Author(s): Amine EN-NAJAH* and Hassane BOUJETTOU

The competitiveness of companies has been influenced by recent occurrences, particularly the COVID-19 pandemic, which caused significant disruption to the global economy. Nevertheless, certain companies have adeptly adjusted to the new circumstances by embracing novel business models, investing in technology, and displaying adaptability to swiftly accommodate rapid changes. The rapid digitalization across various industries has also left its mark on companies' competitive landscape, allowing them to offer products and services with greater speed and reduced expenses. Companies that have channeled resources into technology have also reaped the rewards of improved collaboration and heightened operational efficiency, attributes that have played a pivotal role in sustaining their competitiveness. In fact, even audit firms have not remained unaffected by this trend. Digitalization is fundamentally reshaping the audit sector. These firms are under growing pressure to provide services that are not only swifter and more precise but also cost-efficient. Digitalization presents fresh avenues to enhance audit procedures through the integration of technologies such as big data, artificial intelligence, blockchain, and cloud computing. Through this article, we aim to explore the impact of these technologies on the "Audit Risk Equation" that represents our research model.

Companies’ competitiveness has been affected by recent events, notably the COVID-19 pandemic, which caused a major disruption to the global economy. However, some companies have managed to adapt to the new conditions by adopting new business models, investing in technology and being flexible to adapt to rapid changes in demand.

The accelerated digitalization of many industries has also had an impact on companies’ competitiveness, enabling them to offer products and services more quickly and at lower cost. Companies that have invested in technology have also benefited from greater collaboration and operational efficiency, helping them to remain competitive.

Indeed, audit firms are no exception. Digitalization is profoundly changing the audit industry. They are increasingly under pressure to offer faster, more accurate and more cost-effective services. Digitization offers new opportunities to improve auditing processes using technologies such as big data, artificial intelligence, blockchain and cloud computing.

Against this backdrop, the aim of this article is to explore: How has the methodology of an accounting and financial audit engagement evolved thanks to digital tools? First, we'll look at how the practice of Financial Auditing has evolved; then, we'll move on to digitalization, presenting some of the tools involved and listing their impact on the risk of material misstatement.

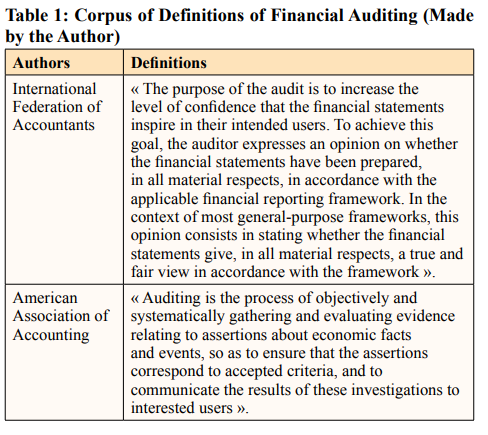

We cannot limit external/financial auditing to a single, universally accepted definition, but we can nevertheless present a few issued by international entities, others by national organizations and then by individual author:

The external audit is therefore a standardized, methodological examination, carried out by a professional who must be, and appear to be, independent and objective, and whose purpose is to assess and certify, or not, a company's accounts. Approaches to auditing have evolved, as have its aims: from a means of deterring and detecting fraud at the beginning of the 20th century to a determination of the company's current financial conditions and results to the assurance of a reasonable impression of the reliability of the accounts [1].

We find Financial Auditing in organizational theory, on the one hand with agency theory designating: "a contract by which one (or more) persons (the principal) engages another person (the agent) to perform on his behalf some task which involves a delegation of some decision-making power to the agent"; and on the other hand with information asymmetry, in which we find 2 types: The first type, "before the contract", is the situation of "adverse selection" with hidden information and the second type, "moral hazard" and opportunism [2,3].

