Author(s): <p>Venkat Kalyan Uppala</p>

ABSTRACT

The COVID-19 pandemic has served as a catalyst for the accelerated adoption of artificial intelligence (AI) across the financial sector, leading to a profound transformation in how financial institutions operate. This paper explores the innovative applications of AI that have emerged in finance during and after the pandemic, including advancements in automated trading, credit risk assessment, fraud detection, and personalized financial services. These AIdriven innovations have enabled financial institutions to navigate unprecedented market volatility, enhance customer experience, and manage risks more effectively. However, the rapid integration of AI has also introduced significant regulatory challenges, particularly concerning data privacy, algorithmic transparency, and the ethical use of AI technologies. The paper examines the evolving regulatory landscape, highlighting the measures taken by global financial regulators to address these challenges and ensure that AI is deployed responsibly and ethically. By analyzing the balance between fostering innovation and maintaining financial stability, consumer protection, and data security, this paper provides a comprehensive overview of the critical issues facing AI in finance in a post-pandemic world. The discussion underscores the importance of collaborative approaches between regulators, financial institutions, and technology providers to build a robust framework that supports both innovation and accountability.

The COVID-19 pandemic has catalyzed unprecedented changes across various sectors, with the financial industry being one of the most impacted. As social distancing measures and economic uncertainty became widespread, financial institutions were compelled to accelerate the adoption of digital technologies, particularly artificial intelligence (AI). AI has played a crucial role in enabling the continuity of financial services, improving operational efficiency, and adapting to the rapidly changing environment. This paper explores the innovations in AI-driven finance that emerged during and after the pandemic and examines the regulatory challenges that have arisen in response to these developments.

Before the pandemic, AI was already gaining traction in the financial sector, particularly in areas such as algorithmic trading, credit scoring, and customer service automation. However, its adoption was somewhat gradual, as financial institutions balanced the potential benefits against concerns about data privacy, cybersecurity, and the ethical implications of AI decision- making. The pandemic served as a catalyst, pushing AI from a supplementary tool to a central component of financial operations.

The global crisis created by COVID-19 forced financial institutions to rethink their operational strategies. With physical branches closed and economic volatility at an all-time high, the need for AI-driven solutions became more urgent. AI was leveraged to manage everything from remote customer interactions and loan processing to fraud detection and market analysis. This paper will delve into specific innovations that have reshaped the financial landscape and consider how these changes are likely to influence the future of finance.

The post-pandemic era has seen several AI-driven innovations that have fundamentally altered the financial sector. This section explores some of the most significant developments, focusing on automated trading, credit risk assessment, fraud detection, and personalized financial services.

Automated Trading and AI-Driven Investment Strategies AI has revolutionized trading by enabling the development of sophisticated algorithms that can analyze vast datasets and execute trades at speeds and volumes far beyond human capabilities. During the pandemic, the volatility of financial markets created both opportunities and risks, and AI-driven trading strategies played a crucial role in navigating these challenges.

A study by Lee and Chung demonstrated how AI algorithms were employed to adapt to the extreme market volatility during the early months of the pandemic [1]. These algorithms, capable of processing real-time data and adjusting trading strategies on the fly, helped firms capitalize on fleeting market opportunities while managing risk more effectively.

As economic uncertainty soared during the pandemic, traditional credit scoring methods proved inadequate for assessing the rapidly changing financial situations of individuals and businesses. AI offered a more dynamic approach, utilizing real-time data and advanced analytics to evaluate creditworthiness more accurately.

Research by Brown et al., highlighted the use of AI in redefining credit risk models during the pandemic [2]. By analyzing alternative data sources, such as utility payments and social media activity, AI systems provided a more nuanced assessment of credit risk, enabling lenders to make better-informed decisions in a volatile environment.

The rise in digital transactions during the pandemic also triggered a rise in financial fraud. AI has played an important role in improving fraud detection and prevention by utilizing machine learning algorithms to detect suspicious activities and patterns indicative of fraudulent behavior.

A report by the Federal Reserve noted a significant reduction in fraudulent transactions at banks that implemented AI-driven fraud detection systems during the pandemic [3]. These systems were able to detect anomalies in transaction patterns, flagging potential fraud more quickly and accurately than traditional methods.

The shift to digital banking during the pandemic accelerated the adoption of AI in personalized financial services. AI- driven platforms offered tailored recommendations for savings, investments, and spending, helping consumers manage their finances more effectively in uncertain times.

Smith and Zhao examined the impact of AI on customer experience in the banking sector [4]. They found that AI-powered chatbots and virtual assistants not only provided timely and personalized financial advice but also improved customer satisfaction and loyalty during the pandemic.

The rapid integration of AI into finance has not been without its challenges, particularly in the realm of regulation. This section examines the regulatory landscape that has emerged in response to AI innovations in finance, focusing on issues such as data privacy, algorithmic transparency, and the ethical use of AI.

The use of AI in finance relies heavily on the collection and analysis of vast amounts of personal and financial data. This raises significant concerns about data privacy and security, particularly in light of increasing cyber threats.

The European Union’s General Data Protection Regulation (GDPR) has set a high standard for data privacy, and its implications for AI in finance are significant. A study by Johnson and Roberts explored how financial institutions have adapted their AI systems to comply with GDPR, highlighting the challenges of balancing innovation with stringent data protection requirements [5].

