Author(s): Patricia Singini

Each and every business concern must maintain adequate amount of finance for their smooth running of the business concern and also maintain the business carefully to achieve the goal of the business concern. The business goal can be achieved only with the help of effective management of finance. We can’t neglect the importance of finance at any time at and at any situation. Financial management is very important in the field of increasing the wealth of the investors and the business concern. Ultimate aim of any business concern will achieve the maximum profit and higher profitability leads to maximize the wealth of the investors as well as the nation. There is higher rate of business stagnation of businesses due to its product cycle being affected due to economic downturn, mostly we expect business to grow from introduction, growth ,maturity then if not well managed may decline, The other stagnation has been created because of challenges of globalizations, the emergency of COVID 19 which started in Wuhan migrated to the whole world through those involved in international business. Qualitative research was done to explore the financial impacts of covid 19 from January to june 2020,the case of Blantyre city persperctive,Blantyre was chosen because it is a commercial city has all people of Malawian ethnic background and more of International business it gave a true reflection of Malawi small and medium enterprises stand. Quantitative data was collected using questionnaires, interviews, media and observations were also used to achieve the objectives. Managers of small and medium enterprises were interviewed to represent the organization to give a broader picture of the organization ,15 SME’s and 10 entrepreneurs were interviewed to have a picture on the other side of an individual. A deductive approach was used ,theories of international business and income inequality were used to assist in the finding out the problem. Primary data was used to collect raw data through a structured questionnaire and secondary data was used to create literature review as well as part of raw data.it was collected in journals, books, newspapers. Data analysis was done using content analysis. The respondents feedback on the financial dynamics that affected the business and individuals were analyzed in either positive or negative way to find out the impact COVID19 has left on these businesses. Covid 19 has negatively affected international business and entrepreneurship in Malawi from a period of January to June, it has left negative financial impacts. As government there is need to put good financial policies in place to bail out small and medium enterprises.

Finance is the lifeblood of business organization. It needs to meet the requirement of the business concern therefore a need for Financial Management which means applying general management principles to financial resources of the enterprise, planning, organizing, directing and controlling the financial activities such as procurement and utilization of funds of the enterprise. Financial management helps to improve the profitability position of the concern with the help of strong financial control devices such as budgetary control, ratio analysis and cost volume profit analysis. Increase the Value of the Firm.

An important tool for understanding the consequences of events like the emergence of COVID-19 is to consider asset price changes. These price changes capture current expectations. Thus, the researcher need not trace all the future changes to cash flows and discount rates separately (Schwert 1981). Effectively, asset markets provide ongoing, high-stakes surveys regarding future expected outcome. Due to COVID-19, the transit time of goods from import countries has gone up due to non-availability of containers to move the cargo. Informal exports from customers coming from Mozambique & Zambia has gone down due to fear of denial of entry visa at the border.

Importation of goods from China and travel to China has come to a standstill. Furthermore, goods that were bought late last year are yet to be dispatched as there are not enough volumes to allow for containers to be fully loaded and shipped. To put it in perspective, in normal times with Malawians regularly travelling to China, goods could be loaded and shipped within a week or a fortnight. This has greatly affected many businesses. Some of the businesses have had all raw material orders from China withheld. The delay has resulted in slow down as well as reduction of production of goods. If the trend continues a shutdown of production is likely. Less international travel is affecting airline and ticketing companies. Travelling outside the country has reduced significantly in particular to and from Europe (especially Italy where connection flights pass through Rome extensively) and China. If this pandemic continues, it will bring business on its knees.