In fact, auditing has undergone a methodological evolution. The first formal method used by auditors was the tally approach, or also known as the output approach, which consisted in checking all journal entries. This method relied solely on reconciling the amounts entered in the accounts with the invoice amounts (proof). Detailed tallying was limited to checking compliance with the double-entry accounting principle. Subsequently, the accumulation of practical knowledge on the one hand, and the volume of accounting transactions on the other, increased considerably. In fact, it became imperative to find a new tool for identifying risk

areas and checking the plausibility and reasonableness of annual financial statements. This is how analytical control came into being; consisting of an analytical comparison, through financial analysis of the balance sheet and the CPC, of the company's financial statements for year N with those of the previous year, in order to highlight significant and inconsistent items. This control is carried out using 4 main techniques: plausibility review; absolute data comparison; relative data comparison and trend analysis.

From the 1920s onwards, there was a gradual shift towards the systems approach, based primarily on the evaluation of internal control. From the Second World War onwards, internal control systems were adopted, companies formalized their procedures and processes, and managers began to replace shareholders at the head of corporate management. The first definition of internal control was given in 1948: "It consists of a rational organization of the accounting and bookkeeping department aimed at preventing, or at least discovering without delay, errors and fraud" [4]. A recent definition of internal control has been given by a number of authors, and refers to "all the safeguards contributing to the control of the company. Its aim is to ensure the protection and safeguarding of assets and the quality of information, as well as the application of management instructions, and to promote improved performance. It manifests itself through the organization, methods and procedures of each of the company's activities, in order to maintain its continuity [5]".

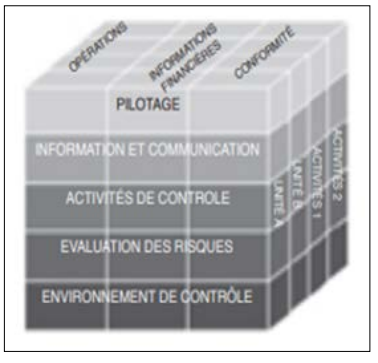

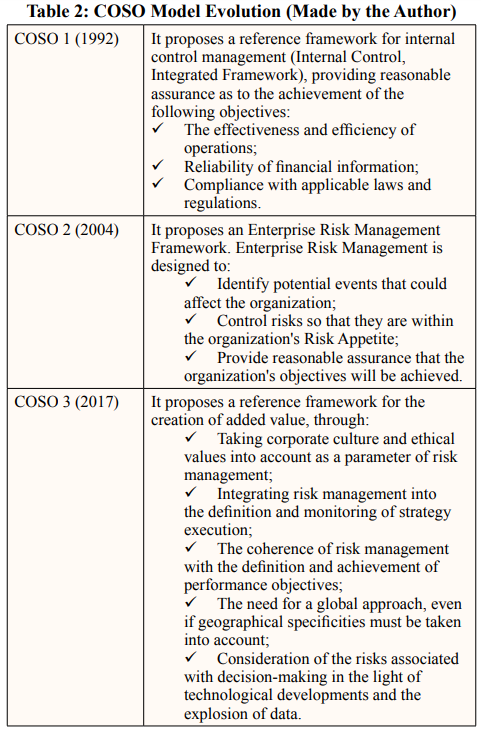

Subsequently, the risk-based approach appeared around 1992- 1994, when the cost of the audit assignment was high for the client and profitability fell for audit firms. Significance was introduced. In the 2000s, companies listed on the US stock exchange caused unprecedented financial scandals involving account manipulation and accounting malpractice, to which the introduction of the Sarbanes-Oxley Act was a response. At the same time, the COSO internal control framework was adopted.

