Author(s): Goutham Sabbani

The technology that service providers and market participants have embraced over the past 20 years has greatly influenced the structure and trading practices of capital markets. High-frequency trading systems require speed and processing power since they are designed to analyse trends in tick-by-tick financial data and inform buying and selling choices. They also need back-end systems to be highly available and scalable, which comes with a hefty price tag. This paper explores the question of whether cloud computing can give trading companies the flexibility they need to thrive in the long run.

The nature of trading in financial markets has altered because of technological advancements and improvements in computers [1,2]. These advancements have shortened the holding times needed for investments and made order transmission and execution speedier than before. High-frequency trading emerged as a new investment discipline as a result [2]. High-frequency trading, to put it broadly, is the process of examining trends in tick-by-tick data and using that information to inform buying and selling decisions. The rise of high-frequency trading in the markets has been assisted by exchanges that offer high-speed, low-latency information flow [2].

Since high frequency trades are completed in milliseconds, high frequency trading systems necessitate speed as well as high availability and readiness to trade at any moment. Robust hardware safeguards the speed of execution, and systems are collocated with electronic execution platforms to reduce network latency. Increasing system capacity and grouping datacentres together will result in high availability. These all require expensive investments [2].

Using cloud computing architecture, the financial business cloud model for high-frequency trading builds an effective trading platform and IT infrastructure for financial organisations. This model deploys runtime risk management, analytics, trading, and data collecting modules to the cloud. These modules are integrated by an Enterprise Service Bus, a standard-based integration platform that manages messages, routing, data transformations, and mediations amongst them. Essential activities such authorization and access, security, application management, policy management, account management, scheduling, routing, monitoring, auditing,invoicing, and metering are under the purview of Cloud Manager [2].

Financial organisations may now focus on business rather than IT by outsourcing their IT operations and infrastructure thanks to cloud computing.

Due to cloud providers' Service Level Agreements that guarantee availability and service delivery, it also helps to lower their operational risk and risk management expenses [1].

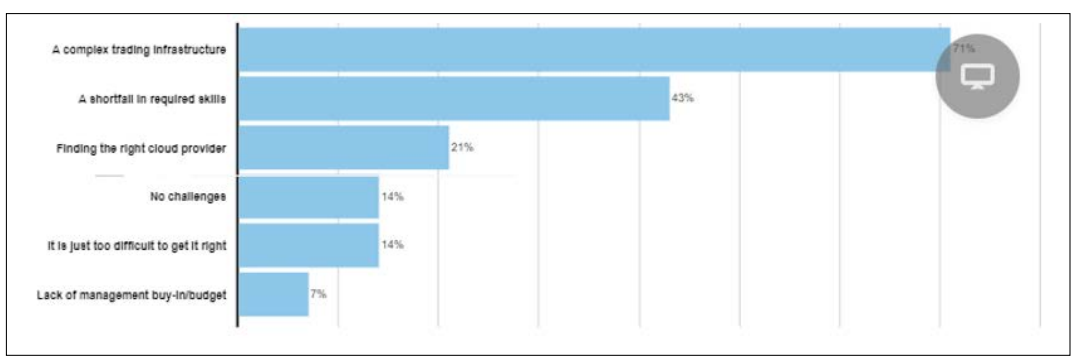

The following audience poll's participants also mentioned difficulties they had integrating cloud computing into their companies' high-performance trading infrastructure. One of these was that adding cloud would be difficult due to the intricacy of their trading infrastructure, and another was that they had trouble finding the necessary personnel [5].

Businesses can use hybrid cloud solutions, which combine on- premises and cloud infrastructure to balance performance and cost, to overcome the difficulties in integrating cloud computing into high-frequency trading (HFT) systems. Risk management and regulatory compliance can be made easier by using managed services. To combat complexity and manpower shortages, engage in staff training and form partnerships with specialised cloud providers. This will ensure a seamless transition and optimised trading operations.

High-frequency trading (HFT) systems can benefit greatly from cloud computing's scalability, cooperation, and improved business intelligence. Leveraging managed services and hybrid cloud solutions can help with problems like integration complexity, risk management, and regulatory compliance. Financial organisations may ensure long-term flexibility and competitiveness in the fast-paced trading environment by optimising their trading infrastructure, reducing operating expenses, and investing in staff training and working with specialised cloud providers.