Malawi scored poorly on the 2017 Global Entrepreneurship Index (GEI) ranking on position 130 out of 137 global economies. The

report was released Monday by the Global Entrepreneurship and Development Institute. Malawi only managed to score above Guinea, Burkina Faso, Bangladesh, Mauritania, Sierra Leone, Burundi and Chad on the index. Neighbouring Zambia is on position 96 on the index ahead of Tanzania on 118 and Mozambique on 123. “Business is what drives the economy. Most developed countries are prosperous because they have vibrant entrepreneurs who are deliberately and effectively supported by their respective countries. With the necessary support, we can make it,” Mlombwa said. In light of the massive impacts of the coronavirus on public physical and psychological health, the economic and financial impacts may seem secondary. However, the economic effects are potentially going to be of first-order importance. Economists are beginning to consider these consequences (see in particular the latest Vox eBook edited by Baldwin and Weder di Mauro 2020). Earlier work also provides valuable insights. For example, Adda (2006) analyses outbreaks of a number of viral diseases in France and evaluates the (sometimes subtle) effects of policies such as school closures and the closure of public transportation networks. Ultimately, predictions are difficult because the spread of the disease, the policy responses, and individual behaviour are unknown.

Exchange rate pressures in the COVID-19 pandemic are an important signal to global policymakers of underlying economic stress. Aggressive and coordinated policy responses within the G20 and the wider world can aid vulnerable economies and damp excessive currency swings. Key measures include central bank swap lines, increased resources for international financial institutions, and avoiding protectionist policies. The G20 support increased central bank cooperation in providing needed financial resources to countries suffering liquidity crises resulting from COVID-19. On March 26, 2020, G20 leaders congratulated the major central banks for extending temporary swap lines to other central banks in which they provide their currencies in exchange for the receiving central bank’s currency. But the major central banks can do more to help countries plunged into crisis through no fault of their own. They can (1) set up facilities to provide cash for sovereign assets in their currencies held by other central banks, (2) provide additional liquidity swap lines where appropriate, and (3) in some critical cases link their swap lines to a backstop from the International Monetary Fund (IMF).

Zoltan Acs a University Professor at the Schar School of Policy and Government at George Mason University , estimate that improving conditions to help entrepreneurs create new companies could add $22 trillion to the global economy women are more likely than men to work in social sectors such as services industries, retail, tourism, and hospitality ? that require face-to-face interactions. These sectors are hit hardest by social distancing and mitigation measures. In the United States, unemployment among women was two percentage points higher than men between April-June 2020.There were predictions that global trade will be reduced by a third as result of the recession caused by the effects of Covid-19. Determining the full scale and impact of major events is an obstacle. Political scientists who look to social and economic indicators face difficulties with this task. While ascertaining accurate information and data to forecast the impact of Covid-19 on trade remains a challenge, ensuing geopolitical tensions illustrate the direction that global trade may take. Currently at the backdrop of the coronavirus includes the US-China trade relations and the South China Sea dispute.

Malawi Economic Monitor did a study just when Government announced the lockdown in April, enforcing social distance measures and closing borders, my business significantly shrunk because at that time we had run out of products such as hair creams, hair extensions and other make up products that we normally use in the salon,” said Phiri.

Valentini observed that the demand for domestic workers has reduced because most people are now working from home and schools remain closed. Therefore, families can manage daily household affairs with support from relations and their children. The need for an extra hand is no longer there. Malawi’s economy grew by 4.4% in 2019, a marked increase from 3.5% in 2018 supported by a rebound in agriculture production, as maize and key crops increased.

The world economy has already entered a recession as a result of the measures adopted to contain the spread of COVID-19. The first estimates of the scale of this recession, published by Goldman Sachs, anticipate global income contracting by 1 per cent in 2020, representing a 4-percentage point reduction in global growth versus pre-pandemic estimates. This would represent 2 the worst year for the world economy since 1950. Based on prior global downturns, it is expected that there will be further downward revisions of global growth projections, as the depths of previous recessions have been consistently underestimated, especially at the outset. Some initial modelling by the International Food Policy Research Institute (IFPRI) indicates that for each percentage point reduction in global growth, extreme poverty (US$1.90 a day) will increase by 14 million to 22 million people. Based on the initial growth projections by Goldman Sachs, this would imply an increase of between 50 and 90 million people living below the global poverty line over the next three years, half of whom are children.