Figure 1: COSO 1 - Internal Control, Integrated Framework (traduction du COSO 1, IFACI & Cooperts & Lybrand, The New Practice of Internal Control, Page 29-1992)

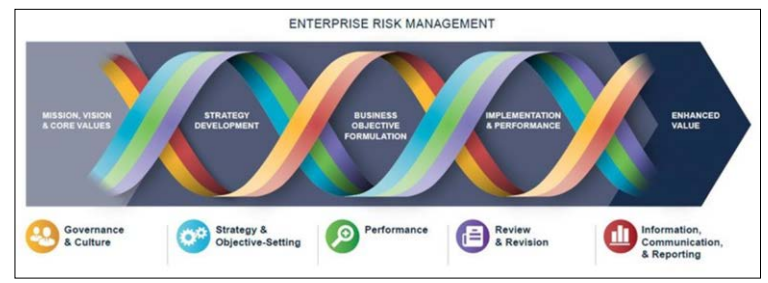

Figure 2: COSO 2 - Entreprise Risk Management Framework (COSO 2004 Report)

Figure 3: COSO 3 - Enterprise Risk Management Integrated with Strategy and Performance (COSO 2017 Report)

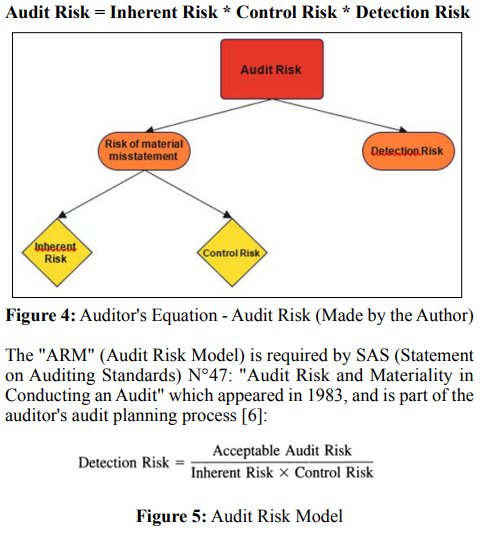

This is the approach on which all accounting and financial audit engagements are based today, and it has given rise to the "auditor's equation", which broadly refers to the risk of the professional expressing an inappropriate opinion when the financial statements contain material misstatements.

Acceptable Audit Risk (AAR) is the probability that the auditors will be prepared to certify unqualified financial statements that are materially misstated. It is designated by the auditor.

IR" (Inherent Risk) refers to the probability of finding material errors in a company's audited financial statements prior to assessment of the internal control system. This risk is assessed by the auditor. This is the systematic risk.

Control Risk (CR) is the probability that a material misstatement will not be prevented or detected in a timely manner by the audited company's internal control system. This risk is assessed by the auditor. This is the systemic risk.

The "DR" ("Detection Risk") refers to the tolerable risk threshold at which audit procedures fail to detect material misstatements [6].

The risk of non-detection is inversely proportional to the accumulation of inherent risks and control-related risks. And conversely, when inherent and control risks are low, the auditor can accept a higher level of non-detection risk while reducing audit risk to an acceptably low level.

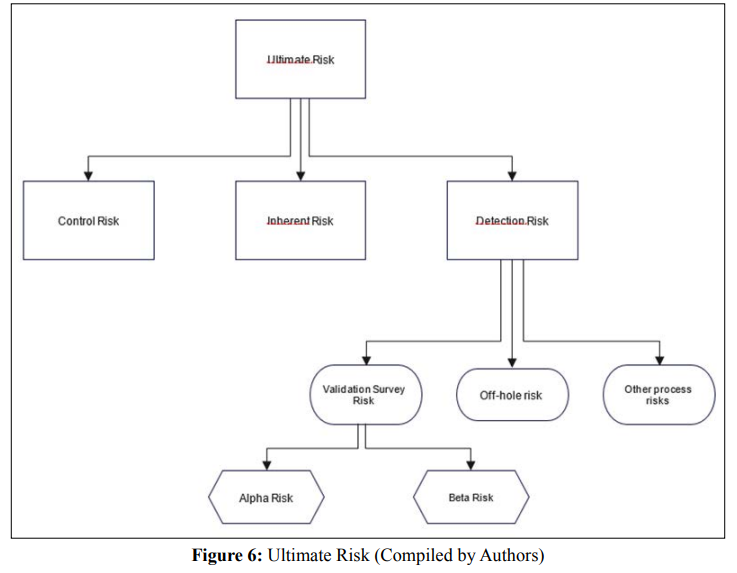

Some authors, like Cormier, divide the risk of detection/non- detection into 3 sub-risks:

