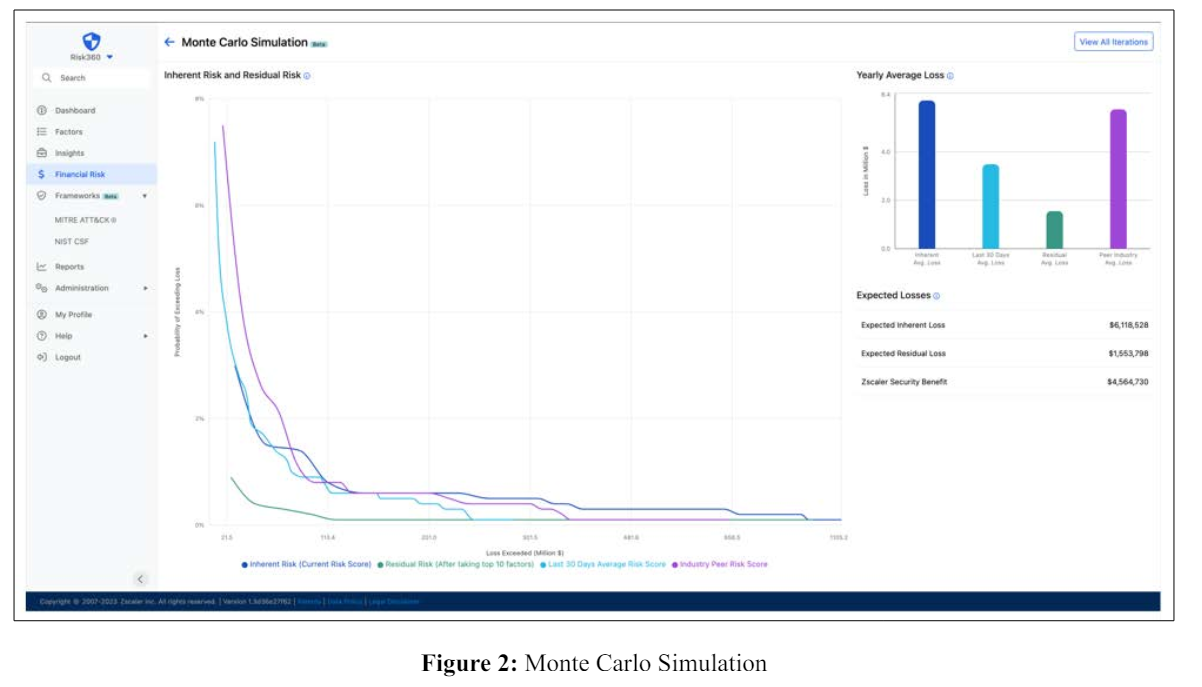

The Monte Carlo Simulation button at the top right corner of the page acts as an entry point and emphasizes the newly added methodology and feature allowing expert users to further analyze the financial losses. Clicking on it, takes users to an interface that presents Inherent Risk and Residual Risk Graph. This graph shows the probability of exceeding loss values (in percentage) in millions of dollars. The graph shows the simulation across 4 risk parameters presented in 4 colors (see Figure 2):

This simulation is based on the organization’s current risk score. This shows the probability of loss based on the overall organization risk score.

The residual risk is the risk score obtained after rectifying the 10 Risk360 contributing factors. This simulation helps users see the financial impact of addressing the top 10 Risk360 contributing Factors.

This simulation is based on the average risk of the last 30 days. This helps users to see the impact of changes in risk scores for the last 30 days.

This simulation is based on the industry peer risk score. This helps users in comparing loss probability to their industry peers.