The rapid spread of coronavirus (COVID-19) has dramatically impacted financial markets all over the world. It has created an unprecedented level of risk, causing investors to suffer significant loses in a very short period of time.While the exact global economic impacts are not yet clear, financial markets have already responded with dramatic movements. In March 2020, the US stock market hit the circuit breaker mechanism four times in ten days. Since its inception in 1987, the breaker has only ever been triggered once, in 1997. Together with the US crash, stock markets in Europe and Asia have also plunged. FTSE,the UK’s main index, dropped more than 10% on 12 March, 2020, in its worst day since 1987.The stock market in Japan plunged more than 20% from its highest position in December 2019.3Central banks and authorities responded immediately by throwing their policy instruments into the market. For example, on 15 March, 2020 Dayong Zhang et.al conducted a study on Financial markets under the global pandemic of COVID-19, this study aimed at giving a first-hand description of the scenario and to understand the patterns of systemic risk in financial markets, they explored the available data and attempts to answer the following questions: How do risks in stock markets react to the pandemic outbreak?

Morgan 2020, says currency has been volatility during the COVID-19 outbreak. The outbreak of the COVID-19 pandemic has been unprecedented, and its impact to world markets has been reflected in foreign exchange. The impact of COVID-19 touches every part of the economy, and can largely be divided into three categories: Demand Shock, as quarantines, travel restrictions, and global disruption have thrown a stick in the spokes of consumer goods & services, tourism, hospitality, and more, Supply Shock, as the complex, global supply chains that make the world go ‘round

are continuously disrupted and halted without a clear resolution point and Financial Shock, such as lack of cash flow and liquidity threaten to sink enterprises in an economic environment where the global financial safety net is strained and international cooperation is in declining health.

In year 2020, the spreading of coronavirus disease (COVID-19) has contributed to 1,056,159 confirmed cases, 57,206 deaths and involving 207 territories by 4th April 2020. The new disease is spreading human to human contact with an infected person when they cough or sneeze. It also spreads when a person touches a surface or object that has the virus on it, then touches their eyes, nose, or mouth. The disease causes respiratory illness with symptoms such as a cough, fever, and in more severe cases, difficulty breathing. The outbreak of COVID-19 creates unstable economic condition due to market sentiment that slowdown all economy activities.

An exchange rate is the value of the currency of one country expressed in the currency of another country. An exchange rate or currency quotation is necessary to determine the proportions of currency volume in case of international trade in goods and services, cash flows, revaluation of accounts in foreign currency, etc. The cost basis of the currency is its purchasing power

The formation of an exchange rate is a complex process of interrelation of national and world economy and politics, therefore, in case of its forecasting various factors, which may have an impact on the currency quotes, are taken into account.

Inflation rate. The increase in the level of prices in the country leads to the decrease in purchasing power of its monetary unit, and, respectively, to the decrease in exchange rate. Interest rates. Central banks of various countries have a significant impact on the rate of a national currency through the change in refinancing rate. When the interest rate hike is associated with the tightening of the monetary policy of the country, then the exchange rate rises, but if the rate rises because of high inflation, then the exchange rate will fall.

Balance of payments. The balance of payments of the country is the cash flow in the form of payments received and paid by the country. In case of the active balance of payments, the demand for national currency increases, thereby its rate strengthens as well. In case of the passive balance of payments, increases the demand for a foreign currency, thus the rate of a national currency decreases. Inflation rates, Interest Rates, Country’s Current Account / Balance of Payments, Government Debt, Terms of Trade, Political Stability & Performance, Recession and Speculation all these are factors determining the foreign exchange rate fluctuations. If you send or receive money frequently, being up-to-date on these factors will help you better evaluate the optimal time for international money transfer. To avoid any potential falls in currency exchange rates, opt for a locked-in exchange rate service, which will guarantee that your currency is exchanged at the same rate despite any factors that influence an unfavourable fluctuation.

In an unprecedented global health crisis, trade is essential to save

lives and livelihoods; and international co-operation is needed to

keep trade flowing. In the midst of significant uncertainty, there

are four things we can do:

1 ) boost confidence in trade and global

markets by improving transparency about trade-related policy

actions and intentions;

2) keep supply chains flowing, especially

for essentials such as health supplies and food;

3) avoid making

things worse, through unnecessary export restrictions and other

trade barriers; and

4) even in the midst of the crisis, think beyond

the immediate.

