Author(s): Zhang Ya Chun

This paper mainly explains the digital financial transformation of, explains the general background of today’s catering industry, and describes in detail the catering company Delta Pizza in what circumstances to carry out digital financial transformation and the process of digital financial transformation, the measures developed in the process of transformation and the problems that will be encountered before and after the transformation, the changes in financial data before and after the transformation, focusing on the effectiveness of the transformation of. And the benefits of digital financial transformation for Delta Pizza versus other industries.

Human society has entered the era of digital economy. In this new historical period, digitalisation, networking and intelligence have become an important force driving the development of the world economy [1]. Today’s era is an era in which technology and resources are developing side by side, and all industries are constantly competing with each other and making progress together, but the resources in each market are limited, so every enterprise needs to enhance its competitiveness through various ways to ensure that it can enjoy more resources. The catering industry is also facing some challenges in this era of information technology, such as the rising cost of raw materials, high mobility of frontline staff, and customer consumption momentum to be improved. It also has to face the changes in consumer demand, the rise of the Internet has changed the lifestyle and consumption habits of consumers. Consumers have higher demands for food quality, the convenience of placing orders and the level of delivery services. They are more inclined to use digital channels for ordering and payment, expecting a faster, more efficient and personalised service experience [2]. In the wake of the financial crisis, the real economy has experienced a sharp downturn and consumers’ purchasing power has weakened. This has caused companies such as Delta to face greater operational pressure and the need to find new growth avenues and operating models to meet the challenges. Founded in 1960, after years of development, Delta’s original business model and operation methods may be gradually difficult to adapt to the rapid changes in the market. In order to attract a new generation of customers and create new market value, Delta actively seeks to adjust and innovate at the strategic level, taking digital transformation as an important development direction.

This article focuses on the results of Delta Pizza before and after the digital financial transformation, as well as the problems encountered during the transformation process, hoping to provide new development ideas for Delta Pizza as well as other catering industries. In today’s digital wave, companies are facing unprecedented challenges and opportunities. Studying the digital financial transformation of Delta can help enterprises better understand and adapt to the digital environment, and adjust their financial strategies and management modes in a timely manner in order to maintain market competitiveness and sustainable development [3]. As an influential enterprise in the catering industry, Delta’s experience and model of digital financial transformation can provide a valuable reference for other enterprises in the same industry. Through the study, replicable successful strategies and pitfalls to be avoided can be summarised to help other catering enterprises better achieve financial transformation in the digital era and improve financial management efficiency and decision making science.

This paper first investigates a large number of literatures on digital financial transformation of the food industry, and discovers the research value of digital financial transformation of the food industry. For its transformation reasons and processes are analysed. A theoretical framework is established and the transformation effect of the research topic is evaluated.

This study delves into the motivation and transformation process and effectiveness of enterprises in digital financial transformation through the case study method. The selected cases are representative and unique. The study analyses the cases in the logical order of “why digital financial transformation the process of digital financial transformation the effect of digital financial transformation”. It focuses on analysing the strategies, techniques and results of enterprises in the process of digital financial transformation.

Accompanied by the continuous iteration of digital technology, digital transformation has become one of the key directions of national development, digital transformation has been the enterprises and institutions “against the current, not to advance is to retreat” of the road [4]. In recent years, the domestic first manufacturing enterprises through the change of business processes and advanced big data, cloud computing, Internet of Things, artificial intelligence, blockchain, virtual augmented reality and other new generation of technology application and integration, digital management accounting changes, financial information management model reconstruction and other financial digital transformation of the exploration, to lead the new round of financial management of the industrialisation of digital technology and the development of leapfrog [5]. Under the background of digital transformation, enterprises should comprehensively deepen the integration of industry and finance, with new digital technology to empower enterprise value creation and enhancement. Digital financial transformation can help enterprises to improve financial management efficiency, reduce costs, improve decision-making support capabilities, etc. [6]. Enterprises should actively promote digital financial transformation to meet the needs of market competition, is a key step towards the future of the enterprise. Enterprises must take effective measures to promote financial digital transformation, so as to obtain better economic and social benefits [7]. It is recommended that enterprises take the establishment of a financial shared service centre, build a perfect data governance system, design a mature data value chain, cultivate composite digital talents and other strategies to accelerate the process of digital transformation of enterprise finance, comprehensively improve the enterprise’s financial management capabilities, and promote the enterprise to achieve high-quality development [8]. Therefore, in the context of digitalisation, enterprises must change their thinking and promote the development of financial transformation to ensure that the current stage of the enterprise’s financial management model is more in line with the actual needs of the enterprise, to achieve the financial digital upgrading, and to promote the sustainable development of the enterprise [9].