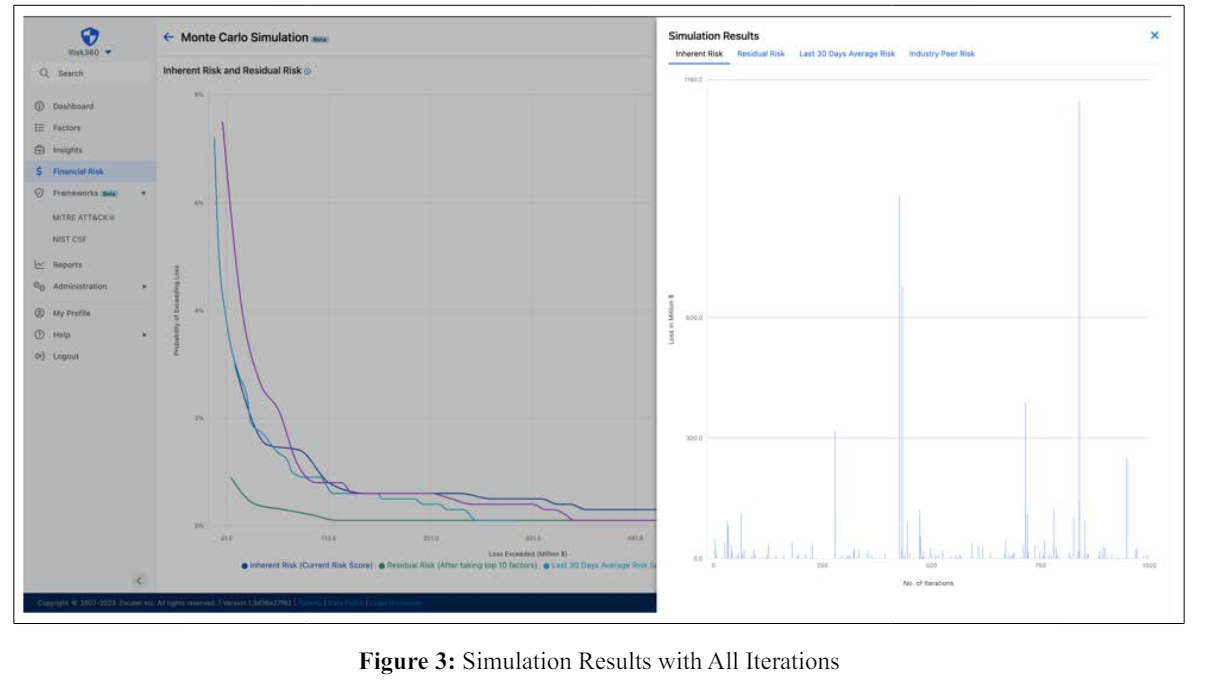

Hovering over a risk parameter curve in the graph allows users to view the probability of exceeding loss for a certain amount (in millions of dollars) inside a tooltip. Other supporting charts include: The Yearly Average Loss bar chart shows the average yearly loss in millions of dollars for each of the risk parameters. The Expected Losses section shows the loss incurred due to the organization’s inherent risks (as Expected Inherent Loss), the changes in expected loss after implementing Risk360’s recommendations (as Expected Residual Loss), and finally, the amount of money saved as a result of implementing the recommended configurations and policies through various Zscaler services. Clicking on the ‘View All Iterations’ button at the top right corner opens the Simulation Results drawer (as shown in Figure 3). The drawer consists of 4 tabs for each risk parameter. Each tab shows the results for all the 1,000 iterations run by the Monte Carlo Simulation.

The financial modeling capabilities of Risk360 allow organizations to optimize their resource allocation. By identifying the areas of highest financial risk, organizations can strategically channel their investments into strengthening specific aspects of their cybersecurity infrastructure. This targeted approach ensures that resources are not merely allocated based on perceived threats but are directed toward mitigating risks with the highest financial implications. This optimization of resources will not only enhance the organization’s cybersecurity posture but also ensure financial prudence.

The ability to articulate cybersecurity risks in financial terms significantly enhances communication with a range of stakeholders, including investors, board members, and crossfunctional executives. Risk360’s financial risk assessments provide a common language that bridges the gap between technical cybersecurity teams and decision-makers. This enhanced communication is critical in fostering a deeper understanding of cybersecurity issues among stakeholders, leading to more robust support for necessary cybersecurity measures.

Risk360 extends its capabilities beyond the assessment of current risks to project the financial benefits of future security improvements. This forward-looking approach is vital for strategic planning, as it provides organizations with a roadmap for evolving their cybersecurity measures. By quantifying the potential financial benefits of future improvements, Risk360 aids in the long-term planning and budgeting for cybersecurity initiatives, ensuring that organizations are well-prepared to meet future cyber threats.

While Risk360 offers a comprehensive and innovative approach to quantifying cybersecurity risk, it is not without challenges and limitations. The accuracy of its risk assessments and financial projections depends heavily on the quality and completeness of the input data. Inaccurate or incomplete data can lead to skewed risk assessments. Additionally, the Monte Carlo simulation, while robust, is based on probabilistic models and cannot account for every possible scenario, especially in the context of emerging and unknown cyber threats. There is also the challenge of continuously updating and adapting the platform to keep pace with the rapidly evolving cyber threat landscape.

Future enhancements to the interface could include the integration of artificial intelligence (AI) and machine learning (ML) algorithms to further refine risk assessments and financial projections. These technologies could provide more dynamic and adaptive modeling capabilities, enabling the platform to stay abreast of the latest cyber threats and trends. Additionally, exploring the development of industry-specific models could enhance the platform’s applicability and ac- curacy across different sectors. Research into incorporating global cybersecurity regulations and standards into Risk360’s framework could also ensure that organizations remain compliant and resilient against an ever-evolving array of cyber threats.

The Monte Carlo Simulation Interface design described in this paper represents a significant innovation in the realm of cybersecurity risk management, providing organizations with a tool to quantify cyber risks in financial terms. This capability is crucial in today’s digital landscape, where the ability to make informed decisions, optimize resources, enhance stakeholder communication, and plan for the future is imperative. As cybersecurity threats continue to evolve, user-centered visualizations and interfaces like these will play an increasingly vital role in helping organizations navigate these challenges with confidence and strategic foresight.