COVID-19 is a humanitarian crisis on a global scale. The virus continues to spread throughout the globe, placing health systems under unprecedented stress in the battle to save lives. The human scale of this tragedy is set to worsen as the virus spreads to lower income countries with weaker healthcare systems.

In the March 2020 OECD Interim Economic Outlook, the downside scenario saw global growth halved to 1.5%. That was optimistic. The most recent estimates in the June 10 OECD Economic Outlook suggest an unprecedented collapse in the first half of 2020 - an almost 13% decline in global GDP (Figure 1). Moreover, the costs to the global economy from support packages, through central banks and fiscal actions, are very significant and likely to have long-lasting and complex effects on management of sovereign and corporate debt. Yet notwithstanding these efforts, most major economies now look set to enter recession, and more serious scenarios cannot be discounted.

A further challenge is the uncertainty about COVID-19, including terms of the scale and pace of infection; how long and widespread shutdown measures will prove necessary; the prospects for treatments to better manage symptoms, allowing health services to focus only on the most serious cases; and the risk of “second wave” infections as the virus moves around the globe. The virus is proceeding in waves, with countries succumbing - and set to recover - at different times. What is clear is that the virus and its aftermath looks likely to be with us for some time.

Against this background, there is a clear need to keep trade flowing, both to ensure the supply of essential products and to send a signal of confidence for the global economy. Trade is essential to save both lives and livelihoods. Coronavirus has disrupted global value chains that connect producers across multiple countries. Comparative figures between the first two months of 2019 and the first two months of 2020 reveal a collapse in Chinese trade with the EU and US. Researchers have studied data from China to see which imports and exports have been the most affected. The COVID-19 pandemic is now expected to trigger the worst economic.

Key interventions by social workers in Malawi during the crisis included providing mental health and psychosocial support, counselling and rehabilitation support to children and families impacted by COVID-19 including those facing abuse, domestic violence and discrimination, Disseminating factual information about coronavirus to dispel misconceptions and fears;

Ensuring that children affected by COVID-2019 have access to adequate alternative care arrangements as well as deliver protection services for children left without a care provider, due to the hospitalization or death of the parent or care provider. Facilitating referrals to other organizations and agencies for specialized mental health and psychosocial support (MHPSS), Child protection (CP) and Gender-based violence (GBV) services and other basic needs; Carrying out case management with those suspected and/or confirmed to be affected to prevent further spreading the virus.

Several theories have been used in the study international business like theory of comparative advantage as with globalisation most businesses are interconnected the interlink has affected the local business as well.

By definition, a rise in income inequality increases purchasing power disparities. If more income improves health, larger income gaps between the rich and poor should result in larger health gaps between rich and poor.

They are two pathways from income inequality to individual health: direct and indirect effects. Rising income inequality can affect individuals in two ways. Direct effects operate through changes in an individual’s own income. Indirect effects operate through changes in other people’s income, which in turn change a society’s political and economic institutions, as well as its customs and ideals. Such changes can, in turn, alter an individual’s incentives and behavior, even if her own income has not changed. Indirect effects can change either the average level of health or the slope of the relationship between an individual’s income and her health Several overarching theories have been proposed as frameworks to understand differences and trends in population health (Schofield, Reher, and Bideau 1991).

Direct effects by definition is a rise in income inequality which increases purchasing power disparities. If the health benefits of an extra dollar of income diminish as income rises (as most evidence suggests), transfers from the rich to the poor will increase mean health, whereas transfers from the poor to the rich will reduce it (3). We call this asymmetry a concavity effect because the line is concave downward.

Indirect effects of rising income inequality are the product of social changes that alter the relationship between individual income and individual health. Changes in income inequality might, for instance, affect the enforcement of laws banning unsafe consumer products, the benefits and costs of higher education, the social bonds among relatives and neighbours, or the distribution of political influence. Such long causal chains make precise prediction difficult. Indirect effects of income inequality can affect individuals in at least two ways, which we call level effects and slope effects.