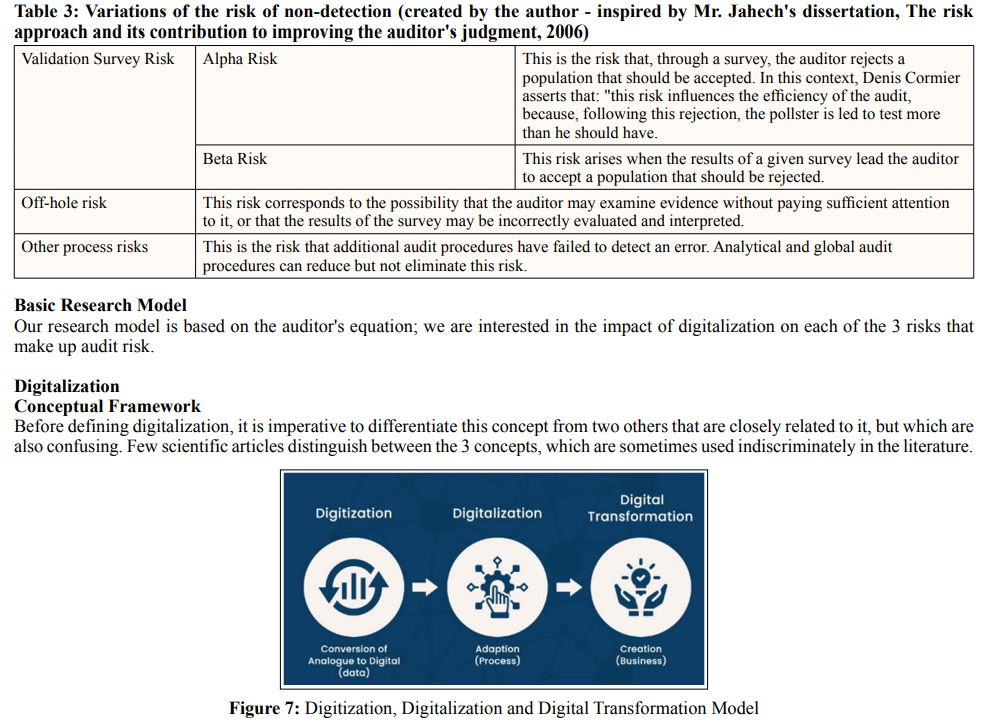

The term "digitization" originated with the advent of computers in the 1950s, it refers to: "the process of transforming data into a digital form that can be easily read and processed by a computer" [7].

An additional clarification to the OED definition was mentioned: this transformation of data acts without modifying the process itself (Gartner glossary).

It consists in the conversion of traditional forms of information storage (such as paper, photographs...) into binary code (a succession of 0s and 1s). In other words, it's the transformation of analog signals, which are continuous signals that can take on an infinite number of values, into digital signals, which are discrete, discontinuous signals [8]. This transformation is the driving force behind the digital revolution, more commonly known as the 3rd Industrial Revolution (SAP). In modern life, digitization has become synonymous with convenience and reliability, present in our daily lives at every level: economic, cultural, social... This massive digitization of data has led to fundamental changes in processes.

Generally speaking, digitization represents the integration of multiple technologies into all aspects of daily life that can be digitized [9].

In the entrepreneurial world, digitization refers to: "the integration of digital technologies and solutions into a company's existing business processes" (SAP). The major impact of digitization has been hinted at as a 4th industrial revolution. Digitization therefore exploits digitization to a very large extent, and evolves this concept to the level of process change.

However, for companies today, the question is no longer whether digitization is necessary to remain competitive in today's ever- changing economic environment, but how soon they can embark on their digital transformation journey (SAP).