In the process of understanding the digital financial transformation, there are many enterprises have successfully completed the digital financial transformation, they all have something in common, invested enough manpower and resources to promote the transformation, the use of emerging technologies, but also continuous innovation. Each of these organisations has developed a strategy that takes into account the current state of their business and is appropriate for its development. It provides an important impetus to promote the development of each industry.

Digital financial transformation is divided into data driven decision making, industry finance integration and Finance Cloud Services.

In digital financial transformation, data becomes a key element. Enterprises make use of a large amount of internal and external data, including financial data (e.g., revenues, costs, profits, etc.), business data (e.g., sales order volumes, production quantities, inventory levels, etc.), market data (e.g., industry trends, competitors’ information, etc.), and macroeconomic data, etc., and convert the data into valuable information to support management in making accurate decisions by using data analysis and mining technologies.

Industry finance integration emphasises close cooperation and information sharing between finance and business departments. Finance personnel are no longer limited to traditional financial accounting and report preparation, but understand business processes and business needs, and provide professional financial support and decision-making advice to business departments.

Financial cloud is a financial information service model based on cloud computing technology. It stores financial management software and data on cloud servers, and enterprise users can access and use the financial system anytime, anywhere via the Internet.

Digital financial transformation is the use of cloud computing, big data and other technologies in the field of finance to reconstruct the financial portfolio and re-engineer business processes, improve the quality of financial data and financial operational efficiency, better empower finance, support management, assist operations and support decision making.

Digital financial transformation mainly has the following steps of the process: first planning and strategic provisions, finishing financial processes; then programme research, technology modelling and design framework; the establishment of unified norms and standards, financial business process grooming, data governance and integration; then the configuration of the digital financial system and the development of the process optimization and reengineering; unit testing, system implementation and testing; and finally, personnel training and change management. There are many smaller branches within these larger modules. These make up the basic process of digital finance transformation. See the figure below.

Figure 1: Digital Finance Transformation Process

Domino’s Pizza is an international pizza chain originating in the United States. The current CEO of Domino’s is Russell Weiner. The company focuses on technological empowerment, such as the launch of online and mobile ordering, Delta Tracker and other technologies, as well as cooperation with Ford and other companies to carry out the application of self driving car technology in pizza delivery. Its unique business model and brand concept has led to its global recognition and popularity. However, its market performance and popularity may vary in different regions. In China, Delta faces competition from other pizza brands. However, it has attracted many consumers, especially the younger group, through special promotions and fast delivery. Meanwhile, Delta is constantly innovating and improving its dishes to meet consumers’ diversified tastes.

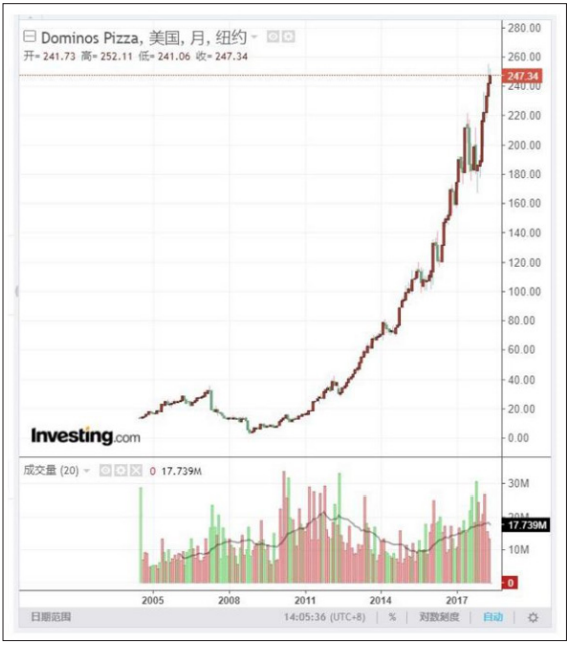

While 2008 was a special year for China’s catering industry, experiencing a boom brought by large events and the impact of some emergencies, but generally maintaining high growth, Delta Pizza stock plummeted during the year.See the chart below.