One of the most prominent is McKeon’s thesis that better nutrition is the most important factor in explaining mortality declines in 19thcentury Britain (McKeown 1976; Szreter 1988, 2002a). According to Easterlin (1999), it is commonplace in economics to believe that improvements in population health are mostly a serendipitous byproduct of economic growth, that there is little left to be discovered about the production of population health not covered by understanding the production of wealth. Preston proposed that it is not improved nutrition, rising incomes, or better standards of living but more efficient public health technology that is most important to explaining rising life expectancies among poor countries during the 20th century (Preston 1976). Caldwell (1986) pointed out the importance to better population health of female autonomy, the education of women, and maternal and child health services. Subsequently, health behaviors (McGinnis and Foege 1993), medical treatment (Bunker, Frazier, and Mosteller 1994), and, more recently, genetic explanations (Venter et al. 2001) have been offered to understand health differences within and among populations.

for a place among these “meta-theoretical” frameworks for the determinants of population health (Davey Smith and Egger 1996). This research theme has coincided with concerns over the extent of income inequality between the rich and poor within countries, and the economic inequality between rich and poor nations. This interest in the health effects of income inequality has also coincided with the long-standing epidemiological interest in whether physical and, more recently, social environmental characteristics?not conceptualized or measurable as characteristics of individuals, but as characteristics of places or aggregates of people?can affect the health of individuals (Diez-Roux 1998).

China has recorded impressive growth over the past 25 years since the introduction of the market economy, and there has been a substantial increase in average living standards. However, in recent years there has been growing concern about the large increase in income inequality over the same period. For example, Bramall (2001) shows that the Gini coefficient for rural China has increased by almost 50 per cent from 1980 to 1999. The rising inequality has had and will have important impacts on various aspects of social life, resulting, for example, in frequent social conflicts (Alesina and Perotti 1996), higher levels of violent crime (Hsieh and Pugh 1993), and ultimately in a slowing down of economic growth (Aghion, Caroli and Garcia-Penalosa 1999). While inequality may affect society and its economic development in many ways, we focus in this chapter on a particular aspect of the socioeconomic effects of inequality; that is, its impact on health.

In analysing Malawi nation has been mostly affected with income inequality due to politics ,the party loyalist were benefiting ,money was circulating within the party members ,more of state capture this has been revealed with a lot of court cases after they lost the elections hence court initiated fresh presidential elections, many top men in the party have become billionaires due to corruption. Covid 19 pandemic came in when there was political destabilization, people did not mind on the preventive measures schools closed early .According to the author , the pandemic of covid 19 has brought more inequality in Malawi, They are direct and indirect effects ,the indirect effects are coming because of education ,most Malawians in marginalized areas they don’t have access to doing school online ,which is narrowing levels of knowledge ,the rich getting richer ,the poor getting poor.

The direct one is due to those who have accumulated more money their purchasing power parity is higher than others. And in the emergency of covid the testing centre were only in central and southern Malawi ,this has been causing more cost on the northerners to get tested , they were dying with not knowing there status. More supplies were given the other regions than the northerners. This was putting the northerners on high risk.

Comparative advantage is an economic term that refers to an economy’s ability to produce goods and services at a lower opportunity cost than that of trade partners. A comparative advantage gives a company the ability to sell goods and services at a lower price than its competitors and realize stronger sales margins.

One of the most important concepts in economic theory, comparative advantage is a fundamental tenet of the argument that all actors, at all times, can mutually benefit from cooperation and voluntary trade. It is also a foundational principle in the theory of international trade.

People learn their comparative advantages through wages. This drives people into those jobs they are comparatively best at. If a skilled mathematician earns more as an engineer than as a teacher, he and everyone he trades with is better off when he practices engineering. Wider gaps in opportunity costs allow for higher levels of value production by organizing labour more efficiently. The greater the diversity in people and their skills, the greater the opportunity for beneficial trade through comparative advantage

If we apply theory of competitive advantage in this era of covid 19 we will find that those working in the hospital are at more advantage than all careers, since its risky to manage covid 19 patients they have a rise of salary ,there economic situation is better off than those working in other organizations.