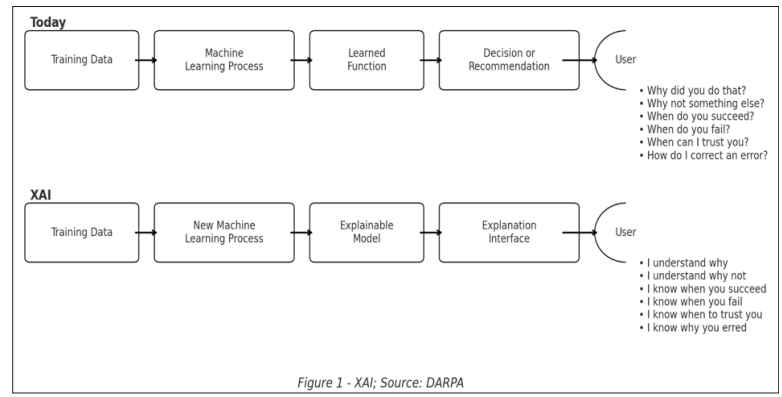

As AI-driven decision-making becomes more prevalent in finance, there is a growing demand for transparency and accountability in how these algorithms operate. Regulators are increasingly focused on ensuring that AI systems are explainable and that their decisions can be audited.

The proposed AI Act by the European Union, as discussed by Müller, aims to establish a framework for the ethical development and deployment of AI [6]. This includes requirements for transparency, risk management, and human oversight, particularly in high-risk sectors like finance.

The deployment of AI in finance raises ethical concerns, particularly regarding the potential for bias in AI algorithms. Ensuring that AI systems do not perpetuate or exacerbate existing inequalities is a key challenge for regulators and financial institutions alike.

Research by Hernandez and Williams highlighted the risk of bias in AI-driven credit scoring models [7]. Their study found that without proper oversight, these models could disproportionately disadvantage certain demographic groups, leading to calls for more stringent regulatory oversight.

The challenge for regulators is to strike a balance between fostering innovation in AI-driven finance and ensuring that these innovations do not compromise financial stability, consumer protection, or data privacy. This section discusses how regulators can achieve this balance, focusing on collaborative approaches between industry and regulatory bodies.

One approach to balancing innovation and regulation is through collaborative frameworks that involve close cooperation between regulators, financial institutions, and technology companies.

A study by Carter and Green examined the effectiveness of regulatory sandboxes in fostering innovation while maintaining oversight [8]. These sandboxes allow financial institutions to test AI-driven products and services in a controlled environment, enabling regulators to monitor and evaluate their impact before full-scale deployment.

Given the global nature of finance, international standards play an important role in ensuring consistent and effective regulation of AI. This section explores the importance of harmonizing regulatory approaches across different jurisdictions.

The Financial Stability Board (FSB) has been instrumental in coordinating international efforts to regulate AI in finance. A report by the FSB outlines the board’s recommendations for harmonizing AI regulations to prevent regulatory arbitrage and ensure a level playing field across global financial markets [9].

The future of AI in finance is promising, but it will require ongoing attention to the challenges of regulation, ethics, and technological innovation. This section outlines potential future directions for AI in finance, including advancements in explainable AI, the development of more robust ethical frameworks, and the evolution of regulatory approaches.

Explainable AI will be critical in building trust between financial institutions, regulators, and consumers. This section discusses emerging techniques in explainable AI and their potential impact on the financial sector.

Emerging research by Williams et al, has shown that explainable AI models can enhance transparency in credit decisions, helping to build trust and ensure that consumers understand how their financial data is being used [7].

As AI becomes more deeply integrated into financial systems, there will be an increasing emphasis on ethical AI practices. This section explores the role of corporate social responsibility in guiding the ethical deployment of AI in finance.

Banks such as Barclays and HSBC have implemented ethical AI initiatives, focusing on transparency, fairness, and inclusivity in their AI-driven services. These initiatives aim to ensure that AI systems are designed and deployed in ways that do not perpetuate discrimination or inequality. For example, Barclays has established an internal AI ethics committee to oversee the development and deployment of AI technologies within the bank, ensuring that ethical considerations are integrated into the decision-making process from the outset. Similarly, HSBC has launched a series of AI transparency reports that provide stakeholders with detailed insights into how AI is used within the bank, the data it relies on, and the safeguards in place to prevent bias [10, 11].

The rapid adoption of AI in finance, accelerated by the COVID-19 pandemic, has brought about significant innovations that have transformed the industry. From automated trading and AI- driven credit risk assessment to enhanced fraud detection and personalized financial services, AI has proven to be an effective tool in addressing the complexities of the post-pandemic financial landscape. However, these advancements have also introduced new challenges, particularly in terms of regulation, data privacy, and ethical considerations.

Regulatory bodies around the world are grappling with the task of ensuring that AI technologies are used responsibly and effectively within the financial sector. The evolving regulatory landscape, characterized by initiatives such as the GDPR, the proposed AI Act in the European Union, and international standards set by organizations like the Financial Stability Board, reflects the need for a balanced approach that fosters innovation while safeguarding consumer protection and financial stability.

As the financial industry continues to evolve in response to the capabilities of AI, it is crucial that stakeholders-financial institutions, regulators, and technology companies-work collaboratively to address the challenges and opportunities presented by AI. By focusing on explainability, transparency, and ethical AI practices, the industry can build trust with consumers and ensure that AI-driven finance contributes to a more equitable and sustainable future.