Figure 2: Delta Pizza Stock Chart 2005-2017

Source: Damerel’s Pizza (DPZ) Stock Balance Sheet U.S. Stocks.

The main reasons for the sharp decline in the stock market in 2008 were the weakness of the financial system, the economic recession and the crisis of confidence. In the economic system, there was a widespread leverage problem in 2008, which led many financial institutions into a crisis that could not be resolved. Before the global financial crisis, the national economy had already entered a downturn, which led to a decline in corporate performance and accelerated the collapse of the stock market. In addition to the impact of the general external environment, companies also encountered a number of internal problems and challenges.

Reliance on manually operated management systems and separate distribution channels: its supply chain operated poorly in the face of huge order tasks;

Inadequate operational control capabilities: leading to a decline in the quality of its output and lower consumer satisfaction with its products and services;

Decline in core profitable business: its shops experienced a negative growth of 1.21% in 2008 and same shop sales declined by 4.9%;

Impact of external situation: with the rise of the Internet, the traditional industry has been impacted.

In the wake of the financial crisis, the real economy declined and consumers’ weak purchasing power was accompanied by higher demands for food quality, order placement and delivery service levels. In addition, the entry of new competitors (e.g. Pizza Hut and Bang John) also threatened Delta’s market share [10].

In order to cope with these problems, Delta started the road of digital transformation, adjusting the strategic level to focus on the digital transformation of customer experience, making changes in various aspects such as company strategy, organisational structure, daily operation and corporate culture, and gradually becoming one of the successful cases of digital transformation. Today, more than 80 per cent of Delta’s orders come from digital channels and the ROI on stock is considerable.

Digital financial expertise has become an important part of every large organisation today [11]. Delta is a global restaurant chain. Its daily operations involve a large amount of financial data and processes such as shop operating costs, food ingredient purchasing costs, employee salaries, marketing expenses, and revenue streams. Delta has introduced the following initiatives in its transformation process.1. Launch of Anyware2. Improvements in GPS and car delivery, data analytics and forecasting. Investments in technological changes were mainly to improve the Pos sales system. Any ware is the Delta Pizza ordering platform which provides customers with more ways to order online. Improved GPS technology allows customers to better pinpoint their location and car-side delivery allows customers to pick up items without getting out of the car, which improves customer convenience Delta’s competition is analysing data to better improve industry efficiency and understand customer needs.

Following the strategic transformation, Delta Pizza’s financials have changed significantly. Between January 2011 and December 2019, the company’s annual revenue grew from $1,571 million to $3,911 million, an increase of nearly 150%, and gross profit increased by 144.7% over the same period. In 2023, Delta Pizza’s total revenue was $4,537 million, an increase of 4.13% over the previous year; net profit wasUS$452 million, down 11.40 per cent. Between 2017 and 2023, except for the epidemic years when revenues declined, all other years were in a position of revenue growth.

|

Year |

Total revenue (Hundred million yuan) |

|

2017 |

11.04 |

|

2018 |

16.11 |

|

2019 |

20.2 |

|

2020 |

13.76 |

|

2021 |

16.11 |

|

2022 |

20.2 |

|

2023 |

30 |

Data Source: Cash flow Statement of Delta Pizza (US).