This shall mean other careers are benefiting most than the others, another example would be suppliers of medical supplies which have a higher comparative advantage than stationery suppliers.

The other group would be those doing cross boarder business for the borders were closed against those who are doing business within the country.

“Imperfect competition is a competitive market situation where there are many sellers, but they are selling heterogeneous (dissimilar) goods as opposed to the perfect competitive market scenario. The markets for the various resources used in production are “imperfect.”

Market imperfections theory is a trade theory that arises from international markets where perfect competition doesn’t exist. In other words, at least one of the assumptions for perfect competition is violated and out of this is comes what we call an imperfect market.

An imperfect market is one in which individual buyers and sellers can influence prices and production, where there is no full disclosure of information about products and prices, and where there are high barriers to entry or exit in the market. It’s the opposite of a perfect market, which is characterized by perfect competition, market equilibrium, and an unlimited number of buyers and sellers.

If we have to apply the theory to the era of covid pandemic the past months from January to June we will find that other sectors like Telecommunication companies ie Telecommunication Networks Malawi and Airtel the duopoly companies have higher data cost than the neighbouring countries this was revealed after MCP was voted into power, when Minister of Information ,Mr Gospel Kazako lamented for the reduction in price ,there have been monopoly power in production, assessing a multi-country market like the production of masks ,more business has been given to China on the production of the recommended mask called N95.

Imperfect markets are found in the real world and are used by businesses and other sellers to earn profits. Imperfect or incomplete information about products and prices There is less information on covid 19 ,true information has been coming very slowly which is putting many people on danger and they are scared to do business, hence low productivity affecting the economy.

Most organizations are working on shifts ,slowing down its services ,other sectors like tourism and schools which were completely closed have affected inflows thereby making less people buy items. In this study we will further find out how imperfect markets have been created.

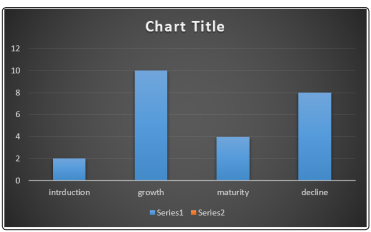

As a firm matures, it may recognize additional opportunities outside its home country. A product life cycle is the amount of time a product goes from being introduced into the market until it’s taken off the shelves. There are four stages in a product’s life cycle?introduction, growth, maturity, and decline. ... Newer, more successful products push older ones out of the market.

The life cycle of a product is associated with marketing and management decisions within businesses, and all products go through five primary stages: development, introduction, growth, maturity, and decline.

This is when a new product is first brought to market, before there is a proved demand for it, and often before it has been fully proved out technically in all respects. Sales are low and creep along slowly. The seven steps of BAH model are: new product strategy, idea generation, screening and evaluation, business analysis, development, testing, and commercialization.

Demand begins to accelerate and the size of the total market expands rapidly. It might also be called the “Take off Stage.”

Demand levels off and grows, for the most part, only at the replacement and new family-formation rate.

The product begins to lose consumer appeal and sales drift downward, such as when buggy whips lost out with the advent of automobiles and when silk lost out to nylon.

When first introduced in the late 19th century, typewriters grew in popularity as a technology that improved the ease and efficiency of writing. However, new electronic technology like computers, laptops and even smartphones have quickly replaced typewriters - causing their.

This example shows how the yoghurt product category has moved through the product life cycle by remixing elements of the authorization of cloth face mask has made many Malawians buy less of surgical cloth face mask.

The study sought an approval of Azteca University Ethics Committee as a small scale academic research as part of academic requirements of a doctoral degree of doctor of philosophy in development studies. The study was conducted between 10 to 17th July 2020.

The research interviewed 15 small medium enterprises managers, who were giving actual representation of how the individuals and organizations, the organizations had 20 to 100 employees and 10 entrepreneurs’ inorder to have a picture of how individuals have been affected. The other data was collected through Media reports and interviews were used as well as well as observation to find out how covid 19 has affected finances has been impacted. An exploratory research which shall explain the financial impacts covid 19 pandemic has brought on international business andentrepreneurship. The study was conducted in Blantyre city ,The site was chosen since it is a commercial city, and it handles more international businesses around the city, The city has people from all walks of life ,almost all people from different Malawian Cultures representing reality of all Malawians.

