Author(s): Balasubrahmanya Balakrishna

This paper delves into the transformation of a complex banking sector process, traditionally focused on paper generation, into a blockchain solution leveraging Hyperledger Fabric. Overcoming the limitations of conventional systems, such as automation and transparency issues in reconciliation, the study aims to enhance the process's security, tracking, and overall efficiency through blockchain adoption. The proposed Hyperledger Fabric framework comprises seven key components: a centralized system, bank integration, smart contracts and chain codes, a creation engine, APIs, third-party interaction, and a feedback loop. Each component is crucial in streamlining the end-to-end paper generation cycle, ensuring robustness, scalability, and interoperability

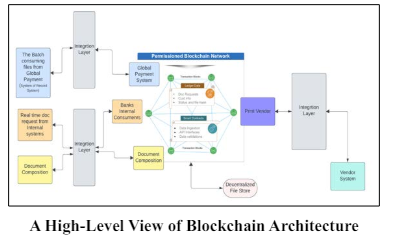

In today's fast-changing digital world, financial institutions heavily rely on efficient and accurate documents to maintain rule compliance, reduce risks, and build customer trust. Despite technological improvements, many banks continue using outdated file-based batch systems for essential tasks like document creation, resulting in below-average performance and limited visibility into operations. Also, these old systems often have weakened security due to manual steps during the document generation and distribution stages. To solve these challenges, this study looks at converting a complex process in a paper document application within the banking credit card area to a centralized blockchain platform powered by Hyperledger Fabric, as shown in Figure 1. The literature proposes a novel approach that uses unique features offered by blockchain technology - namely, distributed ledgers, automated reconciliation, and integrated APIs - allowing improved collaboration between partners, enhanced security, increased transparency, and lower costs [1]. By closely examining each architectural part and its functions, the paper shows how the suggested solution fixes issues with standard batch systems while providing a stronger foundation for future growth and innovation.

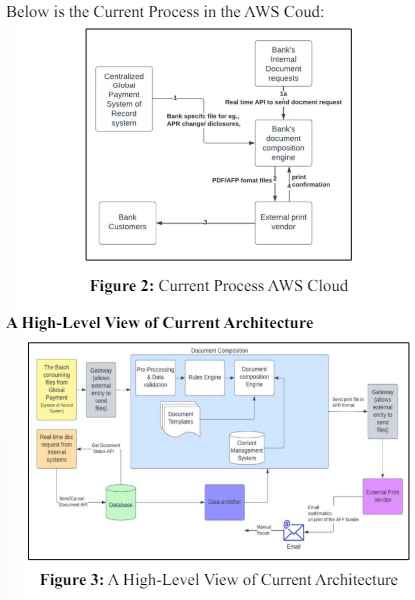

A paper document generation application in a Banking credit card domain potentially uses Blockchain technology, leveraging its distributed ledger and automated reconciliation, along with integrated APIs, can address the limitations of a file-based batch system. The current batch process model used for document generation has several limitations. It introduces delays from when a document request is created until it reaches the external print vendor due to batch processing [2]. Real-time API requests also have the same limitation as batch processing regarding document composition. Reconciliation is a mix of system and manual processes between parties and is not tightly integrated with the core application. Individual data failures can cause an entire batch to fail as processing occurs at the file level. There is also limited transparency between parties, which requires extensive monitoring. Overall, the batch process model causes processing delays, has composition limitations, lacks integration, is prone to failures, and has transparency issues between organizations.

A real-time document request system sends or cancels document requests via an API connected to a centralized database. As shown in Figure 3, this database contains all the necessary information for generating documents, including data enrichment features. Once a document request is received, it undergoes preprocessing and data validation before being passed to a rules engine that determines how the document should be composed based on specific business logic. Afterward, the actual document composition occurs, resulting in a print file in AFP format. This file is sent to a gateway that enables external entities (such as print vendors) to receive and process the file for printing. The print vendor returns a confirmation to the system upon completion, triggering a manual reconciliation step. An external system responsible for managing global payments can also access the document composition feature through the same gateway.

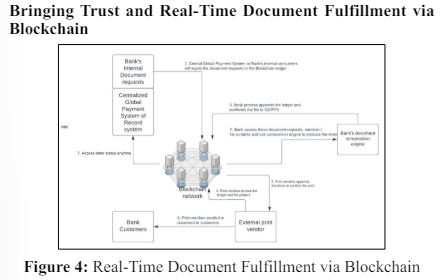

• The central global payment system or internal consumers

will ingest the document requests to the blockchain ledger,

as shown in Figure 4.

• The bank will access these documents, enrich the contents,

and use a composition engine to produce the letter.

• Bank process appends the ledger and publishes the file to

S3/IP4S.

• Print vendors access the ledger and print it.

• Print vendors append the block to confirm the print.

• Print vendors send the document to customers.