Digital transformation refers to the process by which a company integrates digital technologies into all its activities, with the aim of boosting its performance, acquiring new prospects, facilitating their transformation into customers, and guaranteeing their loyalty through optimal and enhanced exploitation of the company's various functions [10]. Today, customers' needs are constantly growing, and companies are obliged to be more competitive, an obligation to which digital transformation responds.

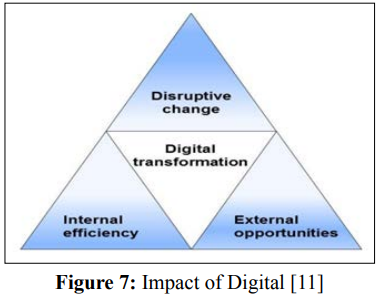

The following 3 areas need to be taken into consideration to achieve digital transformation:

We can therefore assume that a digital transformation can only take place through an organizational transformation of the company, so that it is optimal and requires the effective collaboration and participation of everyone, starting at the highest level of the company and reaching down to its grassroots, and specifying the impact of this digital transformation on roles and operational flows, but also the reasons why its implementation would be considered a worthwhile necessity.

According to the figure below, digital transformation has 3 major dimensions of impact on the organization:

So, from digitization to digital transformation to digitalization, these 3 concepts, although often linked in the literature, have different nuances all the same.

They represent 3 chronologically successive stages for any organization wishing to remain competitive.

An IT audit is a systematic process for evaluating and verifying the security, compliance and performance of IT systems.

The general steps for carrying out an IT audit are as follows:

It is important to note that the steps may vary according to the objectives and needs of each audit. It is also important to hire a qualified auditor to carry out the IT audit to guarantee the quality and accuracy of the results.