The inclusion criteria was on all businesses involved with internal business, therefore different types of organisations were selected textile and designing cargo, private schools, banks, tobacco industry,saloons,food production industry et.c, this was done inorder to have a picture from different types of businesses.

The study is a qualitative research approach which involves collecting and analysing non-numerical data (e.g., text, video, or audio) to understand concepts, opinions, or experiences. It can be used to gather in-depth insights into a problem or generate new ideas for research. Its methods are exploratory; they seek to unearth the opinions, thoughts and feelings of respondents. It is most commonly used to help inform new concepts, theories and product.

The study targeted managers of small medium enterprises 15 of them, Purposive sampling was used. Primary data was collected to get raw data from the respondents ways a questionnaire was developed which had question simplified to a participant level ,they were distributed to several small and medium enterprises in Blantyre from different nature of businesses the case of Blantyre city persperctive,Blantyre was chosen because it is a commercial city having all people of Malawian ethnic backgrounds and more of International business it gave a true reflection of Malawi small and medium enterprise. The study used multistage and stratified sampling which is a secondary data was generated through different studies and available literature.jornals and newspapers, this answered several questions that exists in the research and it is to complement the primary data which was collected using three methods ,Interview ,structured questions by developing a questionnaire were developed and secondly was non structured interviews in which I had used themes using the main objective and lastly observation was used . A deductive approach was used by involving the data with some preconceived themes that were expected to find reflection, based on theories or existing knowledge. Survey research design was used.

Participants voluntarily participated in the study, only small and medium enterprises were eligible to participate. The outcome of the result was determined with fairing of finances of businesses and those in businesses the dependent variable of financial state proved by good cash flow and growth of business deductive approach was adopted where the existing theories of Keynesian theory, economic theory of income inequality and three international business theories were used theory of comparative advantage ,imperfect markets theory and product cycle theory.

Content analysis was used for the study had used a descriptive approach in both coding of the data and its interpretation of quantitative counts of the codes . It analyses documented information in the form of texts, the information obtained from the media, in short it analysed responses from interviewee.

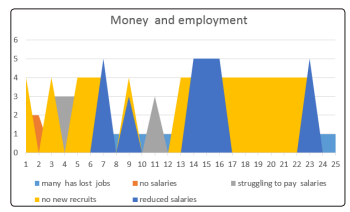

The study showed that covid 19 has negatively affected international business and entrepreneurship in Malawi. Starting with employment and money

Out of 25 respondents 23 confirmed of colleagues losing jobs representing 92% .Out of 25 respondents 15 respondents manifested to be going without salaries representing 60%, 11 out of 25 small and medium enterprises are struggling to pay salaries representing 44%. 16 out of 25 small and medium enterprises did not recruit new employees due to the financial stand this represents 64%. 6 out of 25 small and medium enterprises have reduced their salaries representing 24%.

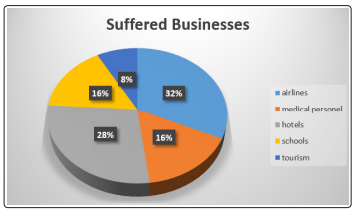

If we are to compare business which survived and those that suffered in the past six months, It has been found that airlines, hotels ,schools, medical personnels and tourism suffered most in the first half of the year as presented below.

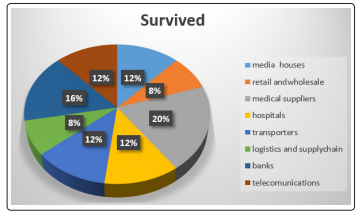

From January to June still other businesses got opportunities out of the disaster of covid19 pandemic, businesses like media houses, retail and wholesale companies, medical supplies,hospitals,trans porters,logistics and supply chain ,banks and telecommunication companies.