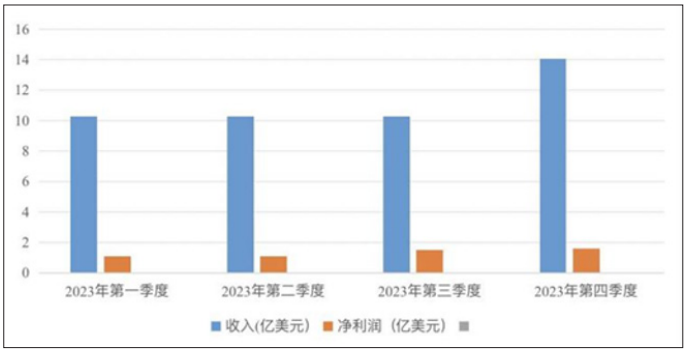

In 2023, Delta Pizza’s revenue and net profit were up in every quarter. revenue of $1,024 million and net profit of $105 million were reported in the first quarter of 2023; revenue of $1,025 million and net profit of $109 million were reported in the second quarter; revenue of $1,027 million and net profit of $148 million were reported in the third quarter; and revenue of $1,403 million and net profit of $157 million were reported in the fourth quarter.

Figure 3: Delta Pizza Revenue and net Income by Quarter 2023

Source: Delta Pizza (US) Financial Statements.

Delta Pizza has also achieved impressive management success following its digital financial transformation. Delta Pizza can achieve optimisation and improvement in cost management, sales data analysis, shop performance management, budget forecasting, and supply chain financial management. In the process of digitisation, the company can reduce costs through data analysis. They can also analyse different products in the shop to increase sales. Digital transformation can measure the performance of the shop for better allocation of resources and funds. It is important to know your budget and funds before doing any project or investment. With big data, budgets and funds can be calculated more accurately, providing some support for future planning of the business. It can also provide supply chain effectiveness and stability.

Delta Pizza has encountered some problems in financial aspect after successful transformation.

The front-end technology investment is large. In order to support the digital transformation, Delta needs to make large investments in technology, such as building an online ordering platform, improving the order tracking system, and introducing data analysis tools. These investments may put some pressure on the company’s financial position and need to be carefully planned and managed.

Pay attention to data security and privacy protection. With the advancement of digital transformation, Delta needs to handle a large amount of customer data, including order information and payment information. As a result, data security and privacy protection have become critical issues. Companies need to invest money and resources to ensure data security and prevent data leakage and misuse, or they may face legal risks and reputational damage.

Risk management in managing the financial process, the transformation process may face various financial risks, such as exchange rate fluctuations, interest rate changes, and market uncertainty. Delta needs to establish an effective risk management mechanism to identify and assess potential risks and take corresponding hedging measures to reduce the impact of risk on financial position [12].

Finally, attention needs to be paid to the introduction of talent, digital transformation requires talents with relevant skills and knowledge, such as data analysis experts, technical engineers, digital marketers and so on. Delta needs to strengthen the training and introduction of talents to build a high quality digital team to support the smooth progress of the transformation.

In the future, Delta will need to focus more on the needs of its customers and serve them better. It will also need to improve productivity. At the same time, it will continue to innovate its products and keep developing more special dishes that meet the tastes of Chinese consumers to keep the menu fresh and attractive. Improve brand awareness and strengthen brand promotion and marketing activities to increase the brand’s visibility and recognition across the country. Enhance digitalisation, which is already well established but still needs to be improved. Use technologies such as big data and artificial intelligence to better understand consumer needs and behaviour. Adapt to market changes, pay close attention to the dynamics and trends of China’s catering market, and adjust our strategies in a timely manner to respond to changes in competition and consumer demand. Focus on consumer feedback, pay continuous attention to consumer feedback and improve products and services in a timely manner. Maintain good interaction with consumers.

The impact of digital financial transformation on Delta can be gradually transitioned to the entire catering industry. Traditional catering companies often consume a lot of manpower and time in financial processing, such as expense reimbursement, invoice management and bookkeeping. After digital transformation, these processes can be automated by introducing financial automation software and tools. For catering companies, the cost of raw materials is one of the major costs. Digital transformation can help companies achieve more accurate costing [13]. Through IoT technology and supply chain management systems, the procurement, inventory and use of raw materials can be tracked in real time, and the cost of each dish can be accurately calculated Inventory management in catering enterprises is crucial, as too much inventory can lead to wastage of ingredients and capital consumption, while too little inventory may affect normal business. Digital financial transformation can achieve real-time inventory monitoring and early warning through the integration of inventory management system and financial system.