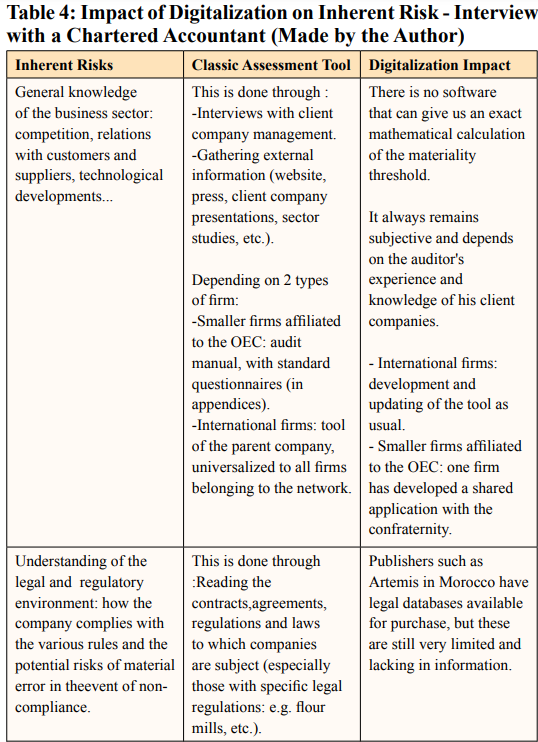

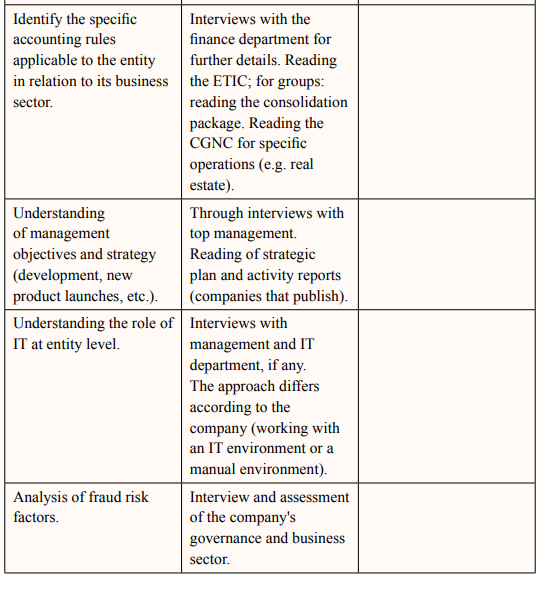

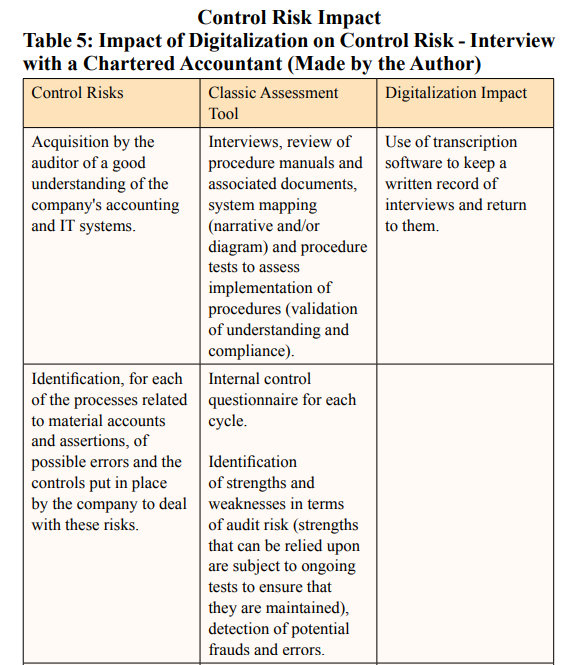

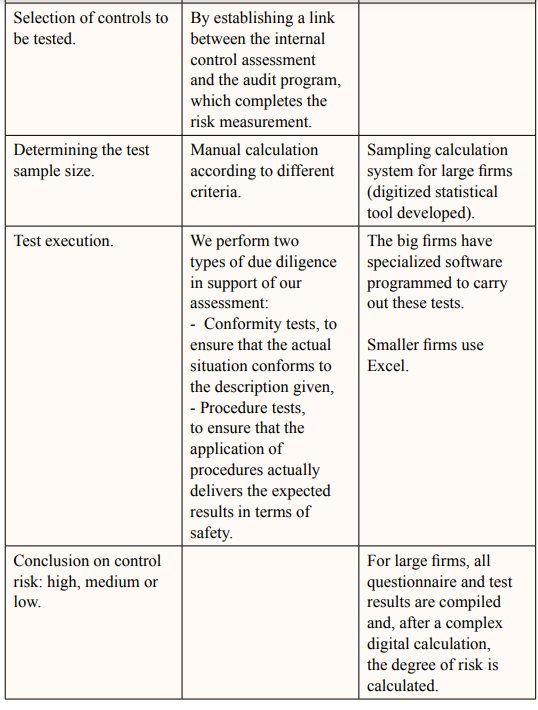

Impact of Digitization on the Risk of Material Misstatement We conducted an interview with a Chartered Accountant, with the aim of presenting a comparison and evolution of the audit tools normally used by firms, and the new tools introduced by digitalization to assess the following audit risks: inherent risks and control-related risks.

Every company operates in its own environment (with customers, suppliers, regulations, etc.). The auditor assesses the potential for this environment to give rise to a risk of material misstatement, irrespective of any internal control systems in place.

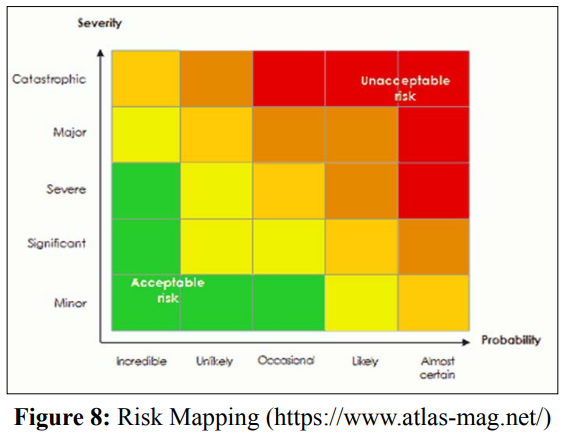

Once the inherent risks have been identified, the auditor classifies them according to their probability and impact:

Identifying inherent risks requires interviews (with management or other key people), a preliminary analytical review and study of the information collected (such as minutes, sector studies, organization charts, activity reports, etc.).