• The centralized payment system can access the letter status

anytime in the blockchain network, as shown in Figure 4.

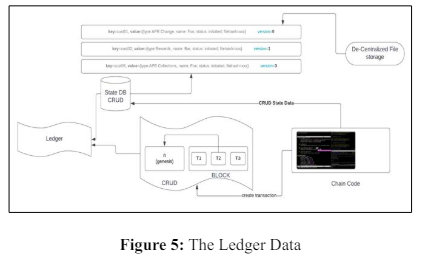

Hyperledger Fabric is an open-source blockchain platform for exclusive enterprise use. It has a modular, scalable, and secure structure that solves the restrictions of conventional public blockchain networks concerning private deals and confidential contracts [3]. With its concentration on permitted networks, all members have validated identities in industries with strict information processing principles, like the banking industry. Hyperledger Fabric supports Enterprise Blockchain, as shown in Figure 5.

• Hyperledger is a permissioned blockchain network.

• Hyperledger has an efficient consensus mechanism as it has

endorsement-based consensus.

• Hyperledger ensures the privacy and confidentiality of Txs

via channels.

• Hyperledger has medium to high-performance capabilities.

• Hyperledger has medium enterprise readiness.

• Hyperledger is an open-source platform.

• Hyperledger has medium platform maturity.

To solve the challenges of file batch system, converting a complex process in a paper document application within the banking credit card area to a centralized blockchain platform powered by Hyperledger Fabric involves the following approach:

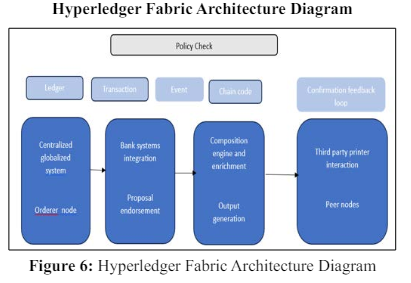

Instead of generating files directly, they would now submit transactions containing relevant information to the orderer node within the Hyperledger Fabric network as shown in Figure 6. These transactions represent events related to APR updates, disclosures, and so forth.

Upon receiving transaction proposals from the payment system, internal bank systems (payment, collections, etc.) may issue endorsements after validating the data. Endorsement policies determine whether enough organizations agree upon the proposal before committing it to the ledger. Once all necessary approvals are obtained, the updated transaction moves forward for further processing.

Chain codes serve as executable implementations of business logic acting as smart contracts inside the Hyperledger Fabric environment. They receive input parameters from submitted transactions, perform computations, update the world state accordingly, and generate outputs ready for consumption by external services. In our scenario, chain code processes incoming transactions and composes appropriate responses for downstream operations.

After obtaining processed results from chain code execution, the composition engine integrates them with additional data sources to produce final documents in formats compatible with thirdparty printers. For instance, PDF or AFP formats could still be utilized here.

RESTful APIs expose functionality the Hyperledger Fabric network provides to maintain compatibility with existing workflows. External parties interact seamlessly without requiring explicit knowledge of underlying blockchain mechanics. As part of this stage, communication channels facilitate secure exchange between participants in printing and confirming delivery status.

Similar to the previous setup, print vendors retrieve generated documents via exposed APIs and produce physical copies. Set up dedicated peer nodes at their premises or utilize cloud-hosted options provided by platforms supporting Hyperledger Fabric. However, instead of relying solely on email notifications, bidirectional messaging ensures timely receipt of acknowledgments and eliminates potential delays associated with traditional methods.

Post-printing, printer nodes send confirmations back to the originator(s), updating the shared ledger with successful deliveries. Depending on specific implementation choices, event triggers, or periodic polling mechanisms, ensure up-to-date records reflect actual outcomes accurately.

The proposed blockchain system offers several improvements over the current approach. A shared ledger allows real-time information sharing between parties, making the reconciliation process much easier [4].Business validations can be implemented through smart contracts to reduce turnaround times and discrepancies. Batch processing may no longer be required since all parties can access data in real time, as shown in Figure 6. Distributed ledger technologies aim to streamline the process through instant data sharing, automated validation logic, and elimination of batch steps. This helps enhance the overall efficiency, accuracy, and transparency of document generation activities between organizations.

The proposed change from a complex AWS process to a blockchain system using Hyperledger Fabric provides multiple benefits for a paper document creation program in the banking credit domain. Banks can streamline submitting and confirming transactions using a centralized global payment system, reducing the need for file systems and manual reconciliation. Integrating bank systems and smart contracts enables effective processing and approval of transactions while keeping compatibility with existing workflows through RESTful APIs. Furthermore, the enrichment, creation engine, and third-party printing interaction improve document formatting and production abilities. Finally, the confirmation feedback loop guarantees precise tracking and status reporting of deliveries, contributing to an overall boost in efficiency, security, and transparency. Overall, this method has the potential to considerably enhance the dependability and performance of paper document creation programs in the banking industry.