Out of 25 people who were interviewed 25 infested the product cycle of these businesses had been affected. A further check was done on the level of the product cycle 42% of the small and medium enterprise’s had its growth been affected ,33% of businesses had declined, 17% of the business was affected on maturity level and 8% of business which were introduced had been affected.

Other services had comparative advantage than others ,Bankers were much better than being a teacher who has been affected due to closure of schools to avoid the spread of the disease, who have had to go without salaries or less than 30% of their salaries or in many cases without salaries

100% of the respondents responded that the exchange rate had been affected and Kwacha value has been affected. The buying power of the kwacha has been affected, in most cases the impact of COVID 19 has left the already minimum reserves to the banks. Less volumes of cash inflows due to lack of international trade.

In thematic way ,the researcher had to find out factors that influenced the exchange rates in covid 19 the following were the responses. Demand and supply of foreign currency, people are cueing for foreign currency and you have to go early in the morning due to the closure of boarders it has created demand of goods and services form across borders. International markets have been affected with lockdowns. Forex is accumulated on seemingly on one section of the economy. Business sale lowered.

Out of 15 small and medium enterprises 12 responded that income inequality was one of the emerging issue that has risen representing 80% being affected with inequalities Covid 19 has brought income inequality ,covid 19 was widening the gap between the poor and the rich

One other thing that has brought inequality is closure of schools with reference to Ben Mkandawire, 2020 that Malawi had 669 child marriages from April to june this means half of the Malawian children got married ,the number had risen to 83% than last year There have been also a lot of gender based violence. The closure of schools and economic down turn which has brought child marriages, gender based violence and teenage pregnancies.

70% of respondents said there was duopoly of telecommunications company and medical suppliers who are controlling the prices.

The cost of living has risen as the rules of social distancing are demanding two people on a row in a minibuses which has doubled the transport cost. Prices of goods have risen because of high demand due to closure of borders.

Covid 19 has created a lot of un employment and rate vandalism has increased ,five out of six children of one family who are married live in different regions of Malawi explained to have there money stolen in crooked e business deals.

85% of the respondents had there business cancelled without getting refunded much as consumers know that they have the right to be refunded. After the directive of closing schools the president inauguration, the closure of airlines to mention a few made stakeholders to get affected for these businesses got cancelled as well.

Psychologically many Malawians were affected .In most cases people didn’t and were scared of the un known , what will happen next .This has also contributed to economic downturn ,as other would prefer to stay home risking there business ,most organizations were working half day this cumulatively slowed the cash flow. Most respondent’s financial welfare had been affected.

Kwacha had lost value from 745 to 750.2500 tt sale Out of 25 respondents entrepreneurs and small and medium enterprises 25 of them said there businesses were affected with covid 19 representing a 100%

All respondents lamented that the closure of the borders had affected there business for there business is one way or another connected to international business,cashflow had lowered due to low sales.

The study has found that the International financial dynamics have greatly been affected.100% respondent expressed that there business was connected to international business, social distancing and closure of borders have greatly affected there cash flows.

The exchange rate has been affected affecting the value of Kwacha. There have been comparative advantage between different careers .Business which are in line with combating covid 19 have had more advantage than others.

Globalization has been disconnected with covid 19 leading to recession due to the closure of the borders ,the world system has been disconnected ,its high time nations have to start depending on their own economy ,Covid 19 has created many vulnerable people in Malawi.

Malawi has been double hit the political instability made the business to slow down, the whole year fighting in court the ruling and the opposition parties which led to change of government increased economic down turn with a combination of covid which also increased the prevalence of covid 19 because two weeks later Malawi had many cases and many lost their lives ,which lead to the cancellation of cerebration of the inauguration of presidents ,many businesses got affected as entrepreneurs prepared there businesses to take to the functions where they would find the readily available market. with rallies has let International businesses and entrepreneurship to go down to suffer.

due to economic inequality that has made the richer to be more richer and the poor getting more poor. The closure of schools and borders have created more demand of goods and services asking prices to go higher ,to make ends meet ,unemployed have started steal by tricks , girls go in search of men to get a source of income creating teenage pregnancies Lack of information no gadgets to use for online classes