Artificial intelligence (AI) refers to the simulation of human intelligence in computers and machines. This involves the development of algorithms and computer programs capable of performing tasks that usually require human intelligence, such as visual perception, voice recognition, decision-making and language translation.

Artificial intelligence (AI) has had a significant impact on financial auditing, both in terms of increased efficiency but also improved accuracy. Here are some of the aspects impacted:

Overall, AI has the potential to revolutionize the way financial audits are conducted, providing auditors with more effective tools for analyzing data and identifying risks. While AI is still no substitute for human auditors, it can be used to significantly improve their work, enabling them to make better decisions.

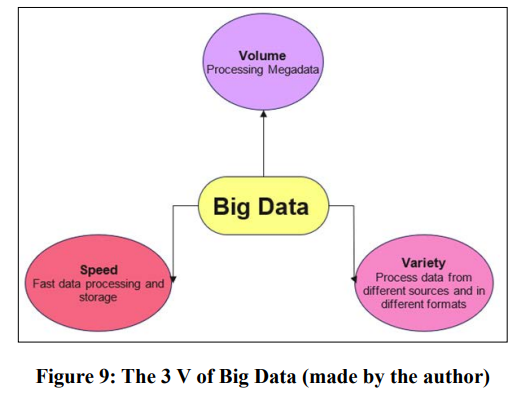

It represents high-volume, high-velocity and highly varied information assets that require cost-effective and innovative forms of information processing for better decision-making.

3 Main Properties Define Big Data:

Big data analytics" has enabled auditors to collect and analyze large quantities of financial and operational data in a relatively short space of time. This has made it easier for them to identify areas of risk and focus their attention on the most relevant aspects of an audit, notably the interpretation of results.

Big Data has had an impact on financial auditing at the following levels:

Big data therefore provides auditors with a more complete and accurate picture of an organization's financial health. However, it is important to note that auditors must also consider the confidentiality, security and ethical implications of collecting and analyzing large quantities of financial data.

Blockchain is a decentralized digital ledger that records transactions over a network of computers. It is used to store and transfer data securely and transparently without the need for intermediaries. Each block in the chain contains a certain number of transactions and is connected to the previous block, forming a chain of blocks that cannot be altered.

Blockchain can revolutionize financial auditing in terms of :

Overall, blockchain technology improves the efficiency, transparency and security of financial records. However, it's important to note that while the technology has advanced rapidly, there are still regulatory and technical challenges to overcome before it can be widely adopted in the auditing sector.

Cloud computing is an Internet-based delivery model for IT services, including servers, storage, databases, networking, software, analytics and intelligence.

There are 3 main types:

Cloud computing's influence on Financial Auditing can be summed up as follows:

Following this in-depth literature review, we can formulate the following research hypotheses:

Digitization is therefore a key element in today's business competitiveness. For audit firms, it can boost confidence in audit findings by enabling more transparent verification and providing stronger evidence for investment decisions. Digitization can also present them with challenges, such as protecting data confidentiality and security, training and upgrading employee skills to work with new technologies, and understanding and complying with ever-changing regulations and standards.

Technological models have been developed and the auditing sector has benefited from them: we find big data, artificial intelligence, cloud computing and blokchain.

The digitization of Financial Auditing offers a number of advantages:

But it can also have its Drawbacks:

In conclusion, Digitization can bring many benefits for audit firms, but they need to be prepared for the challenges that come with adopting new technologies. Audit firms need to be able to assess the potential opportunities and challenges of digitization to maximize the benefits for their clients and their business [12-23].